How to spot fake tax documents

It's February 2026 and tax season is once again upon us. Like 2025, most people will submit their tax returns online. In the U.S. for example, from February 2025 to February 2026 IRS web usage is up more than 35% (from 94 million to 127 million).

With so many tax return submissions, it begs one important question for businesses that collect these documents as proof of income, employment, etc: what percentage are real and what portion are fake tax returns?

If your business is looking to stop fake tax returns from hindering your income verification workflows, you might be at risk.

Generative AI and tax return document templates have made it dangerously easy to forge financial records.

As a trusted proof of income document across industries, tax returns have become the ideal weapon for fraudsters who want to inflate earnings, fake solvency, or bypass compliance.

Personal, business, or joint filings, If a tax return looks legitimate, it can be used to apply for loans, secure government benefits, pass background checks, and more.

Learning how to verify them matters.

Read on to learn what a tax return is, how they’re being forged, how to identify a fake tax return, and how AI-powered verification solutions can help spot them automatically.

Check out our “How to spot fake documents” blog to learn about more common document forgeries.

What is a tax return?

A tax return is a formal document submitted to a government authority detailing an individual’s or entity’s income, expenses, and tax obligations for a specific fiscal year. It serves as both a legal declaration and a financial summary, often used in broader compliance, lending, or risk assessment processes.

Whether it's a W-2 or a P60, core fields in a tax return typically include:

- Taxpayer identification. Name, Social Security Number or Tax ID, and filing status.

- Declared income. Summaries of earnings from employment, investments, business activities, and other taxable sources.

- Adjustments and deductions. Line items for eligible tax relief, such as education costs, mortgage interest, or charitable contributions.

- Tax calculations and liability. The total amount of tax owed, refunds due, or payment plans established.

- Signatures and filing metadata. Confirmation of submission, preparer details (if applicable), and submission timestamps or e-file IDs.

Together, these details create a comprehensive portrait of a filer’s financial standing and tax behavior over time.

An example of a business tax return for illustrative purposes only

What are the most common tax documents?

Tax forms can come in two main formats: self-issued and third party. Third party-issued documents can easily show signs of forgery (faking the document for fraudulent purposes). For example, stealing a W-2 template and editing it to change work history.

Self-issued returns, on the other hand, can only be fraud-detected through content analysis, as the forms can be easily downloaded online and filled in with whatever information the person desires — no imitation necessary.

Here’s a list of common tax return documents from various regions and their issuing identities:

|

Document name |

Country |

Self-issued or third party issued |

|

1040 |

United States |

Self-issued |

|

W-2 |

United States |

Third party issued (employer) |

|

1099-NEC |

United States |

Third party issued (business) |

|

T1 |

Canada |

Self-issued |

|

T4 |

Canada |

Third party issued (employer) |

|

T4A |

Canada |

Third party issued (business) |

|

Formulaire 2042 |

France |

Self-issued |

|

DSN (Déclaration Sociale Nominative) |

France |

Third party issued (employer) |

|

PASRAU |

France |

Third party issued (employer) |

|

SA100 (Self Assessment tax return) |

United Kingdom |

Self-issued |

|

P60 |

United Kingdom |

Third party issued (employer) |

|

P45 |

United Kingdom |

Third party issued (employer) |

|

Form 11 |

Ireland |

Self-issued |

|

Einkommensteuererklärung |

Germany |

Self-issued |

|

Lohnsteuerbescheinigung |

Germany |

Third party issued (employer) |

|

Modelo 100 |

Spain |

Self-issued |

|

Modello Redditi PF |

Italy |

Self-issued |

|

NAT 2541 (Individual Tax Return) |

Australia |

Self-issued |

|

PAYG Payment Summary/Income Statement |

Australia |

Third party issued (employer) |

|

Declaración Anual de Personas Físicas |

Mexico |

Self-issued |

|

ITR Forms ITR-1 to ITR-7 |

India |

Self-issued |

Why are tax returns important?

Tax returns are among the most trusted financial documents used across sectors to validate income, ensure regulatory compliance, and assess financial integrity. Their depth and official status make them especially valuable in high-stakes workflows.

Here’s how tax returns are used for document verification across industries:

- Banking and lending. Used to verify income during mortgage applications, loan approvals, or credit limit reviews.

- Immigration and visa processing. Support financial eligibility or employment history when reviewing residency or citizenship applications.

- Government benefits. Required to determine qualification for public support, healthcare subsidies, returns on taxes paid, or relief programs.

- Insurance underwriting. Helps insurers assess risk or verify reported income for policy issuance.

- Tax investigations and audits. Used by authorities to detect evasion, misreporting, or fraud across previous filings.

If you’d like to know how fraudsters are creating all these fake tax returns, check out our “Types of fraud” blog to learn more about their tactics.

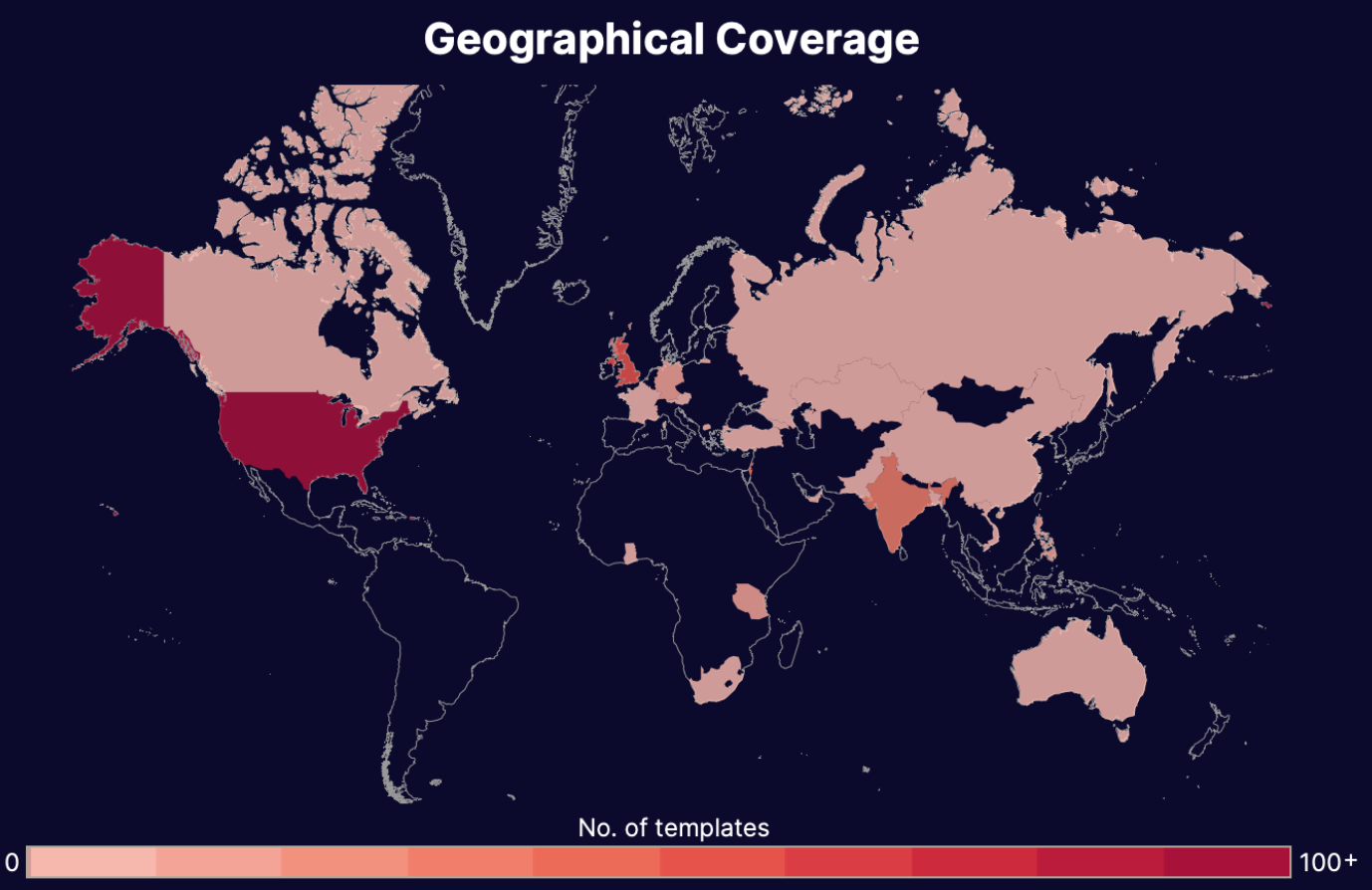

Threat intel: Template data about fake tax forms

Our Threat Intelligence Unit collects data about template farms which make and distribute fake document templates for fraudulent purposes.

Below, you'll find an infographic containing data about fake tax form templates, their availability, their distributors, the institutions or "issuers" whose documents have been exposed, and how much it costs to buy one.

Threat Intel Stats: Tax documents

Our "tax forms" dataset: documents that contain information for government agencies for the purpose of taxes: W-2 forms, 1099-NEC, P60, P45, etc...

5 Signs of a forged or fake tax return

Tax returns are a linchpin in financial verification. Whether used for loan approval, rental applications, or visa processing, a fraudulent tax return can distort a person’s financial identity and garner them unwarranted access and services.

Detecting these fakes manually is tough, but possible if you know where to look. Here’s what to look for:

1. Inconsistent formatting

Fraudsters often rely on outdated templates or cobbled-together documents. Layout mismatches are early warning signs.

- Mixed tax year formats. For example, “2023-24” used interchangeably with “FY23” on the same return.

- Wrong form version. A 2023 return using the layout of a 2021 IRS Form 1040 is a major red flag.

- Header misalignment. Official forms have tightly defined margins — crooked headers or off-center logos suggest tampering.

- Font inconsistency. Real returns use IRS-standard fonts like OCR-B; substitutions often indicate a forgery.

- Odd field spacing. Cramped or overextended boxes, especially on e-file templates, point to manual edits.

2. Incorrect or misleading information

A fake tax return may mix real data with fabricated entries. Inconsistencies give it away.

- Invalid taxpayer identifiers. Fake tax returns often include Social Security Numbers (SSNs), Tax Identification Numbers (TINs), or local equivalents (like France’s numéro fiscal, Germany’s Steueridentifikationsnummer, or India’s PAN) that are either:

- Mathematically invalid. For example, a PAN in India with an incorrect character pattern (it must follow the format “ABCDE1234F”).

- Nonexistent or unregistered. When checked against tax authority databases, the ID may not be associated with any known taxpayer.

- Declared employer not in national registries. French tax return (Form 2042) listing income from an employer that doesn’t appear in France’s SIRENE company directory, or an Irish Form 11 citing a company not registered with the Companies Registration Office (CRO)..

- Income anomalies. Suspiciously even income figures or mismatches with corresponding 1099s.

- Invalid IRS processing codes. Codes that are outdated or used in the wrong sections.

- Contradictory deductions. Claims that don’t logically follow the filer’s reported income or job type.

3. Bad math and uncharacteristic figures

Many fakes fail basic arithmetic or lack financial realism. This is a great way for spotting fraud in self-issued returns.

- Incorrect tax calculations. Tax owed or refunded doesn’t line up with IRS tables or deductions.

- Perfect tax-to-income ratios. Returns that show a flat 10%, 20%, or 30% tax rate without accounting for deductions, credits, or local tax bands (e.g., UK’s progressive PAYE structure or India’s slab system) are highly suspicious. Real returns almost never produce such clean ratios due to the complexity of tax code calculations.

- Exaggerated refunds. Inflated refund amounts that defy income and deduction logic.

- Undeclared self-employment detail. Returns claiming large self-employment or freelance income without the required attachments (e.g., UK’s SA103, France’s 2042-C PRO, Germany’s Anlage S, or India’s ITR-3) often indicate the document was padded with fake totals but lacked the knowledge to include proper breakdowns.

- Unrealistic withholding. Withholding amounts that exceed legal limits or historical employer behavior.

4. Tax return inconsistencies

Real tax returns follow strict form sequences and regulatory standards. Deviations matter.

- Wrong filing status logic. E.g., “Head of Household” filed without dependents or qualifying criteria.

- Mismatched state forms. Submitting a New York state return with California zip codes or tax tables.

- Missing digital submission barcodes. E-filed returns usually contain embedded tracking data or submission IDs.

- Fake IRS watermark. Digitally added watermarks that don’t match official scanned formats.

- Non-standard attachments. Extra “supporting documents” not typical for that return type, its jurisdiction, or filing scenario.

5. Metadata discrepancies

Digital tax returns reveal clues about how (and when) they were created — if you look under the hood.

- Creation date postdates submission date. If a document claims to have been filed or accepted on April 5 but the file was created April 10, it's likely forged or backdated.

- Authored or exported from non-tax platforms. If the metadata shows the file was created using Photoshop, Canva, Google Docs, or Chrome Print, it's a strong sign the return was self-fabricated — not system-generated.

- Suspicious access permissions. Locked PDFs that block text copying, highlight selection, or metadata viewing often aim to prevent fraud detection.

- Unusual file language or region settings. A French return (Form 2042) submitted with metadata set to “English (US)” or an Indian ITR-1 tagged with “de-DE” (German) suggests the document was repurposed or regionally spoofed.

- Embedded image layers. Real tax returns are text-based PDFs. If the form fields are part of an image or unselectable, the file may have been screenshotted and reassembled.

- Gen AI defense. While Gen AI tools and template farms can convincingly replicate layouts, terminology, and formatting, they often fail to accurately model real-world processing timelines. Subtle inconsistencies (such as issue dates that don’t align with filing windows, revision codes that don’t match the stated tax year, timestamps that conflict with version changes, or income and withholding totals that ignore realistic payroll cycles) can reveal synthetic or manipulated documents.

Disclaimer: Today’s fraudsters aren’t relying on white-out and scissors. Spotting fake tax returns now requires scalable, AI-powered verification that can analyze layout logic, submission history, and structural authenticity in milliseconds.

How to verify a tax return

You can spot fake tax returns using either manual or automated detection methods.

We recommend using AI-powered automation because fraudsters are already utilizing these technologies to mimic official tax return forms and logic, doing it so well that traditional checks fall short.

Manual reviews don’t account for the complexity of tax return fakes, their time-sensitive review period, and indications of fraud that go beyond basic metadata and surface-level checks. Even experienced compliance teams struggle to disqualify fake tax returns efficiently without an automated tool to expedite the process.

Still, manual review has its place because tax documents are often part of broader financial packages. Human reviewers can spot context-specific red flags (like those mentioned above), providing real insights into the validity of the documents.

Eventually everyone will need to automate, but if you want to continue verifying tax returns manually, consider the following:

Manual verification of tax returns

Cross-checking your documents against the clear signs of tax return fraud mentioned above is a good place to start. But for real certainty, consider:

- Contacting tax authorities. With permission, you can request official tax return transcripts or filing confirmations directly from government portals. For example, verifying a French Form 2042 (impots.gouv.fr), or checking an Irish Form 11 (revenue.ie).

- Comparing with linked documents. Match contents like “declared income” with supporting documents like W-2s, 1099s, and other documents included in the submission process.

- Verifying deduction thresholds. Use an official dedication threshold summary (like IRS deduction guidelines) to validate what’s allowable based on the filer’s context.

- Consulting official form libraries. Verify that formatting, codes, and values align with official, year-specific templates.

Keep in mind: Manual checks like these are valuable, but they're no match for today's AI-powered scams. As fraud tactics evolve, real-time, document-agnostic verification is becoming the industry norm.

Using AI and machine learning to spot fake tax returns

AI doesn’t just scan tax documents — it understands them. With official form libraries and your company’s data to train the model, AI can spot structural, behavioral, and repetitive anomalies without ever reading the documents.

Benefits of AI in spotting tax return scams:

- Template verification. Detects when layout elements deviate from known regional form structures.

- Behavioral analysis. Can spot anomalies within submission behavior such as geolocation, site heat maps, action timestamps.

- Cross-document context. Compares returns against supporting documents within your dataset to spot fraud patterns and serial threats.

- Manipulation detection. Detects tell-tale signs unrecognizable to the naked eye that the document or its metadata was manipulated before submission.

Automation vs. AI

Automation follows rules (like checking that fields are filled or that refund totals match declared deductions). But that’s where it stops. AI goes further by analyzing the logic and relationships between fields, scanning structural patterns, and catching layout-level irregularities no script could detect.

For example: automation might confirm that an Einkommensteuererklärung exists and that the numbers sum correctly, and it fits a predefined expectation of that document. AI can flag that the same return is indicating new signs of fraud only discovered weeks before as risk-indicators and that it was submitted across multiple identities — something automation would miss entirely.

Conclusion

Tax returns play a pivotal role in identity, credit, and income verification. With more people attempting fraud than ever before, their fakes are flooding the web. New fraudsters can use them to get better, existing criminals can treat them as serviceable upgrades. The days of catching fake tax returns by eye are over.

Organizations that still rely on manual reviews are playing catch-up. Resistant AI’s document fraud detection flips the script combining metadata inspection, structural logic checks, and layout-based detection to flag tax return fraud in real time.

Want to stop tax return fraud in 2025? Scroll down to book a demo.

Frequently asked questions (FAQ)

Hungry for more fake tax return content? Here are some of the most frequently asked questions about fake tax returns from around the web.

What’s the difference between tax returns, W-2s, and P60s?

Tax returns, W-2s, and P60s are all tax-related documents, but they serve different purposes and are issued by different entities. A tax return is submitted to government authorities to calculate and report annual income and tax owed. A W-2 is a wage summary from a U.S. employer, while a P60 is the UK’s year-end tax summary from an employer to an employee.

Tax returns: A comprehensive statement of income, deductions, and taxes filed annually with the government.

- Issued by: Tax authorities (e.g., IRS in the US, HMRC in the UK).

- Characteristics:

- Summarizes a person’s or business’s annual financial picture.

- Includes income from multiple sources, deductions, credits, and tax owed/refunded.

- Self-declared but may include employer-verified data (like W-2 or P60 figures).

W-2 (US): A year-end wage and tax statement issued by employers to employees.

- Issued by: Employers to both the employee and the IRS.

- Characteristics:

- Lists gross wages, tax withholdings, benefits, and Social Security/Medicare contributions.

- Used to complete individual tax returns.

- Employer-certified and time-stamped for year-end accuracy.

P60 (UK): A summary of an employee’s earnings and tax paid through PAYE (Pay As You Earn) for the tax year.

- Issued by: Employers to employees and HMRC.

- Characteristics:

- Captures total pay and deductions for the April–April UK tax year.

- Used in tax return filings, benefit applications, and income verification.

- Trusted for formal uses like visa applications or mortgage approvals in the UK.

Who needs to check for fake tax returns?

Fake tax returns can affect decisions across finance, housing, and immigration. These five roles are especially vulnerable:

- Loan officers. They use tax returns to verify borrower income during mortgage and credit applications.

- Immigration caseworkers. Tax records are often required for visa sponsorships, green card approvals, or asylum assessments.

- Landlords and leasing agents. To confirm prospective tenants meet income requirements or aren’t fabricating financial stability.

- Financial aid administrators. To determine eligibility for student aid, government subsidies, or hardship grants.

- Fraud investigators. Often brought in when patterns suggest synthetic identities or falsified income streams tied to multiple tax returns.

Is making or using a fake tax return illegal?

Yes. Submitting, fabricating, or altering tax returns is a serious offense in most jurisdictions. In the United States, filing a false return can lead to criminal charges under 26 U.S. Code § 7206 with penalties including heavy fines and up to three years in prison. In the UK, tax return fraud is covered under the Fraud Act 2006, which carries up to 10 years of imprisonment.

Aiding someone else in falsifying returns can result in conspiracy charges. Beyond legal risk, there’s reputational fallout and regulatory penalties for institutions that fail to catch fakes.

How do scammers use fake tax returns in fraud?

Fake tax returns are often used to fabricate an applicant’s financial history. Here are a few common schemes:

- Inflated income. Used to qualify for larger loans or rental agreements.

- Identity cover-ups. Fraudsters use synthetic or stolen identities to file clean-looking returns that hide criminal pasts.

- Shell company tax history. Returns are faked to legitimize nonexistent or inactive businesses.

- Government benefits fraud. Forged returns help fraudsters pass means testing for programs like tax credits or stimulus relief.

- Visa and residency scams. Foreign applicants forge tax history to show long-term residency or financial integration.

Can fake tax returns bypass e-filing systems?

Surprisingly, yes… and no. Government e-filing systems have verification checks which can eliminate many fakes, but they’re still imperfect. They’re not bulletproof against the best fraud techniques and when you talk about cross department submissions (filing a form from one department as a part of the submission process for another), you can run into even less guaranteed defenses thanks to information siloes.

The real harm comes when individuals use tax forms from international sources for domestic submissions. For example, European companies submitting fake U.S. tax forms in efforts to circumvent tariffs. Nations rarely have reliable international fraud indicators or source material that lies outside their jurisdiction and fail to spot these tax return scams.

What tools are used to make fake tax returns?

Fraudsters use a mix of common and advanced tools, including:

- PDF editors. Tools like Adobe Acrobat or Nitro PDF for altering numbers and text.

- Template kits. Dark web marketplaces offer pre-filled IRS and local tax return templates with editable fields.

- AI layout generators. Tools that replicate IRS styling, fonts, and logos using generative models.

- Screenshot stitching. Scammers edit images or screenshots of past filings to create plausible-looking forms.

Organizations relying on visual inspection alone won’t detect these — but structural AI analysis can.