KYC verification: Ultimate guide

Have you been walking the tightrope between effective fraud prevention and frictionless customer onboarding experience?

Compliance and risk officers face the constant challenge of protecting the business from bad actors without hindering its growth. Unlike stopping a single high-risk business deal, a slow or overly complex know your customer (KYC) process can mean losing hundreds of valuable customers, putting onboarding targets and company goals at risk.

It can lead to a constant self-questioning cycle of concern, action, and doubt.

Was our process too slow? Did we just lose a cohort of good customers to a competitor? Are we letting fraudsters slip through in the name of speed?

The endless stream of fraud professionals seems to only grow with time. Risk managers, product managers, fraud analysts, and onboarding specialists are tasked with the critical mission of keeping criminals out of your customer base. And your work is fundamental.

In this blog, we'd like to simplify the KYC process, providing a formal definition and clear indications of its necessity within your organization. We want to put your mind at ease, giving you confidence that you're making well-founded decisions that protect your company without slowing its growth.

Read on to learn everything you need to know about KYC verification.

What is KYC verification?

KYC (Know Your Customer) verification is the process of verifying the identity and assessing the risk profile of an individual customer before they can access your products or services.

It helps companies prevent identity theft, money laundering, terrorist financing, and other financial crimes by ensuring they only engage with legitimate and trustworthy individuals.

KYC verification real-world example

To get a better idea of how KYC verification works in the real world, we've provided a step-by-step example.

It's important to remember that companies can perform KYC checks at different points in the customer journey. Many modern neobanks, for instance, prioritize a fast, low-friction sign-up to get a customer on their platform quickly (effectively taking them off the market). They might only require an ID verification initially, and then trigger enhanced due diligence (like proof of address or proof of income) later if the user's activity, such as a large transaction, meets a certain risk threshold. This is called step-up KYC.

Alternate solutions and use cases, like loans (where there is the possibility of the institution losing money up front), prefer to do all KYC controls in the first step, collecting documents and performing other processes before onboarding the customer.

To get a better idea of how KYC verification works in the real world, we've chosen to illustrate a "step-up" KYC model. This approach best reflects the dynamic, risk-based process that defines modern digital onboarding, where the central challenge is to balance a frictionless user experience with robust security (one of the most common pain points in KYC).

It's important to note, however, that this is not a rigid formula. Depending on the industry, a company's specific risk appetite, and regulatory requirements, some of these steps may be skipped, performed in a different order, or handled by a different department/workflow in-house.

- Customer registration. A user starts the sign-up process on a new fintech app, providing basic personal information like their full name, date of birth, and phone number.

- ID document upload. The app prompts the user to use their phone's camera to capture a clear image of their government-issued ID, such as a driver's license or passport. These documents are then verified and checked for different types of document fraud.

- Biometric verification & liveness check. To prove the person opening the account is the same person on the ID, the app asks the user to take a selfie. It may also ask for a short video where they move their head to confirm they are a live person and not a photo or mask.

- Registry lookups. In seconds, the fintech’s system automatically screens the user’s details against global sanctions lists, politically exposed persons (PEP) databases, adverse media sources, address listings, credit checks, and several other databases.

- Initial account activation. Having passed these initial checks, the user’s account is approved and activated, often with certain transaction limits in place.

- Enhanced due diligence trigger. A month later, Alex attempts to make a large international wire transfer. This action triggers an automated alert in the bank's risk system, requiring further verification.

- Request for additional documentation. The bank now places a temporary hold on the transaction and requests additional documents to verify their address and income, such as a recent utility bill and a copy of a recent pay stub.

- Full approval and ongoing monitoring. Once the new documents are verified, the transaction is approved, and their account may be upgraded to have higher limits. The platform continues to monitor the account for any future unusual activity and will request a renewal of documents or additional information if necessary.

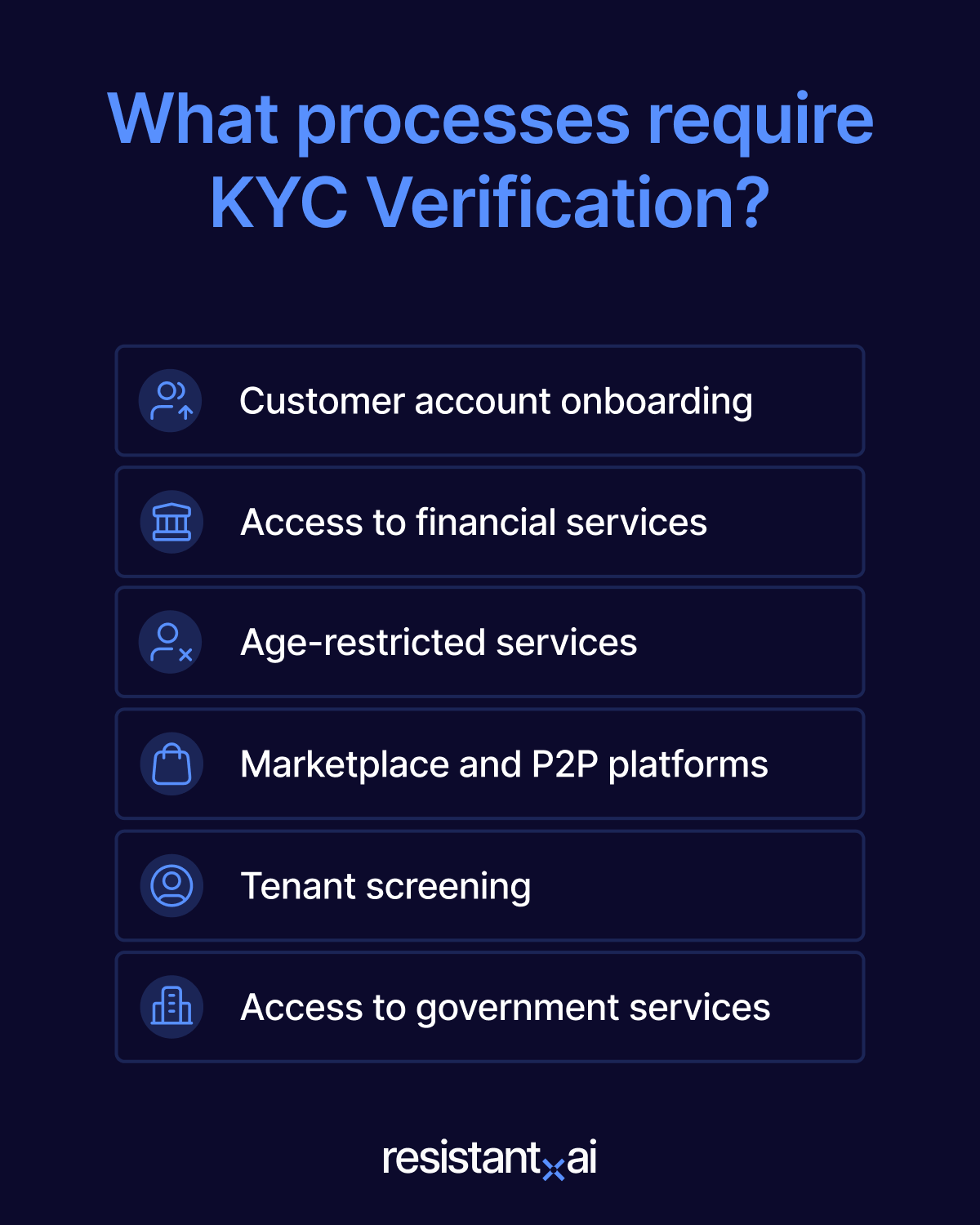

What processes require KYC verification?

Some of the processes that require KYC verification are:

- Customer account onboarding. This covers the initial verification of an individual when opening accounts with banks, fintechs, crypto exchanges, investment platforms, or other financial institutions.

- Access to financial services. KYC is required when a person applies for a loan, credit card, mortgage, or insurance policy. Essentially, it is needed for any service involving underwriting or the extension of credit.

- Age-restricted services. This is necessary for platforms operating in regulated sectors where age verification is critical, such as online gambling, gaming, or the sale of age-restricted goods.

- Marketplace and P2P platforms. Verification is used on peer-to-peer marketplaces and payment apps to build trust, ensure users are who they claim to be, and prevent scams.

- Tenant screening. Used by landlords and property managers to verify the identity of prospective tenants. This is a crucial step before conducting credit and background checks to prevent rental scams, assess financial reliability, and ensure community safety.

- Access to government services. Required for citizens to access public services, such as filing taxes online, applying for benefits, or obtaining official documents like a passport. This process is critical for preventing identity fraud and ensuring that services are delivered securely and to the correct, eligible individuals.

Each of these processes shares a common need: to confidently link a digital action to a real, verifiable person. This is essential for managing regulatory duties, financial risks, and exposure to fraud.

KYC serves as the primary safeguard, preventing criminals from using anonymous, stolen, or synthetic identities, or their own high-risk identities, to commit financial crimes, which in turn protects the business from liability and maintains a trusted environment for all legitimate users.

Why is KYC verification important?

In today's digital-first world, nearly every meaningful customer relationship begins online. From opening a bank account to joining a new investment app, the "digital front door" is the primary point of entry. This shift has made KYC verification more vital than ever, serving as the critical process for establishing trust in an environment where you may never meet your customers face-to-face.

It's not just about following rules. These safeguards are essential for understanding who your customers are and for mitigating risks before they can cause harm.

Some of the benefits of KYC verification include:

- Fraud prevention. Stop criminals from using stolen or synthetic identities to open accounts, commit payment fraud, or take over legitimate user accounts.

- Regulatory compliance. Satisfy global anti-money laundering (AML) and counter-terrorism financing (CTF) laws, which mandate customer identification and risk assessment.

- Verifying true identity. How much do you trust someone who’s passed your KYC checks? You trust them with everything. By giving them access to your systems you’ve given them a blank slate to either use or abuse your platform. In that situation, you better know who you’re dealing with.

- Trust and reputational protection. Protects your platform and its honest users from being exposed to criminals, building a safe ecosystem and preserving brand reputation.

What are the legal requirements of KYC verification?

KYC (Know Your Customer) verification is a legal requirement in many countries across highly regulated industries, rooted in global efforts to combat money laundering, terrorist financing, and identity fraud. Afterall, if you don't know who your customers are, they might as well be criminals.

It's never been more important to be compliant. In 2023 alone, regulators levied billions in penalties globally, highlighted by a landmark $4.3 billion fine against Binance for failures in its anti-money laundering program, underscoring the severe consequences of inadequate KYC.

Like KYB, KYC obligations arise when service providers like financial institutions, real estate firms, or crypto exchanges need to assess the risk of their individual clients.

The legal requirements typically involve collecting personal identification details, verifying the authenticity of documents, and screening individuals against global watchlists.These regulations mandate a risk-based approach, meaning the intensity of KYC checks should directly correspond to the risk a customer presents.

Factors like the customer's geographic location, their expected transaction behavior, and the products they use determine this risk level.

Consequently, a customer deemed higher-risk (such as a Politically Exposed Person (PEP) or someone attempting a large, uncharacteristic transaction) will either require enhanced due diligence (EDD), involving a much deeper level of scrutiny than a standard customer, or be rejected from onboarding.

Many jurisdictions embed KYC requirements directly into their broader anti-money laundering (AML) and counter-terrorism financing (CTF) laws:

- USA. KYC obligations stem from the Bank Secrecy Act (BSA), enforced by FinCEN, which mandates that financial institutions establish a Customer Identification Program (CIP) to verify the identities of their customers.

- EU. The 5th Anti-Money Laundering Directive (5AMLD) imposes stringent customer due diligence requirements on banks, fintechs, and other regulated entities, including crypto platforms.

- UK. Post-Brexit, the UK has retained similar standards through its Money Laundering Regulations (MLRs), which govern customer verification processes.

- Globally. The Financial Action Task Force (FATF), an intergovernmental body, sets the international standards, emphasizing risk-based customer due diligence as a cornerstone of an effective AML/CTF regime.

In practice, failing to meet KYC obligations can result in staggering regulatory fines, loss of licenses, and irreparable reputational damage.

What are some common KYC scams?

Sophisticated fraud isn't just about technology; it's often about exploiting human trust and behavior. Understanding the common scams fraudsters use to acquire the credentials needed to pass KYC checks is essential for recognizing the real-world threats your systems must defend against. Here are a few common examples:

- The receptionist scam. This is a form of insider fraud where a person in a position of trust, like a hotel receptionist or landlord, abuses their role. When a customer provides their ID for a legitimate purpose (they might even ask for a photograph) the fraudster secretly takes a high-quality photo of it to sell on the dark web or use themselves to open a new account in the victim's name.

- The money mule scheme. In this scheme, criminals recruit individuals (often students or people in financial distress such as homeless people) to use their own, legitimate identity documents to open bank accounts. The individual then gives the account credentials and control over to the criminal organization, which uses the account to launder illicit funds, making the original account holder a "money mule."

- Synthetic identity fraud. This is one of the fastest-growing forms of financial crime. Instead of stealing one person's complete identity, fraudsters combine real and fabricated information—such as a real (but stolen) Social Security Number with a fake name and date of birth—to create an entirely new, non-existent "synthetic" identity. This new identity is then used to apply for loans and credit with no intention of paying them back.

- The job application scam. Criminals post fake "work from home" job listings on legitimate employment sites. When a person applies, the fraudsters will ask them to submit a photo of their government ID and a selfie to "complete their application file" or "run a background check." In reality, they are harvesting a perfect "KYC kit" (a valid ID with a matching liveness photo) to pass identity verification checks at financial institutions.

How to perform a KYC verification check: Step-by-step

KYC (Know Your Customer) checks are a critical part of customer onboarding and are increasingly becoming a part of ongoing monitoring (especially in step up KYC and account renewal use cases).

They help verify an individual’s identity, ensure that a person is who they claim to be, and assess their potential risk to the business.

Below is a guide to performing a KYC verification check, keeping in mind that these processes can vary based on use case:

- Collect personal identity information.

- Verify identity documents and status.

- Biometric verification & liveness check.

- Screen the individual against databases and registries.

- Review and verify additional customer information.

- Conduct a customer risk assessment.

- KYC decisioning.

- Document and audit the KYC process.

1. Collect personal identity information

Start by gathering the customer's core personal data, collecting the information you intend to verify. This initial step is typically limited to simple data entry from the user and does not yet involve document collection. The information provided in a sign-up form establishes the basic identity claim that your system will work to verify in the subsequent steps.

Key information to collect includes:

- Full legal name.

- Date of birth (DOB).

- Residential address.

- Country of residence.

- Contact information (phone number, email address).

Real world example: A user, Ryan Resist, begins the onboarding process for a new neobank app. In the initial sign-up form, he enters his full name, date of birth, current residential address, and phone number. The app captures this information, creating a preliminary customer profile based on his self-submitted data.

2. Verify identity documents

Once you have the customer's self-submitted information, the next step is to corroborate that data against official documents. This critical process verifies the authenticity of the identity claim by matching it to a government-issued source.

The primary documents requested for identity and address verification include:

- Identity documents. Passport, driver’s license, national ID card.

- Address documents. Utility bills, bank statements, lease agreements.

The timing of when these documents are requested is a key difference in onboarding strategies. Many traditional institutions (and those with immediate exposure like loans and online gambling) require a comprehensive set of documents upfront (multiple ID docs, address proofs, and even income verification).

However, many modern digital platforms use a tiered, risk-based approach, starting with just a core identity document to reduce initial friction. They then request further proof, like address verification documents, after a set period of time, a transaction threshold, or if the user's risk profile and activity warrants it.

Our “Ryan Resist” example follows this modern approach, demonstrating how additional diligence is applied in later steps.

The verification process itself involves:

- Checking document authenticity. The system automatically checks the submitted document for signs of forgery, tampering, digital manipulation, and other fraud indicators.

- Matching document data to submitted data. The system cross-references the key data points from the ID (full name, date of birth) with the information the user provided in Step 1, flagging any mismatches.

Real world example: Following his initial data entry, the neobank app prompts Ryan Resist to upload a photo of his driver's license. The system's document verification software analyzes the image and confirms the license is authentic and valid.

It then extracts the name and date of birth, which perfectly match the details Ryan provided in Step 1. However, the system flags a data mismatch: the address on the driver's license does not match the residential address Ryan entered during sign-up. This discrepancy is logged in his profile for further review.

3. Biometric verification and liveness check

A valid document isn't enough; you must also ensure the person presenting it is its rightful owner. This step prevents identity theft and impersonation, but is again tied to the company’s risk appetite and how they build their KYC controls.

If they’re building in house, for example, they might favor automated registry look-ups over more complex technology like biometrics and liveness checks. It’s also impacted by the level of risk the institution is dealing with and the scalability of deploying control across an expanding customer base.

That being said, biometrics and liveness checks are still very valuable as it connects the physical person to the digital onboarding process, confirming who they claim to be in real-time.

- Facial matching biometrics. This is a 1-to-1 comparison to confirm likeness. The system uses biometric technology to compare the facial geometry of the user's selfie with the photo on the government-issued ID submitted in Step 2. A successful match provides a high-confidence score that the user is the same person pictured on the document.

- Conduct a liveness test. This is an anti-spoofing measure to confirm the user is physically present. To prevent fraudsters from using a photo, video, or mask of the victim, a liveness check is performed, either by requiring the user to follow on-screen prompts or by using AI to analyze the selfie for subtle textures and movements that prove it's a real person.

- Note on older methods. Some systems request a single photo of the user holding their ID next to their face. This less secure method attempts to combine document and biometric checks, but it often results in poor image quality for both, and more importantly, it fails to provide a true liveness test, leaving it vulnerable to basic fraud techniques.

- Behavioral biometrics and device fingerprinting. This analyzes background signals to assess risk. Device fingerprinting captures technical data (device type, IP address, use of a VPN), while behavioral biometrics analyzes how the user interacts with the application (typing speed, copy-pasting information, phone orientation). These signals feed into each other to build a complete behavioral picture, helping to distinguish a legitimate user from a bot or a fraudster working from a script.

Real world example: With his driver's license confirmed as authentic in the previous step, the neobank now needs to verify that Ryan Resist is the legitimate holder of that ID. The app prompts him to take a selfie. Its facial matching biometric technology scans his facial features and compares them to the photo on his driver's license, confirming a high-probability match.

Next, to ensure he is physically present, the app asks him to follow a simple on-screen prompt to slowly turn his head to the right. This liveness test is successful. The system now has strong evidence that the person currently onboarding is the same person pictured on the valid ID (but the previously flagged address mismatch remains an open issue).

4. Screen the individual against databases and registries

You have verified the customer's identity, confirming their documents are real and they are indeed the person who the documents belong to. Now, you must check it against global risk databases. This screening process is designed to uncover any known legal, regulatory, or reputational red flags and is a mandatory part of most AML/CTF compliance programs.

- Conduct sanctions screening. Screen the individual’s name and date of birth against global sanctions lists (e.g., OFAC, UN, EU, HM Treasury) to ensure you are not onboarding a person legally barred from using your services.

- Check against PEP databases. Identify if the customer is a Politically Exposed Person (PEP): an individual with a prominent public function. PEPs are considered higher risk due to their potential involvement in bribery and corruption.

- Run adverse media checks. Scan global news outlets and public records via a specialized tool (like this Down Jones database) to find any negative news that could link the individual to financial crime, litigation, or other reputational risks.

- Positive screening. It’s also possible to screen for information that isn’t outwardly negative about a person’s character such as address registrations, credit checks, and employment history.

Real world example: With Ryan Resist’s identity confirmed, the neobank's system automatically screens his verified name and date of birth against its risk databases. The sanctions and PEP screenings come back clean.

However, the adverse media check flags a few news articles from two years ago mentioning a "Ryan R." in the same city involved in a litigated dispute over finances with a former business partner. The system logs this as a low-level risk factor.

This finding, combined with the address mismatch from Step 2, means Ryan’s application can no longer be approved automatically and will require further review.

5. Review and verify additional customer information

When the initial automated checks flag discrepancies or potential risks, the onboarding process cannot be completed automatically.

This is the stage where the kind of enhanced documentation that legacy institutions might request from all customers upfront is now required.

In a Step Up KYC process, these documents are only requested when a specific trigger is met (such as a large transaction, reaching an account threshold, or, as in Ryan Resist's case, an escalation due to flags raised during the initial checks).

This step involves targeted due diligence to resolve those specific issues and build a clearer picture of the customer's risk profile.

- Request supplementary documents. This involves asking the customer for additional evidence to either resolve a specific data mismatch (like an address discrepancy) or to perform deeper due diligence to verify their source of funds or wealth.

- Common documents include: a recent utility bill, bank statement, lease agreement,, pay stubs, and tax returns.

- Common documents include: a recent utility bill, bank statement, lease agreement,, pay stubs, and tax returns.

- Consolidate and review findings. A compliance analyst often reviews the complete profile at this stage (the verified identity, the initial red flags, and the new information provided) to see if the risks have been sufficiently mitigated.

Real world example: Because of the address mismatch and the adverse media hit, Ryan Resist’s application is automatically routed for further review instead of being instantly approved.

The neobank app prompts him to upload a supporting document to verify his current address. Ryan uses his phone to take a picture of a recent electric bill.

The system's software extracts the name and address from the bill, which perfectly match the information Ryan entered in Step 1. This action successfully resolves the address discrepancy flagged in Step 2. His profile is updated, and the case is now ready for a final risk assessment.

6. Conduct a customer risk assessment

Before making a final decision, it's essential to evaluate the customer's overall risk profile. Assigning a risk level (typically low, medium, or high) based on the information gathered so far determines the required level of due diligence and how often the customer's activity should be reviewed in the future.

You can determine a risk level by assessing:

- The customer's profile and submitted documents. Were all the initial documents valid and verifiable? Were there any discrepancies or inconsistencies?

- The customer's background and screening results. Check for adverse media, sanctions hits, or PEP status. A PEP classification, for instance, automatically elevates a customer's risk level.

- Geographic location. The customer's country of residence and citizenship can increase risk, especially if they are associated with jurisdictions known for high levels of corruption or terrorism financing.

- Expected account activity. The customer's stated purpose for the account and their expected transaction volume and patterns should be considered.

- Using internal or third-party scoring models. Incorporate all the data points above into a consistent model that scores individuals and tracks risk indicators.

This risk assessment guides whether they should be approved for an account, if their case must be escalated for further evaluation, or denied entirely.

Real world example: A compliance analyst at the neobank reviews Ryan Resist’s complete file. They consider the successful identity and biometric verification, the now-resolved address discrepancy, and the low-level adverse media hit related to a past civil dispute.

Based on the combination of a minor data inconsistency and the media mention, the analyst classifies Ryan Resist as a medium-risk customer, rather than low-risk. This classification is logged in his profile, along with the reasons for the decision.

7. KYC decisioning

After gathering and assessing all available data, the onboarding team must make a final decision: approve, reject, or escalate. This decision should weigh the full context: document authenticity, biometric verification results, the customer's risk classification, and the outcome of watchlist screenings.

Approvals may be conditional (e.g., with lower transaction limits), while high-risk or unverifiable individuals should be escalated for Enhanced Due Diligence (EDD) or declined in line with internal policy and regulatory thresholds.

Real world example: Based on Ryan Resist's classification as a medium-risk customer, the compliance analyst makes a final decision. Rather than rejecting him outright, they decide to approve his account but with specific controls attached.

His account is assigned lower initial transaction limits than a standard low-risk customer, and it is automatically flagged for more frequent ongoing monitoring. The analyst formally documents the decision, noting that the resolved address issue and minor adverse media hit were not sufficient grounds for rejection but justify the enhanced controls.

8. Document and audit KYC process

Every KYC check needs a strong paper trail not just for compliance, but also for internal accountability. This creates a verifiable record of the due diligence performed, which is essential for regulatory audits and future risk reviews.

This documentation will contribute to your Customer Identification Program (CIP) and Customer Acceptance Policy (CAP).

- Store all collected documents and data points. Securely log all submitted documents, the results of verification checks, and any data gathered.

- Log all verification steps and decisions. Maintain a clear, time-stamped record of each action taken, from the initial data entry to the final decision.

- Maintain version-controlled records. Ensure that the customer's risk profile and information can be updated and reviewed over time without overwriting historical data.

- Respect data privacy laws (GDPR, CCPA) during storage and sharing. All customer data must be handled in compliance with strict privacy regulations.

Conduct ongoing monitoring for all approved customers to see if their risk profile changes, they appear on a new watchlist, or their transaction behavior deviates from expectations.

Real world example: Following the approval decision, the neobank’s compliance system logs all supporting files for Ryan Resist’s case.

This includes his submitted driver’s license and utility bill, the outputs from the document and liveness checks, the adverse media screening results, and the analyst’s notes detailing the rationale for the medium-risk score and conditional approval.

The risk score and control limits are clearly tagged, creating a complete audit trail. This ensures that if regulators or auditors revisit the case, every decision is backed by verifiable documentation. Ryan's account is now officially active, with automated systems in place to monitor his future transactions.

KYC Verification Checklist

Use this checklist to confirm that all necessary validation points have been met for an applicant. A complete and defensible KYC file will have addressed all relevant checks across these four core controls, even if your specific workflow performs them in a different order.

Control 1: Document integrity

Focus: Is the evidence authentic and valid?

- The primary ID document has passed automated checks for signs of forgery, tampering, or digital alteration.

- Key security features (e.g., MRZ code, holograms) are present and valid for the specific document type.

- The document is confirmed to be current and not expired at the time of onboarding.

- The submitted proof-of-address document is from a trusted source and is within the required date range.

Control 2: Identity assurance

Focus: Is the applicant the rightful owner of the identity?

- The applicant's submitted name and date of birth have been successfully matched to the identity document.

- The biometric match between the applicant's selfie and their ID photo meets or exceeds the required confidence score.

- A liveness check has successfully completed, confirming the applicant was physically present during the process.

- All initial data discrepancies (e.g., address mismatch) have been identified, documented, and fully resolved.

Control 3: Risk assessment

Focus: Does this applicant pose a risk to the business?

- Screening against all required sanctions and government watchlists is complete with no confirmed matches.

- The applicant's Politically Exposed Person (PEP) status has been determined and documented.

- Adverse media screening is complete, and any relevant findings have been reviewed and assessed by an analyst.

- A final risk rating (low, medium, or high) has been assigned based on a consistent internal risk rubric.

Control 4: Procedural compliance

Focus: Have we logged a complete and defensible audit trail?

- The final decision (approve, reject, escalate) is logged and clearly justified with supporting notes.

- All appropriate account controls or monitoring rules have been applied based on the applicant's risk rating.

- A complete audit trail of all documents, check results, and decisions is securely stored in compliance with data privacy laws.

What documents are required for KYC verification?

When verifying an individual under Know Your Customer (KYC) regulations, companies are typically required to collect a set of official documents to confirm the person's identity, address, and in some cases, their financial standing.

Here are some of the most common documents required in KYC and what they verify:

- Passport. Proof of identity, proof of nationality.

- Driver’s license. Proof of identity, proof of address.

- National ID card. Proof of identity.

- Government-issued residence permit. Proof of identity, proof of legal status.

- Birth certificate. Proof of identity, proof of age.

- Marriage certificate. Proof of marital status, proof of name change.

- Social security card. Proof of national identifier.

- Utility bill. Proof of address.

- Bank statement. Proof of address, proof of funds, proof of financial standing.

- Lease agreement. Proof of address.

- Mortgage statement. Proof of address, proof of financial standing.

- Tax return. Proof of income, proof of financial standing.

- Pay stub. Proof of income, proof of employment.

- Employment contract or letter of employment. Proof of employment, proof of income.

- Business sale agreements. Proof of wealth.

- Divorce settlement documents. Proof of wealth, proof of funds.

- Insurance policy documents. Proof of assets, proof of financial standing.

- Transaction history. Proof of funds, proof of financial behavior.

- Professional licenses. Proof of credentials, proof of professional standing.

- Work permit (for foreign nationals). Proof of legal status, proof of right to work.

- Criminal background check. Proof of criminal record.

How to automate KYC verification

Historically, KYC verification was an entirely physical process, conducted in person with paper documents; the standard practice well into the late 1990s. The entire system was built on the assumption that a customer would be physically present, allowing for face-to-face interaction and the manual inspection of tangible documents.

As the internet enabled remote account opening in the early 2000s, the industry had to solve the new "Card-Not-Present" challenge for identity: how to verify a document you cannot physically hold and inspect. For more than a decade, from the early 2000s into the mid-2010s, the solution was a manual, screen-based version of the old paper process.

Compliance teams would receive scanned documents via email, visually inspect IDs on a computer screen for obvious signs of fraud, manually type names into separate screening portals, and track everything using cumbersome spreadsheets.

This approach was not only slow, but vulnerable. Human error, inconsistent checks, and outdated records meant that sophisticated fraudsters could easily slip through the cracks. Manual KYC struggles to keep pace with the scale and complexity of modern digital platforms, which onboard thousands of new users daily.

To address these inefficiencies, many companies began automating KYC workflows using rule-based systems. These systems follow pre-set logic to trigger key KYC checks and validations.

A typical rule-based KYC system might:

- Automatically check if an identity document has passed its expiration date.

- Flag an application if the name entered on the sign-up form does not exactly match the name on the uploaded ID.

- Trigger an alert if a customer’s country of residence is on a pre-defined list of high-risk jurisdictions.

- Assign a simple risk score based on a fixed set of inputs like age or location.

Then, to orchestrate KYC more holistically, many companies adopt too to automate aspects of their workflow, helping conduct KYC checks at different parts of the customer journey/KYC process.

They connect APIs from:

- Intelligent document processors (IDPs).

- Document fraud detection.

- Sanctions and adverse media screening tools.

- Biometric and liveness verification providers.

While these processes improve efficiency and reduce manual touchpoints, the decision-making logic can still depend on rigid, human-defined rules. They are optimized, but not intelligent.

If data is incomplete, slightly misspelled, or inconsistent, rule-based systems often fail or escalate the case to a human analyst, slowing everything down and creating bottlenecks. They are unable to learn from new data or adapt to emerging fraud patterns that don't fit into pre-set rules.

That's why the best companies are turning to AI-powered KYC verification solutions.

AI-powered KYC verification

AI-powered KYC doesn't rely purely on rigid rules. These systems use machine learning to make smarter, faster decisions across messy and unstructured data, detecting and learning from fraud patterns that would otherwise go unnoticed.

AI can:

- Analyze documents with smaller data sets. You don’t need thousands of documents to train the model, it already starts recognizing signs of fraud after ingesting less than fifty verified examples.

- Detecting subtle anomalies in documents. AI can spot signs of digital tampering, font inconsistencies, or pixel-level alterations that are invisible to the human eye and bypass simple rule-based checks.

- Detect AI-generated fakes that fool other systems. By analyzing the underlying digital artifacts and visual textures of an image, it can identify if a document was created using the latest generative AI techniques, stopping the most modern form of synthetic fraud before it gets through.

- Connect fraud attempts across multiple applications. By analyzing patterns across all document submissions, the AI can detect serial fraud, identifying when the same fraudulent document, template, or digital fingerprint is being reused in what appear to be unrelated applications.

Unlike rule-based systems, AI document verification handles edge cases better, scales globally, and significantly reduces the number of false positives from watchlist screenings, freeing up your compliance team to focus on real threats.

Financial crime is evolving. With tools like ChatGPT, synthetic identity generators, and template farms, it's easier than ever for bad actors to forge convincing identity documents, create fake utility bills, and fabricate entire digital personas in seconds.

Volume is also a concern. If you're a platform onboarding thousands of new users each day, making manual or simple rule-based checks impossible to sustain.

Who must perform KYC verification?

Which institutions and business types are mandated to perform KYC verification? Here's a comprehensive list:

- Banks and traditional financial institutions. Must perform KYC to verify the identity of individuals opening checking or savings accounts, applying for loans, or accessing other banking services, complying with core AML/CTF regulations.

- Fintechs and neobanks. Required to screen and verify individual customers during their digital onboarding, especially when offering banking-like services, issuing cards, or facilitating payments.

- Payment processors and money service businesses. Use KYC to verify the identities of individuals sending or receiving money to prevent fraud and the illicit transfer of funds (e.g., PayPal, Western Union, Remitly).

- Investment firms and wealth platforms. Required to verify individuals setting up brokerage accounts or investment funds, particularly under rules designed to prevent securities fraud and money laundering.

- Cryptocurrency exchanges and virtual asset service providers (VASPs). Mandated under most global AML laws to verify the identity of their clients to prevent the misuse of crypto platforms for laundering or terrorist financing.

- Online gambling platforms and casinos. Must perform KYC to verify the age and identity of players, prevent fraud, and comply with strict regulations designed to stop money laundering in the gaming industry.

- Lending and credit providers (including BNPL and P2P). Use KYC to assess the identity and risk of individual borrowers before extending credit, loans, or financing.

- Insurance companies. Perform KYC to verify the identity of policyholders and beneficiaries, assess risk, and prevent fraudulent claims.

- Real estate agents and firms. In many jurisdictions, they are required to conduct due diligence on the buyers and sellers in property transactions to ensure they are not facilitating money laundering.

Who needs KYC the most?

KYC is legally required, supervised, and enforced (with significant fines) for companies that onboard individual customers into the financial system, hold their money, or facilitate high-volume or high-risk transactions. It's the first place regulators look when financial crime occurs in your institution. This makes it especially vital for:

- Peer-to-peer (P2P) payment apps onboarding millions of users.

- Fintech and challenger banks with fully digital, instant onboarding flows.

- Crypto exchanges and digital wallet providers exposed to fast-moving, global actors and pseudo-anonymity.

- Online gambling and gaming sites that handle rapid, high-volume transactions.

For these businesses, operating without robust KYC would be operationally and legally impossible. Without verifying who you're doing business with, you risk:

- Violating AML regulations in most jurisdictions.

- Opening the door to widespread fraud.

- Allowing your platform to become a hub for scams and money mules

- Eroding user trust

- Exposing your business to reputational damage, billion-dollar compliance failures, and theft.

Challenges of KYC verification (and how to solve them)

KYC verification is critical, but performing it effectively comes with real-world challenges — especially for compliance and risk teams tasked with balancing regulatory obligations, pressure to deliver a frictionless user experience, and the sheer volume of digital onboarding.

Here are some of the biggest challenges faced by KYC verifiers:

Balancing speed and security

One of the most difficult dynamics for KYC verifiers is managing the friction between compliance and the user experience. A slow, demanding onboarding process with too many steps will cause high customer drop-off rates, directly impacting business growth. You're left trying to justify necessary security checks to product and growth teams who see them as a bottleneck.

Solution:

Implement an automated, risk-based workflow. Use AI-powered tools to instantly verify the vast majority of low-risk users in seconds, while only introducing additional steps or manual reviews for the small percentage of applicants who present elevated risk. This creates a fast, frictionless path for good customers and a high-security path for risky ones.

Dealing with uncertainty

While KYB uncertainty often stems from opaque ownership structures, KYC decisions fall into a gray area due to ambiguity and signal quality. For example, you might get a biometric check that returns a 78% confidence match between a selfie and an ID photo. Is this a good customer with a low-quality phone camera, or a fraudster using a sophisticated spoof? The pressure to make a binary "approve" or "reject" decision on this borderline case without more context puts both the business and your reputation on the line.

Solution:

Use systems that provide nuanced outputs instead of simple pass/fail verdicts. Instead of a rigid "80% and above is a pass" rule, an AI-powered system provides a holistic assessment, correlating the medium-confidence biometric score with other data points—like the document's authenticity, the risk of the device used, and the user's IP address. This provides the context an analyst needs to confidently approve a legitimate customer or flag a genuinely suspicious case, moving beyond a simple, and often misleading, single score.

Global document variety and scale

For any company with international aspirations (fintechs, marketplaces, crypto), the variety of identity documents across regions poses a massive operational burden. A manual team cannot possibly be trained to authenticate the specific microprint, security features, and layouts of hundreds of different national and regional IDs. Fraudsters exploit this weakness by deliberately targeting less common or recently updated documents, knowing the manual review queue will be their weakest defense.

Solution:

Rely on an AI-powered document fraud detection solution with specialized global coverage. This forensic approach is also more scalable; while traditional data extraction tools require massive training datasets for every new document type, an AI focused on fraud detection can effectively identify universal patterns of tampering or digital forgery even on documents it hasn't seen before.

False positives and alert fatigue

Sanctions and watchlist screenings often trigger a high volume of irrelevant alerts, especially for individuals with common names. Sorting through this noise to find the real threats wastes valuable time for compliance analysts and dulls their response to genuine risks.

Solution:

Use AI-powered screening tools with entity resolution, fuzzy matching, and context-aware filtering. AI can analyze secondary identifiers like date of birth or nationality to automatically clear the vast majority of false positives, prioritizing only the high-probability matches for human review.

Cross-border data privacy complexity

Operating KYC globally means navigating a labyrinth of conflicting Personally Identifiable Information (PII) laws. The rules for how you can store, share, and process customer data are different under GDPR (EU), CCPA (US), and various data localization laws. This complexity makes it difficult to maintain a unified KYB/KYC workflow without risking severe privacy penalties.

Solution:

Adopt a solution designed for data minimization and privacy by default. AI-powered structural analysis can verify the authenticity of a document without the need to read and store every piece of PII, allowing the system to verify the document's integrity before passing on only the minimum required data (e.g., name, date of birth) for screening.

Modern KYC challenges in 2025 and how Resistant AI fits in

The landscape of identity fraud is evolving faster than ever. As we move through 2025, compliance teams face new, technology-driven threats that legacy systems are not equipped to handle. Here are some of the most pressing modern challenges and how our solution solves them:

- AI-generated documents and synthetic identities. Fraudsters use generative AI to craft fake proof of address, proof of income, and realistic ID cards for identities that don't exist.

Resistant AI's detection models are specifically trained to analyze the underlying digital fingerprints and metadata of a file to spot the subtle, invisible artifacts left behind by AI generation.

- The rise of template farms. It is trivial for bad actors to access online "template farms" to produce convincing fake utility bills, bank statements, and pay stubs by simply filling in a few fields.

Resistant Documents doesn’t analyze the text on a document, but its underlying structure and layout. We can identify when a document has been created from a known fraudulent template, instantly flagging it even if the user's data is unique. - Siloed and fragmented data. Disconnected systems for document fraud detection, liveness checks, and screening prevent cross-checking and slow down fraud investigations. This allows organized fraud rings to reuse the same fraudulent documents across multiple applications without being detected.

Our serial fraud detection connects the dots across separate document submissions, linking multiple workflows to catch the reuse of fraudulent documents and identify coordinated fraud attacks that would otherwise appear as isolated incidents.

KYC verification best practices

While every organization's KYC process will vary by industry and risk appetite, these foundational best practices can help streamline operations, strengthen compliance, and significantly reduce exposure to fraud.

Ask for multiple documents

Relying on a single identity document, even one that passes verification, is no longer sufficient to establish trust. A best practice is to triangulate identity data by requiring at least two different types of documents from independent sources.

For example, by verifying a government-issued photo ID (like a passport) and then cross-referencing the name and address against a separate proof-of-address document (like a recent utility bill), you create a much more resilient and harder-to-fake identity profile, confirming that the applicant exists consistently across different official records.

Build a layered, interconnected defense

The most effective KYC programs operate as a layered defense where each component shares intelligence with the others. Instead of treating document verification, liveness checks, behavioral analysis, and watchlist screening as separate, siloed steps, ensure the outputs from one layer inform the risk assessment of the next.

For example, an ID document flagged with minor signs of tampering should automatically trigger a more stringent liveness check, and a user logging in from a high-risk IP address should have their behaviour monitored more closely. This interconnected approach allows you to spot complex fraud patterns that are invisible when each check is performed in isolation.

Use risk-based questionnaires to assess intent

A short, dynamic questionnaire can be a powerful tool to understand a user's intentions. Asking targeted questions about the intended purpose of the account, the expected transaction volume, or the source of funds establishes a clear baseline for their future behavior.

The answers provide crucial context for the initial risk assessment and serve as a benchmark for ongoing monitoring, making it easier to automatically flag when a user's activity deviates significantly from their stated intent.

What's new in KYC verification?

KYC verification has evolved rapidly in response to a world where digital-first business models and instant onboarding are the new normal. For years, the primary challenge was moving away from slow, manual processes.

The first wave of innovation focused on speed and efficiency, leading to the rise of modern Identity Verification (IDV) systems. These systems were built to answer a simple question: "Is this person who they say they are?"

However, the threat landscape has undergone a seismic shift. Tools like ChatGPT and generative AI have made it easy to produce high-fidelity fake driver's licenses, synthetic identity profiles, and forged utility bills. The challenge is no longer just about verifying an identity; it's about detecting sophisticated, intentional fraud.

This has created a critical distinction between traditional Identity Verification (IDV) and modern document fraud detection. Standard IDV is a matching process; it confirms that the data on a form matches the data on an ID, and that the face in a selfie matches the photo on that ID. It's designed to efficiently process good customers.

Document fraud detection, on the other hand, is a forensic process. It assumes a document might be malicious and actively hunts for evidence of fraud, asking questions like: "Are there signs of digital tampering? Was this created from a known fraudulent template? Does this file contain artifacts left behind by an AI image generator?"

This is why a specialized solution is now critical. A system designed to simply verify identities is not built to fight an adversary who is actively trying to deceive it. It can confirm that a synthetically-generated document is internally consistent, but it can't tell you that the document itself is a complete fabrication.

To combat modern threats, you need a defense that is just as smart as the fraudsters. You need a system trained specifically on spotting the evolving techniques of forgery, manipulation, and AI-generation.

Conclusion

KYC verifiers must juggle the constant pressure for a frictionless onboarding experience against emerging threats like AI-generated identities. They must make split-second risk decisions, justify security measures that can impact growth, and perform the endless tasks that make the difference between a safe, compliant platform and a haven for fraudsters.

The stakes are too high to rely on outdated tools and manual reviews that were not designed to fight today's threats. Resistant Documents prevent you from losing good customers by providing confident decisions without increasing friction.

If you feel like you’re fighting a new wave of fraud with old weapons — it's time to modernize.

See how Resistant AI's intelligent, AI-powered KYC can transform compliance from a growth blocker into a competitive advantage. Scroll down to book a demo.

Frequently asked questions (FAQ)

Hungry for more KYC content? Here are some of the most frequently asked questions about KYC from around the web.

What's the difference between KYC and KYB?

KYC (Know Your Customer) is the process of verifying the identity of individual users to assess their risk. KYB (Know Your Business), on the other hand, is the specific set of procedures used to verify the legitimacy and ownership of business entities.

From a regulatory perspective, KYB is a direct application of the broader KYC legal requirement. Global anti-money laundering regulations mandate that institutions must "Know Your Customer," and this "customer" can be either an individual (a natural person) or a business (a legal person). Therefore, KYB is the industry term for the distinct due diligence process required to fulfill the KYC obligation when the customer is a corporate entity.

How do KYC and KYB work together?

In many B2B scenarios, both processes are required to ensure complete due diligence. A fintech company would use KYB to verify a new corporate client and simultaneously use KYC to verify the ultimate beneficial owners (UBOs) and directors behind that company.

What is enhanced due diligence (EDD) in KYC?

Enhanced Due Diligence (EDD) in KYC is a deeper level of identity verification applied to individuals who are considered high-risk. This is typically required for Politically Exposed Persons (PEPs) or when red flags arise during the initial checks.

What is KYC approval?

KYC approval is the final step in the verification process where an individual is officially cleared to use a platform or service after passing all required checks. It means the person's identity and risk profile have been reviewed and deemed trustworthy under applicable compliance standards.

How do you verify KYC documents?

KYC documents can be verified manually by reviewing their contents for signs of fraud, but the most effective method is AI-powered document fraud detection. This technology can analyze unstructured files to spot sophisticated forgeries, digital tampering, and anomalies far beyond the capabilities of manual review.

What is required for KYC?

KYC typically requires official documentation to verify an individual's identity and address. Common requirements include a government-issued photo ID like a passport or driver's license, and a proof of address document like a recent utility bill or bank statement.

What is digital KYC verification?

Digital KYC verification is the process of verifying a person's identity entirely online using electronic documents, databases, and real-time integrations. It replaces manual paperwork with API-based checks, digital document uploads, and automated risk assessments for faster, more scalable onboarding.

What is an automated KYC verification system?

An automated KYC verification system uses rule-based logic or AI to streamline the business verification process by validating documents, screening for sanctions, and assessing risk without manual input. These systems reduce human error, speed up compliance workflows, and help businesses onboard clients more efficiently while staying compliant with AML regulations.