How to spot a fake proof of address

Fake proof of address documents are quietly fueling identity fraud, money laundering, and onboarding scams across the globe.

In 2026, as bills and statements move online, proof of address documents are becoming harder to secure. Many individuals don’t have these bills mailed to their addresses anymore and online payment portals don’t provide the same kind of verification. That’s why countries like South Africa have many individuals battling to prove where they live.

At the same time, while people are struggling to get legitimate documents to prove their living situations, publicly available document templates and generative AI tools have made proof of address fraud easier than ever to execute.

What once required design skills and insider knowledge can now be done in minutes.

Playing a critical role in knowing your customer (KYC) compliance, a proof of address links an identity to a physical location, supports jurisdictional risk assessments, and helps institutions meet regulatory obligations.

Read on to learn what proofs of address are, how they are being forged, how to spot a fake proof of address, and how AI-powered tools can help.

Check out our “how to spot fake documents” blog to learn about more common document forgeries.

What is a proof of address?

A proof of address is a document used to verify that an individual resides at a specific residential location.

It is a core component of address verification workflows and is commonly requested during customer onboarding, account changes, and compliance reviews.

For individuals, it confirms that they genuinely live at the address they claim, while a proof of business address verifies where a company is registered or operates for corporate compliance purposes.

The most common proof of address documents include:

- Utility bills. Electricity, gas, water, landline, or fixed internet bills issued within the last 30 to 90 days, showing the customer’s full name, service address, billing period, and account number.

- Credit card statements. Issued by regulated financial institutions and typically accepted if recent and clearly linked to the applicant’s address.

- Tax documents. Official correspondence from tax authorities or municipalities, including tax assessment letters, council or municipal tax bills, social security notices, or benefits statements issued to a verified residential address and confirming liability or registration at that property.

- Lease agreements. Signed lease contracts listing the tenant’s name, rental property address, lease duration, landlord details, and signature blocks.

- Government correspondence. Official letters issued by government authorities, such as social security statements, voter registration confirmations, or benefits determinations, that display the individual’s full name and residential address and confirm registration or eligibility at that location.

- Mortgage statements. Issued by regulated lenders, confirming the borrower’s name and the secured property address.

Although the concept of proof of address is universal, acceptable documents vary by jurisdiction:

- United States. Financial institutions commonly rely on utility bills, and government correspondence to meet Customer Identification Program requirements.

- United Kingdom. Council tax bills and utility statements are frequently referenced in official identity verification guidance.

- European Union. Anti money laundering frameworks require verification of residential address but do not prescribe a single document type, leading to broader acceptance of multiple categories.

Together, these documents help confirm that an individual can be reliably linked to a real, traceable residential address for compliance and risk assessment purposes.

Below, you'll see some examples of proof of address documents that we've already covered in our "how to spot fraud" series:

These documents are recreations added for illustrative purposes only.

Why are proofs of address important?

Proofs of address sit inside multiple high-stakes verification workflows. They are used during customer onboarding, account recovery and detail changes, credit underwriting, sanctions screening, jurisdictional eligibility checks, tax reporting classification, fraud investigations, and regulatory audits.

Institutions rely on address verification to determine where a customer legally resides, which laws apply to them, what products they can access, and how their risk should be assessed. When that residency link is falsified, the impact spreads across compliance, credit, and fraud controls simultaneously.

Here’s how proofs of address are used for document verification across specific industries:

- Traditional banking. Account opening, credit applications, and address changes under AML regulations.

- Insurance. Price risk (for example, property location) and validate policyholder identity.

- Real estate and property management. Tenant screening and lease agreements.

- Government benefits and social services. Confirm residency eligibility for local programs.

- Immigration and visa processing. Residence in a specific jurisdiction.

- E-commerce marketplaces. High-risk seller onboarding.

- BNPL providers. Used to support identity and credit risk assessment.

- Healthcare systems. Sometimes required to determine eligibility for regional coverage.

- Fintech and neobanks. Know your customer (KYC) onboarding to confirm residency, apply country-specific regulations, and prevent synthetic identity fraud.

- Crypto exchanges. Enforce geo-restrictions, comply with anti money laundering (AML) obligations, and prevent sanctioned individuals from accessing services.

- Online gambling platforms. Meet licensing requirements, apply local betting laws, and prevent multi-account abuse.

- Telecommunications providers. Reduce risk of identity theft and unpaid account fraud.

In each of these contexts, proof of address documents are often treated as trusted evidence because they originate from regulated entities such as banks, utilities, or government authorities.

What makes fake proof of address fraud so dangerous is when the address link is compromised, the entire identity verification process can collapse.

If you’d like to learn more about how fraudsters are creating all these fake proofs of address visit our “types of document fraud” blog.

How is a fake proof of address used?

A fake proof of address is rarely the end goal. It is a gateway document. When fraudsters successfully anchor an identity to a fabricated or manipulated residential address, they unlock access to financial systems, credit, and regulated services.

Here are the most common crimes enabled by fake proof of address fraud:

- Synthetic identity fraud. Criminals combine real and fabricated identity elements to create a new persona. A fake utility bill provides the “residential anchor” that makes the synthetic profile appear legitimate during onboarding.

- Money mule account creation. Fraudsters use forged proof of address documents to open bank or fintech accounts under false identities, using the account to receive, layer, and transfer illicit funds.

- Sanctions and geo-restriction evasion. By altering the address field, criminals can appear to reside in a low-risk or unrestricted country. This allows them to bypass regional and KYB compliance controls on crypto exchanges, gambling platforms, or fintech services.

- This tactic can also extend to business onboarding, where falsified residential details are used to disguise the ultimate beneficial owner (UBO) and reduce sanctions, jurisdictional, or enhanced due diligence scrutiny.

- Loan and buy now pay later fraud. A stable residential address strengthens perceived creditworthiness. Fake proofs of address are often paired with inflated income documents to secure loans, credit lines, or installment financing.

- Account takeover. Criminals submit forged address documents to change the registered address on an existing account. This can enable interception of physical mail, replacement cards, or identity reset procedures.

- Benefits and welfare fraud. Fraudsters fabricate tenancy agreements or utility bills to claim residence in a specific municipality, gaining access to housing benefits, healthcare coverage, or other local entitlements.

- Immigration and residency fraud. Fake tenancy agreements and utility bills are used to demonstrate continuous residence for visa renewals, naturalization processes, or work authorization.

A fake proof of address is typically part of a broader document fraud package, combined with forged identification and income documents. Because proof of address is widely trusted, frequently requested, and issued by different entities and business types, it often becomes the weakest link in the document verification chain.

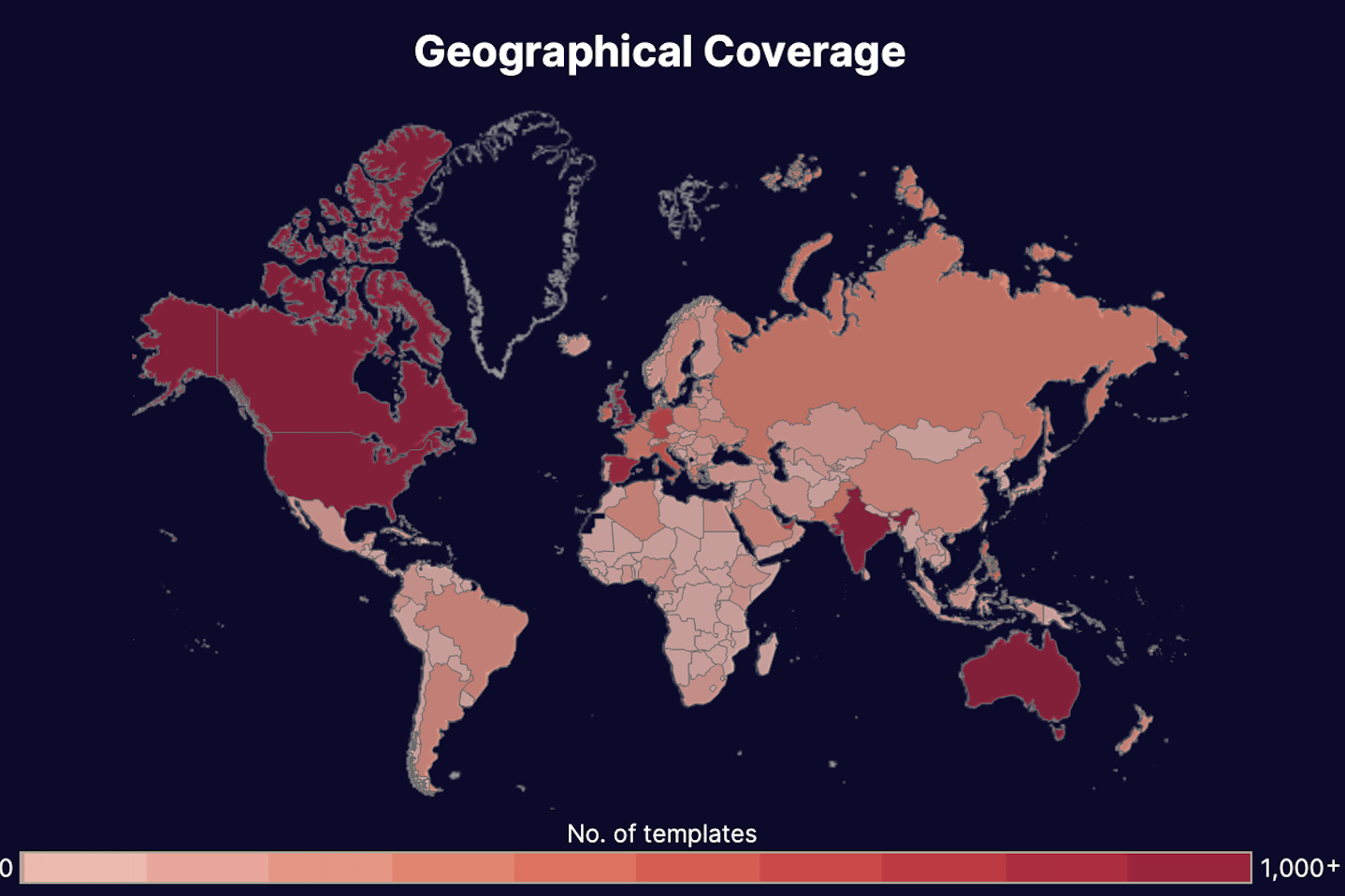

Threat intel: Template data about fake proof of address

Our Threat Intelligence Unit collects data about template farms which make and distribute fake document templates for fraudulent purposes.

Below, you'll find an infographic containing data about all the fake proof of address templates we've found: their availability, their distributors, the institutions or "issuers" whose documents have been exposed, and how much it costs to buy one.

Threat Intel Stats: Proof of address

Find more information about the threat these farms pose in our threat intel blog and webinar content.

Signs of a forged or fake proof of address

Missing a fake proof of address means your institution has accepted a fabricated residency claim. That false anchor can enable money laundering, synthetic identity fraud, sanctions evasion, or organized mule activity.

Unlike other document types, proof of address fraud is not primarily about visual forgery. It is about whether a claimed residence makes structural and contextual sense.

This is why automation matters. A utility bill, a lease agreement, and a tax form all follow different templates, issuers, and regional conventions. Trying to memorize formatting nuances across thousands of providers is not scalable. Modern fraud detection relies on structural analysis and cross-document intelligence, not visual familiarity with layouts.

Still, many organizations continue to rely on manual review in parts of their workflow. If you are reviewing proofs of address by eye, here are the structural and contextual signals to look for.

4 Structural signals of a fake proof of address

These signals apply regardless of whether the document is a utility bill, tenancy agreement, or government letter. They focus on the integrity of the residency claim itself.

1. The address cannot realistically sustain the identity. The property type, occupancy pattern, or economic profile contradicts the applicant’s broader identity narrative:- A small studio apartment linked to multiple unrelated adults across your system.

- A luxury property tied to an applicant claiming minimal income or hardship benefits.

- A rural address associated with high-frequency commercial activity.

- A recently constructed building tied to a claimed long-term residency.

- A property listed as vacant, for sale, or commercial-only while claimed as primary residence.

- The same address appears across multiple customer profiles within a short time frame.

- Slight unit variations are used to bypass duplicate detection (Apartment 1 vs Unit 01 vs #1).

- Multiple rejected applications tied to the same building.

- Address reused across unrelated names, emails, or device fingerprints.

- Internal history links the address to prior confirmed fraud.

- Address changed immediately before a high-value financial request.

- Address modification after a failed identity verification attempt.

- Claimed recent move combined with aggressive credit behavior.

- Device geolocation history inconsistent with stated residence.

- A claimed residence in a low-risk or unrestricted jurisdiction that materially changes the applicant’s compliance profile, product eligibility, or sanctions exposure

- A claimed residence in a low-tax or tax-advantaged jurisdiction while income sources, employer location, and spending patterns are concentrated elsewhere..

- Time zone activity that does not align with claimed location.

- Language patterns inconsistent with region of residence.

Contextual signals of a fake proof of address

Depending on the specific document type used as proof of address, contextual signals focus on whether the document’s underlying narrative matches real-world property and financial behavior.

Utility bills

Consumption levels may not align with the size or type of property. The named utility provider may not service that postcode. Tariff names or fee structures may not exist in that region. Meter formats may not match residential installations. Seasonal usage may contradict the climate of the claimed location.

Lease agreements

The landlord may not be verifiable in property records. The rental price may be inconsistent with market rates for that area. The lease terms may appear unusually generic or short. The same landlord details may appear across unrelated applicants. The property may simultaneously be listed for sale or unavailable for rent.

How to verify a proof of address

Onboarding analysts, KYC reviewers, fraud investigators, compliance officers, and credit risk teams typically perform proof of address verification manually or through automation.

While manual review is still common, it is increasingly strained by scale, remote onboarding, and the sophistication of modern document manipulation tools.

Manual verification struggles for two reasons:

- Fraudsters now use generative AI and editable templates to produce convincing documents in minutes.

- Proof of address fraud is rarely cosmetic. It is contextual. A document may look perfectly legitimate while the residency narrative behind it is actually residency fraud.

AI-powered automation addresses this gap. Instead of relying on surface checks, advanced systems analyze structural construction, cross-document consistency, and behavioral submission patterns at scale.

That said, manual review remains embedded in many compliance workflows due to regulatory expectations and legacy processes. If you are still verifying proof of address documents manually, here are practical ways to strengthen your review process.

Manual verification of proof of address

Outside the signals we mentioned above, here are some other sources verification experts can use to find out if a proof of address is real or fake:

- Confirm address validity through official postal databases. For example, In the United States, reviewers can validate address existence and formatting through the United States Postal Service ZIP Code Lookup tool. In the UK, Royal Mail’s Postcode Finder serves a similar function.

- Review property records and land registries. Where accessible, consult official land and property registries to confirm ownership, classification, and transaction history. For example, HM Land Registry in the UK.

Keep in mind: Manual checks rely heavily on human judgment and limited data visibility. They are time-intensive, inconsistent across reviewers, and ineffective against organized fraud networks that reuse addresses strategically.

Using AI and machine learning to spot fake proof of address

AI document verification enhances proof of address verification by analyzing how a document was constructed and how it fits into a broader behavioral and cross-document context.

Instead of reading and storing personal information, structural systems evaluate document integrity and submission patterns.

Key benefits include:

- Structural construction analysis. Detects manipulation in how the file was built, rather than relying on template matching or database lookups.

- Cross-document intelligence. Identifies reused layouts, repeated address patterns, and linked fraud activity across multiple submissions.

- Explainable forensic output. Provides clear evidence trails that compliance teams can review and defend during audits.

Automation vs. AI

Traditional automation follows predefined rules. For example, confirming that an address field is filled in or that a document is dated within an acceptable time window. These checks are useful but shallow. Fraudsters can easily satisfy static rules while still fabricating the underlying residency claim.

AI systems adapt. They learn structural norms, detect evolving manipulation techniques, and identify patterns across thousands of documents simultaneously. Instead of validating one document in isolation, AI reasons across documents, submissions, and behaviors. This makes it far more effective against coordinated proof of address fraud schemes.

Conclusion

Fake proof of address documents are entry points into larger fraud ecosystems, from mule account networks to synthetic identities and sanctions evasion. When a residency fraud claim is accepted, every downstream risk decision built on that address becomes unreliable.

Resistant Documents doesn’t read or store sensitive customer data, our structural analysis authenticates how a document was built. This allows institutions to identify fabricated residency claims without relying on fragile templates or external database lookups.

If proof of address is a foundation of your onboarding process, it deserves foundation-level protection.

Scroll down to book a demo.

Frequently asked questions (FAQ)

Hungry for more fake proof of address content? Here are some of the most frequently asked fake proof of address questions from around the web.

What counts as valid proof of address for KYC?

Requirements vary by jurisdiction and industry. For example, financial institutions in the United States must verify customer identity under Customer Identification Program rules, while UK-regulated entities follow guidance aligned with anti money laundering regulations.

But documents typically include a recent utility bill, government-issued letter, council tax bill, lease agreement, or mortgage statement. Always check the specific onboarding policy of the institution requesting the document.

Can you fake a utility bill as proof of address?

Yes, and that is precisely the problem. Editable PDF tools, downloadable templates, and generative AI image models make it possible to fabricate convincing-looking utility bills in minutes.

Why do banks ask for proof of address?

Banks request proof of address to comply with anti money laundering (AML) and identity verification regulations. Confirming where a customer resides helps institutions assess jurisdictional risk, apply local laws, and prevent financial crime.

How to spot proof of address with AI?

Resistant AI can detect fake proof of address documents by analyzing structural construction, submission behavior, and cross-document patterns.

What is an example of a proof of address?

An example of proof of address is a recent utility bill (such as electricity, gas, or water) that shows your full name and current residential address.

Is there software to detect fake proof of address?

Yes. Resistant AI provides document fraud detection software specifically designed to identify fake proof of address documents.

Who needs to check for fake proof of address?

Fake proof of address documents are typically reviewed by specific risk, compliance, and fraud roles inside organizations, not just “the industry” as a whole. The responsibility usually falls on teams who own onboarding, regulatory compliance, or financial risk decisions.

- KYC analysts and onboarding specialists (financial services and fintech). These reviewers validate residency during account opening to meet anti money laundering requirements and prevent synthetic identity or mule account creation.

- AML compliance officers (banks and crypto exchanges). They assess jurisdictional exposure, sanctions risk, and enhanced due diligence triggers based on a customer’s claimed residence.

- Fraud investigators (crypto platforms and gambling operators). They examine address patterns during suspicious activity reviews, multi-account detection, or geo-restriction evasion investigations.

- Risk and underwriting teams (telecommunications providers and lenders). They evaluate residency stability when approving postpaid contracts, device financing, or credit products.

- Eligibility and case review officers (government benefit agencies). They confirm that applicants genuinely reside within a qualifying municipality or region before approving housing, healthcare, or social support benefits.

Is making a fake proof of address illegal?

Yes. Creating, altering, or using a fake proof of address is considered fraud in most jurisdictions. It may constitute identity fraud, financial fraud, forgery, or making false statements depending on the context.

How can I get my proof of address?

You can obtain proof of address by downloading or requesting an official document that shows your full name and current residential address. The most common ways include:

- Downloading a recent bank or credit card statement from your online banking portal.

- Accessing a recent utility bill (electricity, gas, water, or internet) from your provider’s website.

- Requesting an official tax or benefits letter from a government authority.

- Obtaining a council or municipal tax bill if applicable in your region.

- Requesting a copy of your tenancy agreement or mortgage statement.

Most institutions require the document to be recent (often issued within the last 30 to 90 days) and clearly display both your name and full address.

What’s a good document for proof of address?

A good proof of address document is one issued by a regulated entity and clearly linking your full legal name to your current residential address.

Commonly accepted documents include:

- A recent utility bill.

- A council or municipal tax bill.

- An official tax authority letter.

- A signed tenancy agreement or mortgage statement.

The “best” document is typically one that is recent, clearly formatted, and issued directly by a recognized bank, government authority, or utility provider.