.png)

Seller onboarding made faster with AI document fraud detection

Automated seller and service provider onboarding with document fraud detection to accelerate checks, prevent manual review slow-down, and stop bad actors from reaching your platform.

Automated seller and service provider onboarding with document fraud detection to accelerate checks, prevent manual review slow-down, and stop bad actors from reaching your platform.

Ready to protect yourself from tenant fraud?

KYC & KYB that scale with your marketplace

Marketplaces have their platforms full of sellers, service providers, and workers (from hobby sellers to global brands to gig-economy partners) waiting to be onboarded. But rapid expansion comes with risk: fraudulent sellers using doctored business documents, identity-spoofing gig workers, shell companies exploiting loopholes, and operational teams overwhelmed by manual checks.

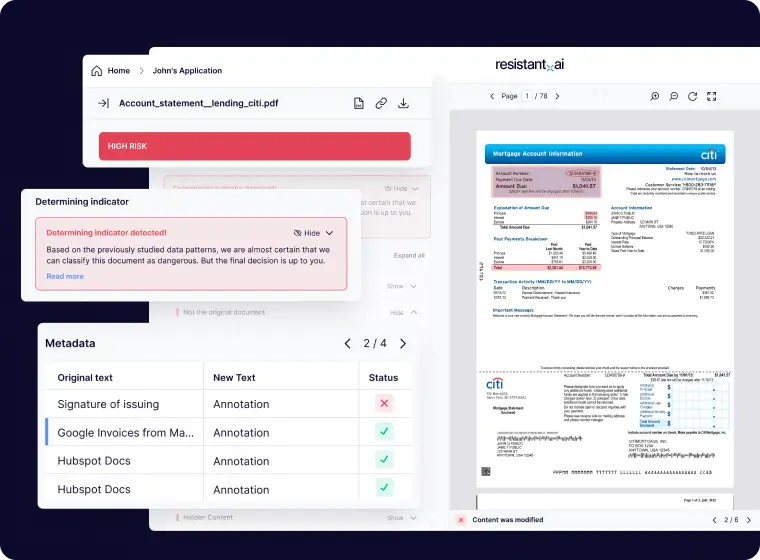

Every marketplace has its own way of evaluating risk. Customize your verdicts when verifying documents to improve seller experience, reduce false positives, and build automated work flows that match your risk appetite now matter the business, language, country, or document type.

Spot fraud in any marketplace onboarding document

Invoices or purchase orders

Bank statements

Tax documents

Pay stubs

Utility bills

Employer contracts

Lease agreements

Certificates of incorporation

Articles of association

Business license or registrations

Trade/commercial licenses

EIN verification letters

Lease agreements

National IDs, passports, drivers licenses

Work/residence permits

And more!

GPT and template generated invoices are the new normal in 2025. Our fake invoice detection service for marketplaces can help you onboard sellers without risk. Investing in our platform for pre-verification of invoices can:

Automating your marketplace onboarding reviews will save you thousands in seconds

- Average out-of-the-box detection rate (pre-training) 86%

- Average reduction in manual reviews 92%

Resistant documents

Our document fraud detection software can check your documents for fraud & authenticity in seconds — regardless of what they are or where they came from.Learn more on our blog

Resistant documents has numerous benefits to several roles in the seller and service provider onboarding process:

- Trust & Safety teams. Prevent fraudulent sellers, fake storefronts, identity-abusing gig workers, and document-based scam typologies from entering your platform.

- Marketplace Operations & Seller Support. Accelerate onboarding, reduce back-and-forth with applicants, and minimize incorrect rejections to deliver a smoother seller or worker experience.

- Compliance & Legal teams. Meet evolving KYB/KYC, PSD2, AML, and payments-related regulations as your marketplace adds financial features such as wallets, payouts, or BNPL.

- Risk & Fraud teams. Identify shell companies, multi-accounting rings, forged documents, and high-risk sellers early—before they transact or harm buyers.

- Product & Platform Engineering. Easily integrate automated document checks into onboarding flows, enabling scalable, globally adaptable verification without exposing systems to PII.

- Payments, FinOps & Vendor Management. Ensure accurate seller identity and ownership validation before enabling payouts or connecting financial rails, reducing downstream disputes and losses.

Yes. Our solution is fully PII compliant because it is document agnostic — it doesn’t read, extract, or process the actual content or sensitive data within documents. Instead, it analyzes the structure, layout, and metadata of files to detect fraud.

By focusing on how documents are built rather than what they say, the tool preserves privacy, protects sensitive information, and reduces exposure to PII. This design helps you meet privacy regulations while effectively spotting sophisticated document forgeries in your marketplace onboarding process.