Industry insights

Global Document Fraud Report 2026

What 170 million documents reveal about amateur and professional document fraud Document fraud has changed. What used to be a craft practiced by skilled forgers has industrialized into a supply chain ...

Global Document Fraud Report 2026

What 170 million documents reveal about amateur and professional document fraud Document fraud has ...

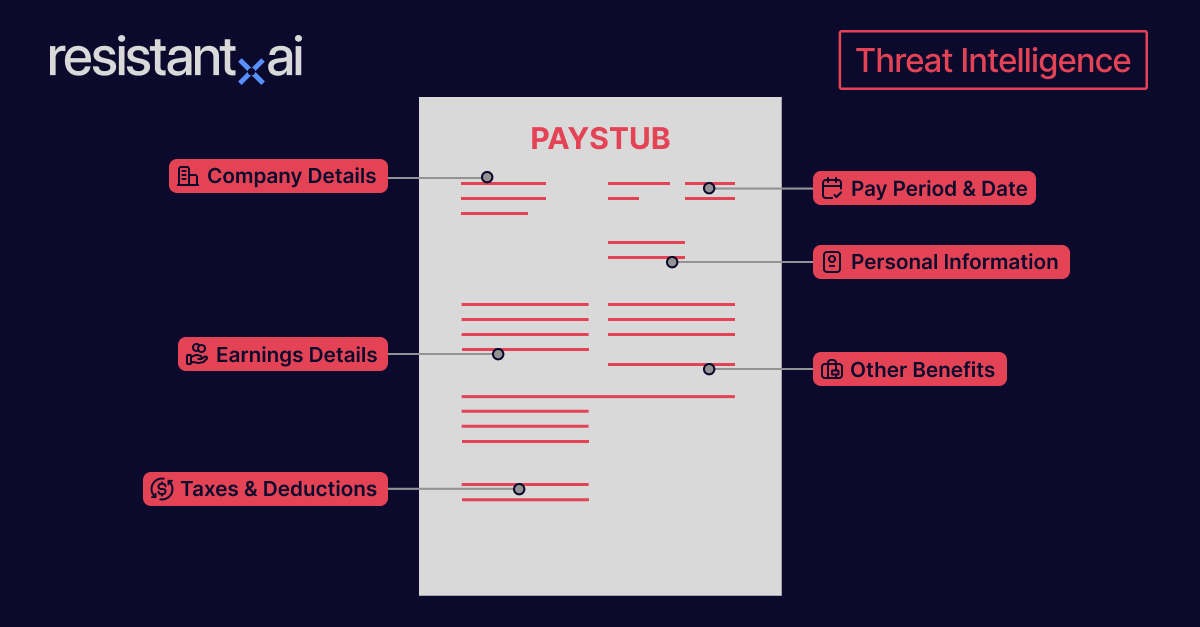

I’m working here...or am I? The threat of pay stub ...

Pay stub, pay slip, salary slip, earnings statement, proof of income... Whatever the designation, ...

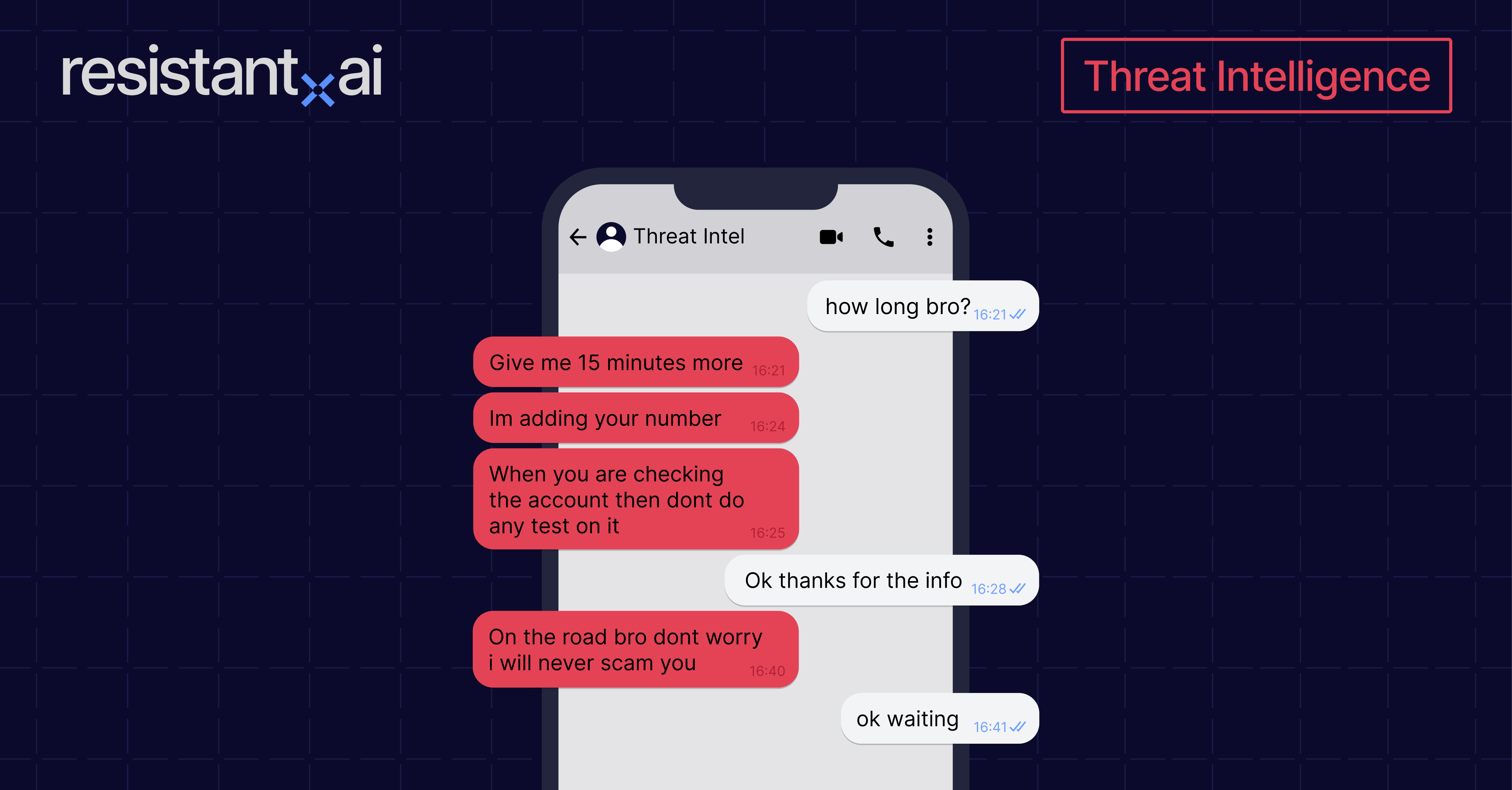

Top 7 quotes from our conversations with fraud enablers

Talking to criminals can feel like you’re watching a foreign film with imperfect subtitles: the ...

Insurance fraud: Ultimate guide

In 2026, insurers will collect trillions of dollars in premiums to protect individuals, businesses, and entire ...

Swatting cockroaches with AI

"And I probably shouldn’t say this, but when you see one cockroach, there are probably more… Everyone should be ...

Trade finance fraud: Ultimate guide

Trade finance enables roughly 80% of global trade, serving as the backbone for $25 trillion in annual transactions. By ...

Payment fraud: Ultimate guide

Payment fraud prevention is a big issue for institutions in 2025. Take Cashapp's scandal earlier this year as an ...

2024 predictions: 5 key fraud, automation, and compliance trends

As we enter 2024, the fraud, automation, and compliance landscapes are poised for dynamic shifts that will shape the ...

Digitizing our physical identities, and the security gap we now need to close

This article was co-authored by Martin Rehak and Lucie Rehakova. Digitization has facilitated an often life-changing ...