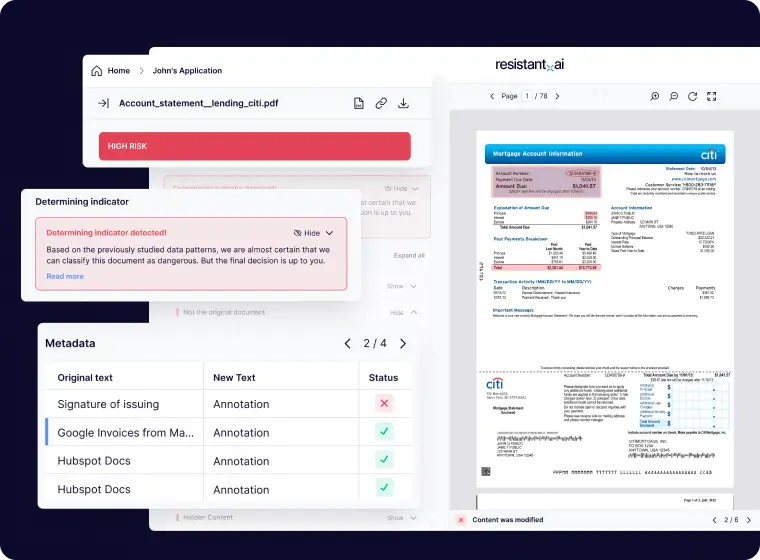

Process claims faster with AI document fraud detection

Keep tampered and fake documents out of your claims workflow, and free up your special investigation units for the fraud cases that really matter.

Keep tampered and fake documents out of your claims workflow, and free up your special investigation units for the fraud cases that really matter.

Claims fraud has never been easier (or more dangerous)

Anyone with a computer and an editing tool can modify a digital document or use one of the hundreds of sites providing high quality fake documents. Insurance companies need defenses that are advanced, resilient, and fast to stop the most sophisticated assaults.

Remove dependencies on issuers and speed up decisions on any document, approving more valid claims while eliminating fakes.

Fast track good claims and escalate bad ones automatically, streamlining operations without needing human oversight on every claim.

Spot fraud in any claims document

Invoices

Death certificates

No-claims discounts

Receipts

Flight confirmations

Vehicle documentation

Medical documents

Hotel bookings

And more!

Automating your claims reviews will save you thousands in seconds

- Average out-of-the-box detection rate (pre-training) 86%

- Average reduction in manual reviews 92%

Resistant documents

Our document fraud detection software can check your documents for fraud & authenticity in seconds — regardless of what they are or where they came from.Resistant documents has numerous benefits to several roles in the insurance industry:

- Loan officers. Verify borrower income and address documents quickly and accurately to reduce fraudulent loan approvals.

- Claims adjusters. Detect fake receipts, utility bills, and tax returns submitted as part of insurance claims to prevent payout on fraudulent claims.

- Fraud investigators. Use AI insights to identify subtle anomalies across documents and metadata that indicate sophisticated fraud schemes.

- Underwriters. Validate applicant financial documents efficiently to assess risk with higher confidence and reduce underwriting errors.

- Compliance officers. Ensure adherence to regulatory standards by automating verification of required proof-of-income and proof-of-residence documents.

- Customer onboarding specialists. Accelerate identity verification and reduce manual review workload during new policyholder intake.

- Audit teams. Cross-check financial documentation for inconsistencies or signs of manipulation during internal or external audits.

- Risk management analysts. Monitor document submission patterns and flag emerging fraud trends to inform risk mitigation strategies.

Yes. Resistant AI doesn’t read, extract, or process the actual content or sensitive data within documents. Instead, it analyzes the structure, layout, and metadata of documents to detect fraud.

By focusing on how the documents are built rather than what they say, the service is architecturally GDPR compliant, and capable of detecting fraud on any insurance document, in any language.