How to spot fake utility bills

Utility bills are one of the most common documents for companies that need to obtain “proof of address.” They’re also a primary target for fraudsters.

In 2026 this may be becoming a consumer problem as well. Utility imposters have begun targeting customers with fake bills.

Fake utility bills are on the rise thanks to Generative AI and editable templates making it easier than ever to fake everyday paperwork for fraudulent purposes.

Utility bills play a critical role in onboarding and compliance workflows, making them a favorite for fraudsters looking to spoof residency, cover up identity mismatches, or pass off shell operations as legitimate businesses.

Electric, gas, water, internet, it doesn’t matter the service. If a utility bill looks convincing, it can be used to open bank accounts, secure leases, pass KYC checks, and more.

Read on to learn what a utility bill is, how they’re being forged, how to identify a fake utility bill, and how AI-powered verification solutions can help spot them automatically.

Check out our “How to spot fake documents” blog to learn about more common document forgeries.

Table of contents

What is a utility bill?

A utility bill is an invoice from a service provider detailing usage and payment due for services like electricity, gas, water, or internet. Issued monthly or quarterly, it's a standard document with consistent formatting that includes account and payment details.

Core elements of a utility bill include:

-

Customer name and service address. Links the account to a physical residence or business location.

-

Account number and reference codes. Unique identifiers for billing and internal tracking.

-

Billing period and issue date. Establishes the timeframe the bill covers.

-

Itemized usage and charges. Service-specific consumption metrics (e.g., kWh for electricity) and costs.

-

Company branding and payment instructions. Logos, customer support contacts, payment due dates, and accepted methods.

While there’s plenty of useful information on a utility bill, the official labeling of name and address together is what makes these documents ideal for proof of identity and proof of address workflows across the board.

They differ from most official verification documents in that the supplier of the information is not an official government body or financial institution, but a private commercial company.

An example of a utility bill for illustrative purposes only

Why are utility bills important?

Utility bills are one of the most commonly accepted forms of proof of address. That makes them valuable across financial services, government workflows, and identity verification scenarios.

Here’s how utility bills are used for document verification across specific industries:

-

Banking & finance. Verifying residential or business addresses for AML/KYC compliance during account opening or loan origination.

-

Real estate. Used by landlords to confirm a tenant’s current living situation or payment reliability.

-

Insurance. Often required to confirm a policyholder’s home address for underwriting and fraud detection.

-

Government services. Accepted when issuing passports, IDs, or during benefits enrollment.

Their official status and recurring nature make utility bills a trusted standard.

If you’d like to know how fraudsters are creating all these fake utility bills, check out our “Types of fraud” blog to learn more about their tactics.

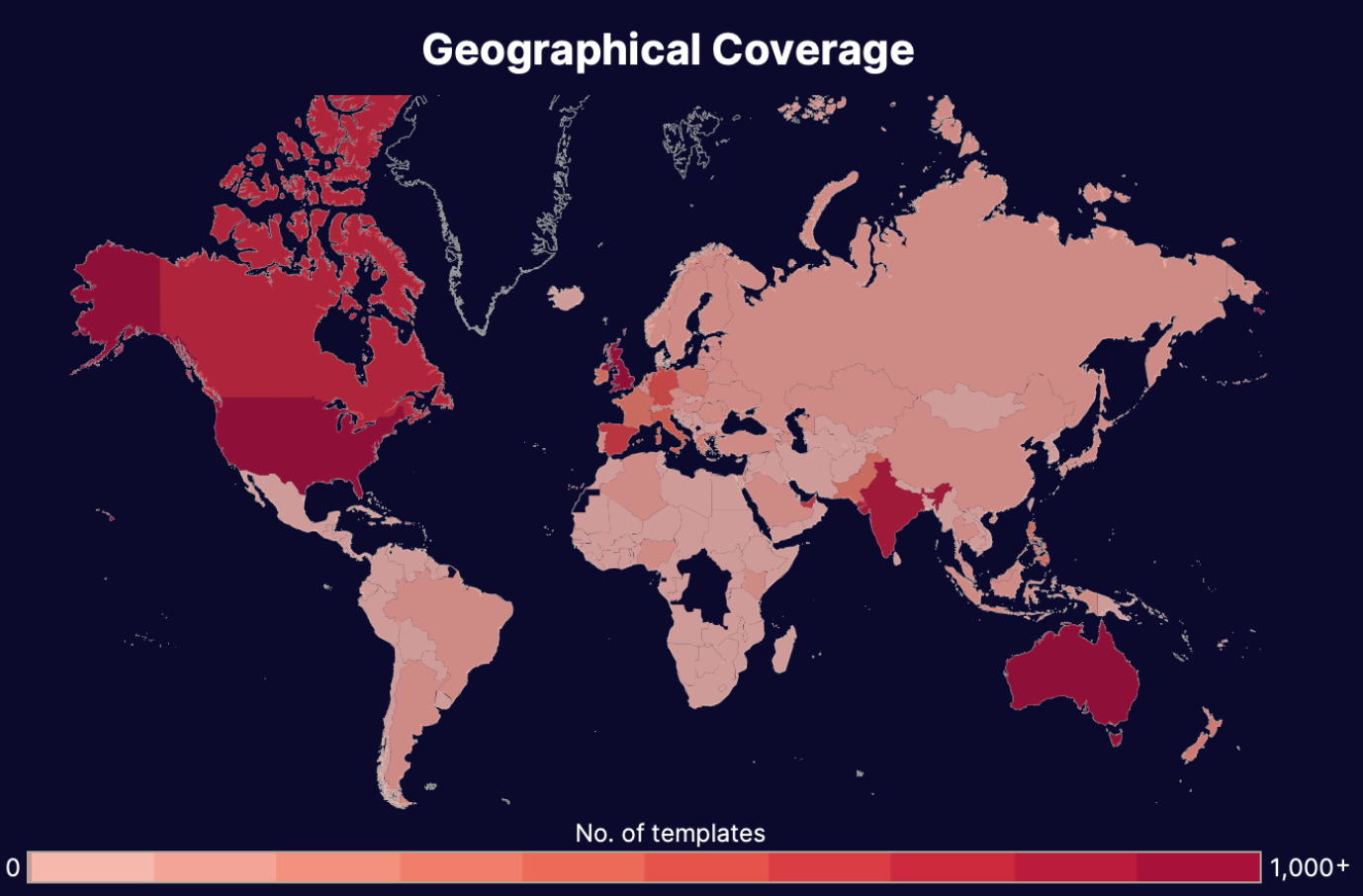

Threat intel: Template data about fake receipts

Our Threat Intelligence Unit collects data about template farms which make and distribute fake document templates for fraudulent purposes.

Below, you'll find an infographic containing data about all the fake utility bill templates we've found: their availability, their distributors, the institutions or "issuers" whose documents have been exposed, and how much it costs to buy one.

Threat Intel Stats: Account Statements

Find more information about the threat these farms pose in our threat intel blog and webinar content

5 Signs of a forged or fake utility bill

Counterfeit utility bills are crafted to mimic authenticity, but the details often betray them. By knowing the key red flags that signal potential utility bill scams, you can begin to detect these details manually.

Below are five core categories of red flags, each with specific, real world examples from utility bills.

1. Inconsistent formatting

Most utility providers use rigidly standardized templates. Deviations in layout, design, or spacing are strong indicators of document forgery.

-

Variable fonts. Real bills don’t mix Arial and Times New Roman, or use erratic bolding between fields.

-

Misaligned sections. If usage charts, account info, or payment boxes drift out of their columns, it’s likely been manipulated.

-

Color tone mismatches. Watermarks or logos that are off-color compared to the provider’s brand palette.

-

Broken page structure. Missing page breaks, random white space, or jammed-together elements.

2. Incorrect or misleading information

When fraudsters guess or reuse data, they often introduce contradictions or logic errors.

-

Wrong rate plans. A bill showing a residential rate for a known commercial property.

-

Outdated contact info. Using legacy addresses or phone numbers no longer associated with the utility provider.

-

Mismatch between service and billing address. Especially suspicious if the service address is left blank or partially redacted.

-

Non-existent utility provider. Fake companies with convincing names (e.g., "National Grid Services Inc.").

-

Improper regional branding. An NYC utility bill should not display UK postal formatting or European VAT fields.

3. Bad math and uncharacteristic figures

Calculations and usage data often trip up forgers who don’t understand real-world benchmarks.

-

KWh totals that don’t match itemized charges. Totals that fail to reflect the individual line items are common in fakes.

-

Rounded numbers. Real utility bills rarely round off everything cleanly; usage values often contain decimals or odd intervals.

-

Misused tax rates. Including outdated energy tax percentages or applying them incorrectly across regions.

-

Missing meter readings. Omitting starting and ending values, or inserting implausible ones like zero usage over a full month.

-

Monthly usage swings. A water bill that goes from 3,000 to 30,000 gallons without explanation is suspicious unless seasonally justified.

4. Utility bill inconsistencies

Every utility company has a document fingerprint (from formatting choices to visual branding) and when those fingerprints don’t match, fraud is likely.

-

Logo mismatch. Using a PG&E logo on a ConEdison electric bill.

-

Unusual bill delivery method. A handwritten or photo-scanned bill for a modern, fully digital provider like Octopus Energy.

-

Payment instructions to third-party accounts. Bills that divert payment to unverifiable PayPal or Zelle recipients.

-

Absence of legal language. Missing regulatory disclaimers, or data privacy statements, or legal language specific to the billing company.

-

High variance or illogical usage totals. Totals that don’t match other bills, or the values present on the same document, or unusual energy measurements (measuring in regular watts as opposed to kilowatts).

5. Metadata discrepancies

If the utility bill was submitted as a digital file, metadata often reveals hidden signs of manipulation.

-

Creator field shows editing software. Tools like Photoshop or PDF Editor listed in metadata.

-

File created after issue date. A bill “dated April 3” that was actually created on April 10 suggests backdating.

-

Unusual modification history. Files with many save iterations (or zero history at all).

-

Mismatch between file name and content. A document labeled "AprilGas.pdf" but referencing electric services instead.

-

Embedded image layers. Real PDFs from providers are text-based; image-layered bills may have been screenshot and recompiled.

-

PDF artifacts. Look for layering glitches or flattened edits that obscure original print fields, like overlaying the payer’s address and name with new information.

Disclaimer: Fraudsters are no longer relying on Photoshop alone. Generative models and AI-powered template generators can reproduce exact layouts, fonts, and branding with uncanny accuracy. That makes manual inspection — especially under time pressure — increasingly unreliable for catching advanced fakes.

How to verify a utility bill

There are two ways to spot fake utility bills: manual inspection and automated verification.

We recommend using AI because it can detect subtle manipulations invisible to the human eye.

Manual reviews rely on inconsistent human judgment and are often limited to basic physical analysis and metadata-level checks. Even trained professionals can overlook technical edits like image layering or tampered PDF structure, and many of these edits don’t appear obviously in the metadata — if at all.

Once you get away from primary source documents and people are submitting photos of originals, metadata is even less useful.

Still, manual review has its place, especially in industries where legacy processes dominate or smaller firms haven’t yet invested in automation.

Eventually, everyone will have to modernize to keep pace with increasingly sophisticated document fraud.

Manual verification of utility bills

Even without specialized tools, several techniques can help confirm if a bill is genuine. Cross-checking your documents against the clear signs of utility bill fraud mentioned above is a good place to start. Some other tactics include:

-

Call the utility provider. Use the customer service number from the official website (not the bill as this could be a fake created by the fraudster) to verify the account name, number, and billing history.

-

Request recent and historical copies. Comparing multiple months can reveal inconsistencies in usage, formatting, or address spelling (you can request copies from official company websites like this one for Con Edison).

-

Check the provider’s rate schedule online. Match the listed charges and usage tiers against the official pricing published (like this one for US) on the utility’s or official government websites.

-

Review the service address in public records. Confirm the listed address exists, is zoned for the utility, and matches the declared customer as extra due diligence if you’re really doubting the document’s authenticity.

Keep in mind: Manual review is time-consuming and prone to error — especially under deadline pressure. Fraudsters are increasingly capable of replicating provider formats so precisely that layout and math alone can no longer guarantee detection. AI-driven systems now offer a more scalable, consistent, and evidence-backed alternative.

Using AI and machine learning to spot fake utility bills

AI is transforming document verification from a manual task into a real-time, evidence-based process. With thousands of authentic utility bills in its training data, an AI system can detect even subtle inconsistencies — not just in numbers, but in submission behavior, fraudulent typologies, online templates, and serial fraud (recurring fraud attempts).

Benefits of AI in spotting utility bill scams:

-

Layout validation. Confirms that the template matches known formats for a specific provider.

-

Cross-document comparison. Compare submitted utility bills against previously seen fraud patterns in the same customer, like the same account number appearing on multiple unrelated documents or the same editing being used on multiple different photos.

-

File property analysis at scale. Scans file properties like internal document structures, trailers, XMP, encryptions/decryption artifacts, etc.

-

Continual improvement. Models learn from each new verified document, getting better over time at spotting emerging fraud tactics.

Automation vs. AI

Automation works well for repetitive rule-based checks — like confirming that an address field is filled or a total value is present. But it breaks down when facing complex, context-sensitive fraud.

It follows hard-coded rules like “field X must be numeric” or “logo must appear in top-left corner.” That works for surface-level checks, but it fails when fraudsters mimic layouts while swapping out core values or hiding fake data behind visual artifacts.

Machine learning models, on the other hand, can understand the full structure and context of a document. They can spot that a billing period doesn’t match the file creation date, or that an energy rate is one decimal point off from the provider’s standard pricing. AI checks fields AND reasons across them, combining visual, textual, and behavioral cues.

Conclusion

Fake utility bills are more than just a forgery problem. They’re an open invitation to identity theft, shell company abuse, and onboarding fraud.

Manual verification helps, but it can’t keep pace with AI-enhanced fraud. That’s where machine learning makes a difference: analyzing not just layout and math, but behavior, metadata, and hidden signals that humans can’t reliably catch.

Resistant AI brings industry-grade document analysis to the fight against fake utility bills. Our solution cross-checks layout structures, matches against historical patterns, and analyzes metadata at scale (so you don’t just catch fraud, you understand it).

Scroll down to book a demo.

Frequently asked question (FAQ)

Hungry for more fake utility bill content? Here are some of the most frequently asked fake utility bill questions from around the web.

How to spot utility bills with AI?

AI uses trained models to evaluate structure, content, and metadata across thousands of genuine samples. It flags discrepancies like misaligned fields, inconsistent usage patterns, incorrect rates, and even tampered PDF properties. Unlike rule-based automation, AI adapts to new forgery techniques as they evolve.

What’s the difference between utility bills, bank statements, and lease agreements?

Utility bills, bank statements, and lease agreements are all used to verify an individual's address, but they serve different purposes, originate from different sources, and contain drastically different information.

Utility bill. An official statement issued by a service provider that details charges for essential services such as electricity, water, gas, or internet.

-

Issued by:

-

Service providers such as electricity, water, gas, or internet companies.

-

-

Characteristics:

-

Tied to a service address

-

Service specific terminology

-

Usage-based billing

-

Bank statement. Financial document provided by a banking institution that summarizes all transactions, including deposits, withdrawals, and balances, associated with an account over a specified time frame.

-

Issued by:

-

Financial institutions like banks or credit unions.

-

-

Characteristics:

-

Chronological transaction history

-

Account-type specificity

-

Financial institution branding.

-

Lease agreement. Legally binding contract between a landlord and tenant that outlines the terms and conditions under which the tenant may occupy and use a property for a specified duration in exchange for rent.

-

Issued by:

-

Landlords or property management companies

-

-

Characteristics:

-

Legally binding language

-

Fixed term and duration

-

Property use provisions

-

Each document type plays a unique role in address verification and carries its own risk profile for forgery.

How do scammers use fake utility bills to commit fraud?

Scammers employ fake utility bills in various fraudulent activities. These forged utility bills can be used to:

-

Provide false proof of address. In applications for loans, rentals, or government benefits.

-

Bypass background checks. Conceal true identities or histories.

-

Enhance creditworthiness. Present a facade of financial stability.

-

Steal personal information. Phishing scams may use fake bills to extract sensitive data.

-

Facilitate rental scams. Convince landlords of a tenant's reliability.

These fraudulent uses can lead to significant financial losses and legal complications for individuals and institutions.

How are fake utility bills used in larger fraud schemes?

Fake utility bills are often employed as components of more extensive fraudulent activities or serial fraud. They can be used to:

Is there software to detect fake utility bills?

Yes. Resistant AI provides specialized tools that analyze utility bills for signs of manipulation. From layout verification to metadata analysis, our software is trained on thousands of document variations and actively flags suspicious patterns or anomalies.

Who needs to check for fake utility bills?

Anyone involved in verifying identity, address, or onboarding customers should be checking these documents.

Roles that specifically need to verify utility bills include:

-

Loan officers. Review utility bills during the identity and address verification phase of loan applications to ensure the applicant resides at the claimed location and to validate proof of stability or residence history.

-

KYC/AML analysts. Verify utility bills as part of customer onboarding and risk assessment to confirm the identity and residential address of clients, particularly in regulated financial services and crypto exchanges.

-

Tenant screening specialists. Request utility bills to verify prior residency and establish proof of address during rental application screening, helping prevent identity fraud and phantom tenants.

-

Human resources / background check vendors. Examine utility bills to confirm candidate address history during employment verification or vetting for sensitive roles, particularly in finance, government, and defense sectors.

-

Immigration caseworkers & visa officers. Review utility bills during residency, asylum, or visa processing to verify current or historical physical presence at a stated address, especially in family reunification and sponsorship cases.

-

Buy now, pay later (BNPL) & fintech risk teams. Use utility bills in soft credit checks and fraud prevention processes to validate identity and mitigate synthetic identity risk during instant credit assessments.

-

Legal professionals. Verify utility bills to support identity validation in affidavits, declarations, and legal filings, or to confirm residence in jurisdiction-sensitive cases like divorce, probate, or guardianship.

-

Healthcare eligibility coordinators. Check utility bills as proof of residency for eligibility in region-specific health plans, benefits enrollment, or Medicaid applications.

Is making a fake utility bill illegal?

Yes. Creating or using a fake utility bill is considered document fraud. In the US, penalties can include fines, restitution, and up to 20 years in prison for aggravated identity theft or conspiracy to commit fraud. In the UK, it falls under the Forgery and Counterfeiting Act 1981. Regardless of jurisdiction, it’s a criminal offense with serious consequences.