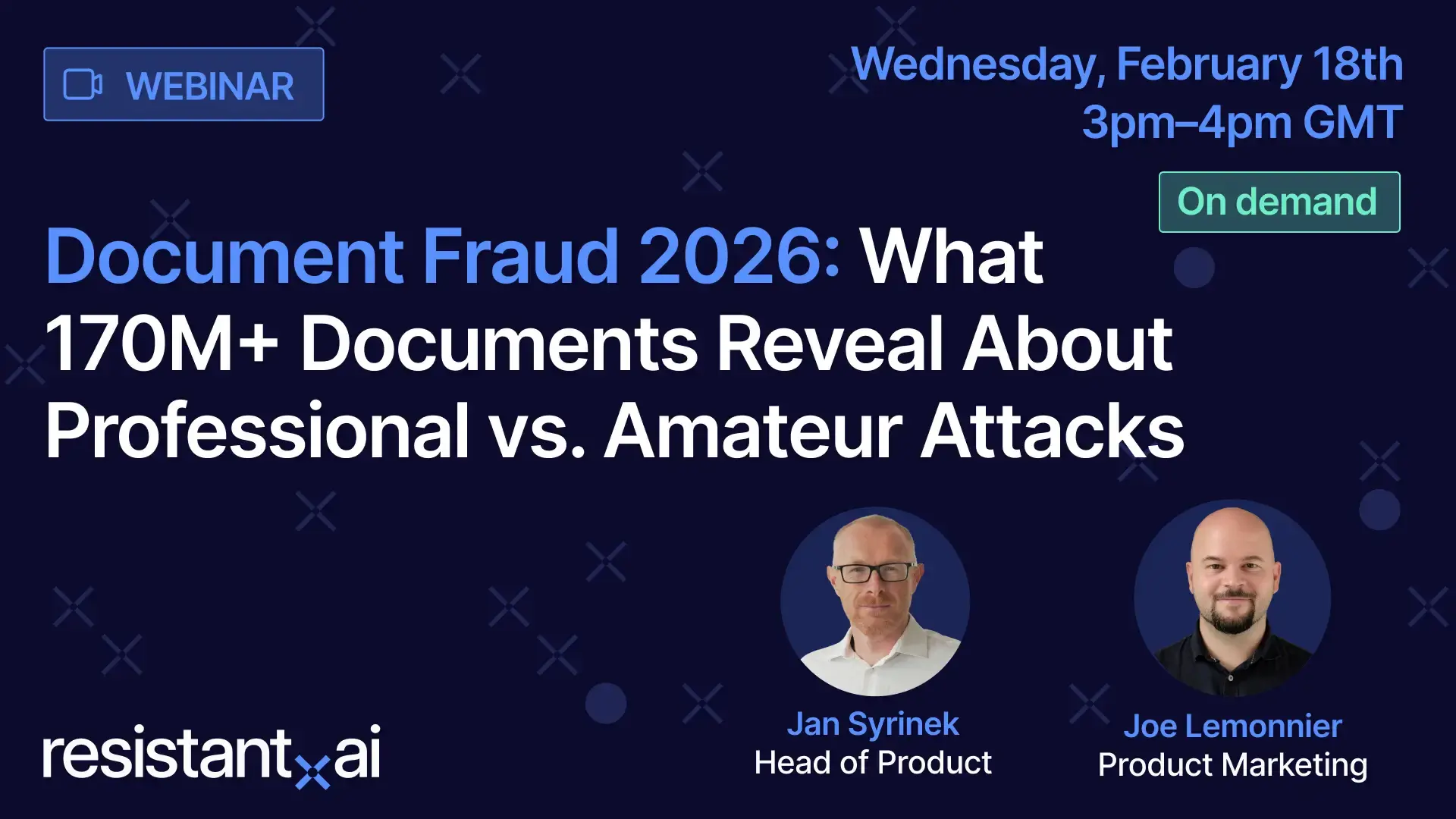

Pan-African document verification for merchant onboarding with Verto

Verto faced the complex challenge of verifying merchants’ legal status and beneficial ownership across diverse document types, formats, and country-specific standards.

SolutionResistant AI’s document fraud detection with adaptive decisioning reduced application review times by 50% while accurately detecting tampering, handling varied documents from multiple countries, and adapting verification to the desired risk appetite.

Related productsBroadening horizons, rising complexities

Partnering with Resistant AI, Verto implemented a solution designed to consider document formats, types, and the results from forensic analysis. An essential component of this strategy was the deployment of Adaptive Decisioning, which aligns the system’s outcomes with the customer’s risk appetite, ensuring that Verto ’s onboarding process remained robust, compliant, and efficient.

Since Resistant AI works without needing to read the contents of documents, it was well suited to authenticate documents types (whether known or unknown) from all the markets that Verto would want to expand in.

Within weeks, Verto could authenticate documents from a myriad of countries in seconds. Leveraging Resistant Documents provided more than just speed: It brought precision and adaptability to the table.

Automating merchant onboarding, not fraud

Partnering with Resistant AI, Verto implemented a solution designed to consider document formats, types, and the results from forensic analysis. An essential component of this strategy was the deployment of Adaptive Decisioning, which aligns the system’s outcomes with the customer’s risk appetite, ensuring that Verto ’s onboarding process remained robust, compliant, and efficient.

Since Resistant AI works without needing to read the contents of documents, it was well suited to authenticate documents types (whether known or unknown) from all the markets that Verto would want to expand in.

Within weeks, Verto could authenticate documents from a myriad of countries in seconds. Leveraging Resistant Documents provided more than just speed: It brought precision and adaptability to the table.

“The way Resistant AI identifies tampered documents in seconds dramatically accelerates our ability to establish UBO in an international setting.”

Quick reviews for expanding markets

Verto was able to reduce application review times by 50%, a feat made possible by the system’s ability to quickly and accurately identify document tampering and inconsistencies invisible to the human eye.

Beyond fraud detection, working with Resistant AI enabled Verto teams to reshape how they approached document verification, establishing a comprehensive compliance policy tailored to handle different kinds of documents.

All of these efficiency gains enabled Verto to expand its global footprint more rapidly without compromising on risk.

“Resistant AI enhances our decision-making speed by rapidly verifying documents from numerous countries enabling us to efficiently onboard more reliable customers and expedite transaction processing.”

Related reading material

Resistant documents

Verify any document for fraud

.png)