How to spot fake leases

Rent prices were climbing in 2025 and they're only getting higher now that we're in 2026.

This raises the stakes for both landlords and tenant screeners to ensure their lease agreements aren’t fake. From bogus income statements in loan applications to squatters enforcing forged landlord-tenant relationships, fake leases are no laughing matter.

Squatters can even use something as common as Instagram to claim an unrightful place within your property (and getting them out can be more costly than you think).

Meanwhile, landlords and lenders are under threat from fraudsters fabricating lease documents with generative AI tools and editable PDFs. They can secure occupancy history, sublet illegally, inflate property credentials for financing, falsify tenant histories, and commit identity fraud.

For landlords, lenders, and background screeners without proper document fraud detection tools, the doors are open to bad tenants, false claims, and exploitation that can cost thousands.

Read on to learn what a lease agreement includes, how to identify a fake lease, and how AI-powered verification tools can detect fraud before it takes hold.

Check out our “how to spot fake documents” blog to learn about more common document forgeries.

What is a lease?

A lease agreement is a legally binding contract that outlines the terms and conditions under which a tenant occupies a property owned by a landlord. It serves as both proof of tenancy and the framework that governs rent, maintenance, and occupancy rights. It can also serve as a supporting “proof of address” document in onboarding workflows.

Unlike standardized documents such as tax forms or corporate certificates, leases are semi-formal by nature. They’re drafted by private individuals, real estate agents, or property management firms rather than a single issuing authority. This makes them universal in purpose but highly variable in form.

In some jurisdictions, local housing agencies provide templates or registration portals that make the document “official.” In others, a simple signed Word file can carry full legal weight if both parties agree to its terms. That flexibility is practical for renters and small landlords — but it’s also what makes leases easy to forge.

Notarization adds another layer of complexity. A notarized lease includes the signature and seal of a licensed notary public, who verifies the identities of both parties and confirms they signed voluntarily.

This doesn’t automatically make the lease “more legal” — it simply adds a verifiable trail of authenticity. Some states or countries require notarization for long-term or commercial leases; others treat it as optional.

When verifying a lease, a notarized version should be checked for the notary’s registration number and jurisdiction, while an unnotarized lease, being less official, should be supported by corroborating documents like rent receipts, property tax records, or utility bills.

A standard lease agreement includes the following key elements:

- Names of landlord and tenant. Identifies both parties entering the contract.

- Property address and description. Specifies the exact premises covered by the lease.

- Lease term and renewal options. States the start and end dates of occupancy and any automatic renewal clauses.

- Rent amount and payment schedule. Details the agreed monthly rent, payment method, and due dates.

- Security deposit and fees. Lists the deposit amount, refund conditions, and any penalties for early termination.

- Maintenance and utilities. Defines who is responsible for repairs, bills, and services.

- Rules and restrictions. Covers property use policies, subletting terms, and behavioral clauses.

- Signatures and dates. Confirms legal consent from both parties.

- Additional documentation. May include addenda such as pet agreements, parking permits, or appliance inventories.

- Notarization and authentication marks (if notarized). A notarized lease typically includes a dedicated notary block at the end of the document with a visible seal or stamp, signature, and commission expiration date. You’ll often see phrasing such as “Subscribed and sworn before me,” or “Acknowledged this [date] by [name],” and the notary’s information (name, license number, jurisdiction) beside or within the seal. These details are usually embossed or stamped in colored ink.

Together, these details verify who occupies a property, under what terms, and with which financial obligations.

Because leases sit in this gray area between personal contract and legal record, their trustworthiness often depends on context. A notarized lease filed with a housing registry carries far more evidentiary weight than a handwritten or unsigned version.

That’s why in verification workflows (especially for banking, insurance, or background screening) leases are best treated as supporting proof rather than standalone evidence unless validated through official channels.

An example of a lease (page 1) for illustrative purposes only.

These are long (8+ page) documents, so we've provided an example of the first and last pages whose contents are typically targeted by forgers.

Why are leases important?

Lease agreements are one of the most frequently used proofs of residence and legal occupancy across financial, governmental, and property-related workflows. Despite their variability, they remain a cornerstone in confirming where someone lives, under what terms, and with what financial obligations.

Here’s how lease agreements are used for document verification across industries:

- Banking and lending. Used to confirm residential address, stability, and income obligations during account openings, loan applications, or credit reviews.

- Insurance. Submitted to verify property occupancy or coverage eligibility for tenant and landlord policies.

- Corporate compliance and background screening. Helps verify employee or applicant addresses in regulated sectors such as finance, healthcare, or defense.

- Government and immigration. Serves as evidence of residency during visa applications, taxation, or local registration processes.

Leases occupy a unique space in verification because they bridge personal and institutional trust. They’re legally binding yet privately created, easy to access yet easy to manipulate. That paradox makes them valuable but imperfect: reliable when validated, risky when taken at face value.

In practice, their strength lies in combination: when paired with secondary evidence like utility bills or rental payment records, a verified lease becomes one of the most credible indicators of legitimate residence and tenancy.

One important scam to be aware of is AI-assisted fake rental listings. Fraudsters generate convincing property ads, communications, and supporting documents as part of a single coordinated scheme.

In these cases, fake lease agreements are often used to legitimize fake properties, pass tenant screening checks, or support downstream fraud such as identity verification, benefit claims, or financial applications.

Since they're relatively unstandardized, leases have become a critical trust artifact within these scams (not just a byproduct). It's a lot easier to send someone a fake lease than it is a property deed. This makes the ability to spot a fake more important than ever.

If you’d like to know how fraudsters are creating all these fake leases, check out our “Types of fraud” blog to learn more about their tactics.

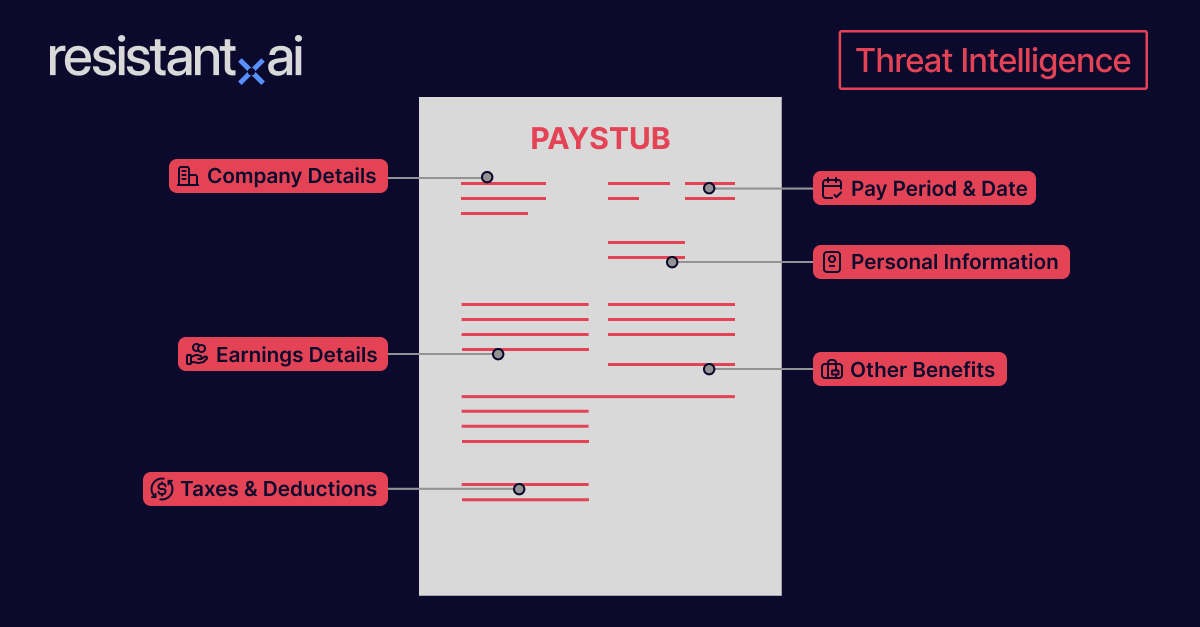

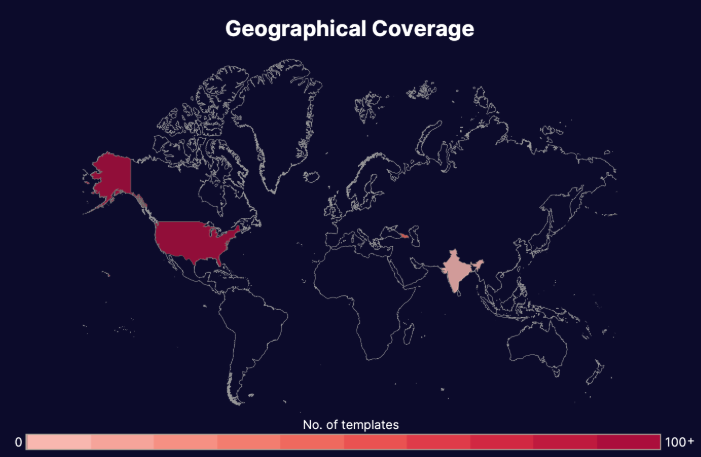

Threat intel: Template data about fake lease agreements

Our Threat Intelligence Unit collects data about template farms which make and distribute fake document templates for fraudulent purposes.

Below, you'll find an infographic containing data about all the fake lease agreement templates we've found: their availability, their distributors, the institutions or "issuers" whose documents have been exposed, and how much it costs to buy one.

Threat Intel Stats: Lease agreements

Find more information about the threat these farms pose in our threat intel blog and webinar content.

5 Signs of a forged or fake lease agreement

Missing a fake lease agreement can have costly consequences — from underwriting a fraudulent mortgage to approving a false tenant background check.

Because they vary so widely in format, it’s easy for a fake lease to blend seamlessly into legitimate submissions. Detecting them manually requires not just an eye for detail, but context about how genuine leases are structured.

Here’s what to look for:

1. Inconsistent formatting

Legitimate lease agreements usually follow recognizable templates from real estate firms, property managers, housing associations, or regional requirements. Fakes often reveal themselves through layout errors and inconsistent design.

- Font mismatches. Different fonts between sections or inserted in relevant fields (e.g., Arial for rent terms and Times New Roman for addresses) suggest copy-paste editing.

- Shifted header lines. The property address header or “LEASE AGREEMENT” title slightly drifts between pages — a tell-tale of multiple scanned documents merged into one fake.

- Inconsistent section headers. Legitimate leases use uniform headings (e.g., “Terms of Tenancy”), not ad-hoc labels like “Rental Info” or “House Details.”

- Outdated branding. Property management logos or letterheads that no longer exist or pre-date a company’s rebrand.

- Low-resolution signatures or seals. Pixelated or stretched signatures — often screenshots inserted from another document.

2. Incorrect or misleading information

Fraudulent leases typically mix real and fake data, counting on reviewers to skim rather than cross-check.

- Nonexistent landlords. The listed owner or agency doesn’t appear in official registries or property tax records.

- Address anomalies. Street numbers that don’t exist or mismatch city/county boundaries.

- Improbable contact details. A “corporate leasing office” using a free email service (like Gmail) or a phone number registered to a different area code than the property.

- Unrealistic lease periods. Multi-year terms for short-term rentals or month-to-month leases labeled as “annual.”

- Incorrect utility responsibility. The lease assigns responsibility for water, gas, or electricity to the wrong party (for example, listing the landlord as paying utilities in a market where tenants always hold the accounts).

- Implausible utility providers. The document references nonexistent or out-of-region service companies (e.g., a New York lease mentioning Pacific Gas & Electric).

3. Bad math and uncharacteristic figures

Numbers in fake leases often fail to align with local market logic or basic arithmetic.

- Unrealistic rent values. A luxury apartment priced far below market rates or a small unit priced abnormally high.

- Rounded rent and deposits. Every amount listed as a clean number (e.g., “$2,000 exactly”) rather than realistic figures including cents.

- Inconsistent totals. Security deposits or prorated rent that don’t match the stated rent schedule.

- Faulty date math. Lease start and end dates that don’t correspond to the stated term length.

- Misapplied taxes or fees. Including sales tax or irrelevant surcharges not standard for that region or property type.

4. Lease agreement inconsistencies

These contradictions within the document itself are among the most reliable red flags.

- Conflicting property types. Described as both “commercial space” and “residential apartment” within the same lease.

- Mismatched signatories. A tenant signs, but the landlord field lists a different name than on the header or payment details (or signatures don’t match printed names).

- Improper terminology. Using casual language like “renter” instead of legal terms such as “lessee” or “tenant.”

- Missing annexes or addenda. References to pet clauses or parking agreements that aren’t attached.

- Inconsistent payment methods. Rent payable to a person instead of a property company or official portal.

5. Metadata discrepancies

Even when a fake looks polished, its file properties can expose the forgery.

- Unverified document source. The lease lacks embedded PDF metadata linking it to a known property management platform or e-signature service (a red flag when large complexes use standardized systems).

- Creation date conflicts. Document metadata shows a creation date after the listed signing date.

- Digital signature mismatch. Embedded digital certificates or timestamps don’t match the printed signing date or the signer’s name — often evidence of template reuse.

- Device metadata reuse. Multiple “unique” leases share the same device ID, author field, or export path, exposing batch generation from a single forger’s machine.

- File language inconsistencies. Metadata set to a language or region that doesn’t match the property location.

Disclaimer: Lease forgeries thrive on inconsistency. Fraudsters exploit the document’s flexibility, knowing most reviewers can’t distinguish a genuine draft from a digitally assembled fake at volume. Modern verification now depends on scalable, AI-driven tools that analyze structure, behavior, and metadata to get a full threat profile of the lease and how it was built — not just its contents.

How to verify a lease

Lease agreements are reviewed by banks and insurers, property managers, immigration officers, and corporate compliance teams in two ways: manually or through automated systems.

The gap in reliability between these two approaches is widening. Manual checks are still common, especially in small organizations or low-volume workflows, but they’re increasingly ill-suited for the scale and sophistication of modern document fraud.

Manual verification depends on human attention to detail. Reviewers often compare signatures, confirm property details, and cross-check records. But these methods are slow and vulnerable to human error. Fraudsters now use AI and editing tools to produce documents that mimic genuine structure, formatting, and even metadata, making fakes almost indistinguishable by eye and submitted at a pace that’s hard to mirror.

AI-powered automation changes that dynamic. Modern systems can instantly evaluate leases, detecting subtle anomalies that manual reviewers miss. By operating at scale, they deliver consistent, evidence-backed results while reducing false positives and review fatigue.

That said, manual review hasn’t disappeared. Many institutions still require a human step for regulatory, privacy, or evidentiary reasons. When that’s the case, here are the most effective techniques for checking a lease agreement manually.

Manual verification of leases

If you’re still verifying leases manually in 2026, the best approach is to look out for the red flags we mentioned above. Otherwise, here are a few other tactics you can employ:

- Contact the property owner or manager. Use a local assessor’s office or land records portal to confirm ownership (like this one for King County, Washington).

- National registry. Some countries (like the UK) have nation-wide registries for cross checking land ownership and responsibilities.

- Verify landlord and tenant identities. Match names and contact information against business registries, government ID, or credit bureau data.

- Request/ review supporting evidence. Review utility bills, payment receipts, or bank statements that align with the lease’s dates and payment terms.

- Housing fraud resources. The U.S. Federal Trade Commission offers a Rental Listing Scams resource, you can review it to see if any of those scams match your experience.

Keep in mind: Manual verification struggles with scale and nuance. Fraudsters exploit the repetitive nature of human review, altering layouts, timestamps, and metadata across dozens of submissions to fool and overwhelm your controls. AI-driven verification offers a more consistent and adaptive safeguard, catching novel cases regardless of submission volume.

Using AI and machine learning to spot fake leases

AI doesn’t just scan leases. It interprets how they were built. By analyzing both structure and behavior, it acts as a critical safeguard for lenders, insurers, and property managers handling thousands of leases every month.

Benefits of AI in lease verification:

- Layout integrity mapping. Evaluates spacing, alignment, and structural consistency across every page, detecting assembled or copied templates often used in forged leases.

- File-construction analysis. Examines how each lease was generated (down to embedded layers, export paths, and compression artifacts) to reveal documents assembled from multiple sources.

- Cross-document intelligence. Compare submitted leases against all submissions in your dataset to detect repeated templates or reused assets across “individual” submissions.

- Audit-ready traceability. Automatically logs every check and anomaly, producing verifiable evidence trails for regulators and internal compliance teams.

- GenAI detection. Identifies synthetic fakes built with generative tools by analyzing indicators invisible to human reviewers.

Automation vs. AI

Automation can only defend against what’s already known. It checks for missing signatures, mismatched dates, or blank fields because those are the rules it was given. But lease fraud doesn’t play by preset rules — it mutates. Fraudsters reuse layouts, alter metadata, and generate new formats the system has never seen before.

AI, by contrast, learns structure and context. It understands how genuine leases are formatted across regions and issuers, adapting when fraudsters introduce new templates or subtle edits.

Conclusion

Fake lease agreements can cause real damage — from underwriting loans on false addresses to reimbursing fraudulent rent claims or approving tenants who don’t exist.

For banks, insurers, and housing providers, even a handful of forged leases can ripple across compliance, risk, and reputational trust.

Resistant documents uses advanced structural analysis to inspect how a lease was built — its submission context, background consistency, and internal structure, and more — exposing edits and synthetic forgeries invisible to human review or basic automation.

The result? Faster onboarding, fewer manual checks, and reliable fraud detection even when every lease looks different.

Want to see it in action? Scroll down to book a demo.

Frequently asked questions (FAQ)

Hungry for more fake lease agreement content? Here are some of the most frequently asked fake lease agreement questions from around the web.

How can I tell if a lease agreement is fake?

The best way is by using document fraud detection software. If unavailable, fake lease agreements often contain subtle inconsistencies (mismatched signatures, impossible dates, or owners who don’t appear in public property records). Look for these red flags to spot a fake.

Can a fake lease be used for tenant or loan fraud?

Yes. Fraudsters use fabricated leases to “prove” residency, inflate rental history, or claim eligibility for loans and government benefits. They’re also used in background checks and visa applications to impersonate legitimate tenants. These scams can lead to unpaid loans, false payouts, and compliance violations across financial and property sectors.

What happens if I unknowingly sign a fake lease?

If a tenant or landlord discovers the lease is fraudulent, both parties should report it immediately. Contact local housing authorities or consumer protection agencies, preserve the document for evidence, and halt any associated payments until verified. Acting quickly can prevent identity misuse or financial loss.

How to spot a fake lease with AI?

AI-powered systems analyze how the document was created — not just what it says. By inspecting structure, formatting, and metadata, they detect anomalies like reused templates, altered signatures, and mismatched creation dates that human reviewers often miss. The result: faster, more consistent verification and fewer manual reviews.

What’s the difference between a lease, a rental agreement, and a tenancy contract?

These three documents all govern property occupancy, but they differ in duration, flexibility, and legal structure: a lease agreement secures long-term tenancy under fixed terms, a rental agreement renews monthly with adaptable conditions, and a tenancy contract serves as a broad legal category encompassing both in various jurisdictions.

- Lease agreement. Fixed-term housing contract (typically 6–12 months or longer) that locks rent, terms, and tenant obligations for the entire period.

- Issuer: Property owner, landlord, or licensed property management company.

- Characteristics:

- Defines the property address, lease term, rent schedule, and renewal options.

- Specifies maintenance duties, deposit conditions, and termination clauses.

- Usually notarized or signed by both parties, with optional registration in some jurisdictions.

- Issuer: Property owner, landlord, or licensed property management company.

- Rental agreement. Short-term or month-to-month contract that renews automatically unless terminated by either party.

- Issuer: Landlord or property manager.

- Characteristics:

- Offers flexible terms that can change with notice periods (often 30 days).

- Common for furnished units, short stays, or interim housing.

- May omit registration or notarization, depending on local law.

- Issuer: Landlord or property manager.

- Tenancy contract. Broad legal term used internationally for any residential occupancy agreement between landlord and tenant.

- Issuer: Landlord, estate agency, or housing authority (depending on jurisdiction).

- Characteristics:

- Standardized in regulated housing markets; often includes government-approved templates.

- May require registration with local housing or municipal authorities.

- Used interchangeably with “lease” or “rental agreement” in many countries

- Issuer: Landlord, estate agency, or housing authority (depending on jurisdiction).

Is there software to detect fake lease agreements?

Yes. Resistant AI’s document fraud detection software analyzes layout, structure, and metadata to uncover manipulation and synthetic forgeries that humans or basic automation can’t detect. It integrates easily into onboarding, underwriting, and compliance workflows to stop fraudulent leases at scale.

Who needs to check for fake leases?

Fake lease agreements show up anywhere residency or property documentation is part of onboarding, underwriting, or compliance. They cut across banking, insurance, corporate, and government workflows. Here’s who needs to check them, and why:

- Loan underwriters at banks and mortgage lenders. Verify the borrower’s address, rental obligations, and payment history to prevent inflated credit profiles or false collateral claims.

- Leasing officers and property management teams. Confirm that applicants and listed landlords are real before signing or releasing keys, protecting against sublet scams and illegal occupancy.

- Claims adjusters and policy issuers in insurance. Validate that the insured party legitimately occupies or owns the property before approving renter, contents, or liability coverage.

- Corporate compliance and HR verification teams. Check employee housing documents during onboarding or relocation to prevent fraudulent expense claims and address falsification.

- Visa adjudicators and housing verification units in government offices. Confirm residency and tenancy claims for immigration, public benefits, or local registration requirements.

Is making or using a fake lease agreement illegal?

Yes. Producing or submitting a falsified lease is considered document fraud. Penalties vary by jurisdiction but often include fines, restitution, or imprisonment. In the U.S., submitting or fabricating a lease for financial gain can trigger federal wire fraud charges under 18 U.S.C. § 1343 and state forgery statutes like Texas Penal Code § 32.21. If the document includes a fake notary seal or is used as proof of identity, 18 U.S.C. § 1028 may also apply. Penalties range from fines and restitution to multi-year federal imprisonment. In the U.K., they’re covered by the Fraud Act 2006.