Document verification: Ultimate guide

When people hear “document verification,” they immediately think of ID checks: passports at border control, driver’s licenses for KYC, onboarding at a bank, etc.

Identity verification might be the most visible use case, but it’s far from the whole picture. Document verification plays a foundational role in countless processes across industries, from finance and real estate to insurance, healthcare, and e-commerce.

Institutions can validate income statements for a loan, verify utility bills for address confirmation, confirm invoice origins in a business transaction, and endless additional possibilities.

As online document intake continues to explode, fraudsters’ tactics are only growing more sophisticated. The need to verify the authenticity, consistency, and origin of documents is quickly becoming a universal business requirement — not just a compliance checkbox.

So, let’s dig into document verification: what it is, its importance, and how it works in the real world.

Table of contents

What is document verification?

Document verification is a process for confirming a document is legitimate, unchanged, and coming from a verifiable source. It checks both the content and structure of the document.

- Content: Verifying the information within the document.

For example:

- Income flow

- Account number

- Balance

- Transaction/order information

- Dates

- Address

- Name

- Structure: Verifying how the document is built.

For example:

- File format

- Fonts and font sizes

- Placement of visual elements (logos, stamps, barcodes)

- Document metadata (software used, timestamps etc.)

- Internal structure in the case of PDFs

- Image integrity

Companies and individuals use document verification to establish trust: Are the people you’re working with who they say they are? Are the claims they’re making legitimate? Are they filling out their documents/applications with real/verifiable information?

Document verification protects companies from document fraud and financial loss, supports smoother operations, and minimizes risk.

Real world example of document verification

To get a complete view of document verification we have to explain the universal journey any document takes as it travels from submission to eventual approval.

For this example, let’s say you’re a lender and you need to verify an individual’s income before approving a short-term loan. Any document you process would need to go through the following steps:

-

Collect. How does the document enter your process? In this case, one of your applicants submits the document, a bank statement for proof of income, via your website’s online portal.

-

Quality. Is the document readable? If you review verification documents manually, you may not even notice this step (as it will be evident if you can use the document). But if you use technology to extract content digitally, it's important to determine if it is of high enough quality to be read by the systems.

-

Classify. Is this the right kind of document? Is it a bank statement or a bank confirmation letter? Is it an original PDF, or a photo? And do they match your compliance policy?

-

Trust. Is the document authentic? The structure of the bank statement is analyzed, revealing it has no changes to the metadata, didn’t undergo any modifications, and has all the correct logos/structural information.

-

Read. The content is extracted from the document. You either manually enter the data from the document into your system, or rely on parsing (in the case of PDFs) or OCR (in the case of images) to do it for you, making it readable for further analysis.

-

Analyze. The content is processed for your needs. You run your credit analysis, do credit and background checks, confirm the identity on the document matches others provided. Everything pans out. You approve the loan.

Understanding the document verification process

So, how do you verify documents? Fraud detection companies define the document verification process differently. Selfishly, most only describe the steps that involve their product offering.

At Resistant AI, we want to deliver our readers content with real value. That’s why we’ve outlined the document verification process in its totality, not just the middle three stages we help with.

Our six-step process — collect, quality, classify, trust, read, and analyze — isn’t just about moving documents through a pipeline. Each step is framed by a specific question: Is the document real? Is it readable? Is it the right kind of document? Can we trust the source?

Rather than outlining a generic procedural flow, we’ve highlighted how verification (and what kind) is occurring at every level, providing a complete picture of not just the document’s journey, but the verification it undergoes throughout every step of that process.

Collect

During the “collect” stage, organizations gather necessary documents through methods such as in-person submissions and digital uploads. The first question businesses need to ask: how do customers submit documents? Some of the most common collection methods include:

-

Web portal: Users upload directly through a browser.

-

Mobile SDK: Users take a photo with their phone.

-

Email/messaging platforms. The doc is sent through one of these platforms either as a file or an image.

Other items to consider:

-

Has the user provided all the required documents?

-

Who is uploading the document? Is it really the document owner?

-

Avoid middlemen. Direct collection reduces the trust layer needed for intermediaries.

Verification checks: Verifying documents at this level primarily involves behavioral analysis of the user.

-

Is the same IP used across multiple submissions?

-

Are they using a VPN?

-

Is the IP from a high-risk country?

-

Does the submitter appear too robotic or unnaturally fluent in the onboarding process?

These indicators can help detect bots, automated fraud attempts, and suspicious behavior.

Quality

Once documents are collected, the next step is to assess their usability. The key question: is this document readable and real enough to be worth processing?

Research confirms that accurate OCR depends heavily on high-quality images. Sending unreadable documents downstream wastes time, creates cost without value, and opens the door to fraud.

Fraudsters often rely on poor-quality uploads — blurry scans, overexposed photos, or low-res screenshots — to hide signs of manipulation.

Resistant AI addresses this issue by performing automated quality checks (within three seconds), rejecting unusable or suspicious documents and triggering instant feedback loops.

Common upload quality issues include:

-

Flash reflections or glare

-

Motion blur or camera shake

-

Low resolution or compression artifacts

-

Cropped or cut-off sections of the document

-

Overexposed or underexposed lighting

-

Obscured or tampered fields (e.g., stickers, fingers, or overlays).

Verification checks: This stage focuses on image and file quality analysis, such as:

-

Is the image sharp and legible?

-

Are all required fields visible and unobstructed?

-

Are there signs of visual tampering (e.g., glare placed to obscure data)?

-

Does the file meet the resolution and format requirements for OCR?

Filtering for these issues early and prompting users to re-upload when needed introduces smart friction for fraudsters, who often rely on one-shot, throwaway uploads to game the system.

Classify

Once you’ve confirmed that a document is high quality and worth processing, the next step is to “classify” what it is — and whether it’s what the user claims it to be. The guiding question: Is this the right document, from the right source, in the right format?

At this stage, the system identifies the document type (e.g., bank statement, utility bill, ID), the issuing entity (e.g., HSBC vs. a lesser-known local bank), and key structural patterns that help validate its authenticity. This allows organizations to set specific rules. For example, accepting utility bills from Provider A but not Provider B, or accepting PDFs but not mobile screenshots.

Resistant AI’s document classifier uses as few as 50 to 80 samples to learn what a legitimate document from a given issuer looks like — across both images and PDFs.

Other classification logic can include:

-

Is the document layout consistent with known templates?

-

Is the issuer recognized and verifiable?

-

Does the file match the declared document type?

Verification checks: This stage includes structural and issuer-level analysis, such as:

-

Document type identification (e.g., invoice vs. bank statement).

-

Issuer recognition and template matching.

-

Format-specific rules (e.g., no scans of printed emails).

-

Entity existence checks (e.g., does this company or utility provider exist?)

-

Matching document type to context (e.g., asking for proof of address but getting an insurance policy).

During this stage, organizations can streamline downstream processing, reduce reliance on manual review, and ensure the right tools are used (e.g., picking the best OCR engine based on doc type).

Trust

Even if a document looks right and is the correct type, there’s a deeper question that needs answering: Can we trust this document? The “trust” stage assesses whether a document was issued by a legitimate source and has not been tampered with or synthetically generated.

At this level, document verification moves beyond surface-level validation. It uses AI and machine learning to identify fraudulent characteristics of any document, providing insight into its origins and authenticity.

Resistant AI’s anomaly detection engine analyzes over 500 characteristics — many of which are invisible to the human eye — to determine if a document was created by a trusted author, software, or device.

We consider several factors during this stage of the document verification process:

-

The software used to create the document is appropriate (e.g., not Photoshop for a payslip)

-

The device’s metadata and generation patterns align with what’s expected.

-

The document matches known visual patterns of real issuers (logos, layout, design)

-

Historical submissions are cross-referenced to detect reuse or templated fraud

Verification checks: At the trust stage, we focus on authenticity signals and anomaly detection, including:

-

Authoring program and software consistency

-

Device fingerprints (camera models, PDF generators, etc.)

-

Logo detection and brand consistency checks

-

Comparison with historical documents to flag re-use or counterfeiting templates

-

Structural consistency with legitimate issuer formats

When a document passes trust-level checks, it can be automatically approved, removing the need for manual review or retroactive fraud investigations. Otherwise, it can move on to the next stage.

Read

The primary purpose of the “read” stage is to extract the document’s contents for further analysis. It’s answering the question: what does it say? It’s typically done through an OCR or ICR technology.

While this stage doesn’t have a lot of risk for direct fraud, you can still run into issues when using an LLM to digest the document’s content. For example:

-

LLMs (Large Language Models) can be tricked, e.g., using white text on a white background in a PDF to insert hidden instructions.

-

LLMs tend to follow what they “read” without deep understanding or skepticism.

Verification checks. Few fraud prevention techniques exist at the raw content extraction layer. However, their necessity is brought into question when considering the actual threat level.

-

In some circumstances a fraudster might intentionally make the document fail OCR so it's elevated to a human-review — a much easier to fool verification.

Most companies rely heavily on analysis after extraction rather than trying to authenticate the digital integrity of the document.

Analyze

At the “analysis” level, organizations digest all the information gathered in the previous stages and use them to make an assessment related to the original purpose for requesting the document.

For example, is this document sufficient evidence for loan approval?

Fraud detection still occurs at this layer, but it's more closely related to the contents of the verification documents (i.e., do the figures make sense/align with expectations). The institution can finally make a decision about the document, answering the question: What does it mean?

There are two processes at play here: cross-verification and data extraction.

-

Cross-verification. Using internal and external data to verify the contents of a document.

-

Do the names match across all submitted documents?

-

Is the account number of SSN consistent?

-

Is the applicant registered in an anti-fraud database?

-

-

Data extraction. Using the contents of the document for decisioning for a business process (i.e., approving a loan).

-

Looking at bank statement details.

-

Analyzing financial patterns.

-

Using extracted data for credit scoring.

-

The use cases for this layer vary based on industry but some examples are:

-

Fraud detection. Detecting inconsistencies or fabricated data.

-

Creditworthiness check. Checking to see if the person’s financial information is adequate.

-

Are there positive balances at the end of each month?

-

Any spending patterns that suggest financial instability?

-

-

Risk profiling. Determining if the applicant is a risk.

-

Are transactions linked to high risk geographies (i.e., sanctioned countries)?

-

Is there indicated exposure to criminal activity or money laundering?

-

Once the institution has conducted its analysis they can make educated decisions about the document including:

-

Add friction. Increase verification steps for higher-risk users.

-

Deny service. Refusing the document if the user presents unacceptable levels of risk.

-

Approve document. If everything looks ok, then the document can be accepted and used for its business purpose.

Why is document verification important?

You might be wondering “why do I need to verify documents for my business?” Beyond the obvious benefits of reducing risk and fighting fraud, it helps companies with compliance, customer trust, and, once automated, can speed up lengthy processes.

-

Compliance with regulations. As companies strive to align with government regulations, document verification can provide organizations with the verified customer knowledge and adequate processes necessary to fill these requirements — especially with KYC and AML.

For example: The Money Laundering Regulations Act of 2017 in the UK requires businesses to perform Customer Due Diligence (CDD). One of those mandatory due diligence measures is mentioned under regulation 28 obligating businesses to verify the identities of beneficial owners where applicable to ensure they understand the ownership and control structure of legal entities in transactions.

-

Customer trust. Automating document verification can actually reduce friction in the customer experience, increasing the speed of the review process and allowing the onboarding of more customers more quickly.

Secondarily, your investment into robust document verification services demonstrates your commitment to security and authenticity — while also deterring regulators from further investigation.

-

Speeding up lengthy processes. Automating document verification can speed up the manual checking of documents for fraud. Companies can verify thousands of documents in the time it took them to verify hundreds, saving time and manpower for more directly beneficial initiatives.

For example: Resistant AI was able to reduce a Rent-to-Buy car subscription loan company, Planet42’s, application processing time to seconds with the implementation of our document forensics solution.

Document verification challenges

While necessary and extremely beneficial to businesses, document verification software is not typically a one-size-fits-all solution. It comes with a unique set of challenges that businesses must overcome to get the most out of their solution.

Specifically, if your solution is based upon reading the document (its contents) as opposed to its structure, you should consider the following challenges before implementing a document verification services:

-

Scalability issues. Increasing volume and diversity of documents can strain the solution’s capabilities and impact accuracy. Businesses must ensure that processes can handle various document formats and quality levels without compromising efficiency and effectiveness of the solution.

-

Accuracy limitations. Done manually, document verification can suffer from human error and inconsistency and isn’t scalable. Even OCR isn’t 100% (the best is probably 90%) which still leaves a large margin for error.

-

Security and privacy concerns. Integrity and confidentiality must be maintained during the verification process to protect against risk and align with compliance requirements.

-

Diverse document types and formats. Every document has unique security features and data structures that must be addressed. Otherwise you can slow the system or produce false negatives.

Document verification compliance

Document verification is also a requirement for regulatory compliance. Highly regulated industries like finance and healthcare are obligated to verify customer identities, confirm the authenticity of supporting verification documents, and maintain record accuracy and data integrity.

KYC (know your customer) and AML (anti-money laundering) are two terms that float around the compliant document verification space. KYC is actually a subset of AML and has to do with managing organizational exposure to illegal customer behaviors (such as money laundering).

However, these terms do not stand alone as document verification legal frameworks. They are requirements for larger encompassing regulations such as the BSA enforced by FinCEN in the US, and the AMLD in the EU.

Document verification best practices

Now that you’re aware of the challenges, let’s cover some best practices to ensure your document verification initiatives are always successful.

1. Implement advanced technology

Integrating a document verification software that utilizes advanced technology like AI and ML will enhance the solution’s accuracy, efficiency, and fraud detection capabilities. They can analyze complex patterns, detecting anomalies and adapting to new fraudster tactics at their inception.

Tips for AI document verification:

-

Ensure data quality. A model is only as good as the data it’s built on.

-

Maintain explainability. To remain compliant models must be explainable. This also helps the fraud team better understand the threats they are facing and implement countermeasures/train the AI.

-

Continuously update. Fraud is a moving target that’s ever-evolving. Any static solution will eventually be figured out and side-stepped.

2. Regular training for personnel

You must equip your employees with the latest knowledge and skills for them to use your solution effectively. It also helps them stay relevant with the latest fraud techniques, regulatory changes, tech advancements, and updates.

Tips for document verification training:

-

Custom training for specific roles. Not everyone needs to know how to do everything.

-

Keep comprehensive training records. Document the training to demonstrate compliance, access protocols, and organizational accountability.

-

Regularly update training content. As tools and fraud tactics evolve, so must your training regiment.

3. Multi-layer your verification approach

As we mentioned above, combining various methods to verify documents creates a layered approach that improves accuracy. If one of them is wrong, another layer looking at the problem from a different angle has a chance to spot the issue.

For example, a document might pass the “collect” and “quality” layer but get disqualified once they enter “trust” because the document’s metadata has been modified.

A document could pass all three of those layers but then get disqualified during “analyze” because it has inconsistent last name spelling compared to other submissions.

It is the “layers of swiss-cheese” theory — stacking imperfect layers on top of one another to fill the holes left by the last.

Tips for multi-layered document verification:

-

Combine traditional and digital. Human eyes can’t spot most fraud, but they can verify the results. Humans should review novel problems as opposed to everyday occurrences, focusing on creativity and complexity.

-

Identify holes and weaknesses. Review your counter measures and their results to see what’s working, what isn’t and what needs additional verification layers to be done properly.

-

Conduct regular audits and assessments. Make these reviews a regular part of your risk routine to ensure an up-to-date approach.

What are the types of document verification?

As there are many types of document fraud, there are also different types of document verification. But what are some specific use cases for document verification?

|

Verification type |

Definition |

Example documents |

|

Proof of address |

Confirms provided residential or business address. |

Lease, mortgage, |

|

Business verification |

Confirms authenticity and operational status of businesses |

Certification of incorporation, |

|

Proof of income |

Validates income source and repayment capabilities. |

Bank statement, pay stub. |

|

Bank account verification |

Verifies ownership and validity of the applicant’s bank account. |

Bank statement, Cheques, |

|

Employment verification |

Confirms employment status and details. |

Employment verification letter, |

|

Proof of Identity |

Verifies the identity through government-issued documents. |

Passport, driver’s license, |

|

Operational license |

Verifies required licenses and permits for business operations. |

Business operating license, |

|

Asset verification |

Validates asset ownership, existence, and valuation. |

Property deeds, tax records, |

|

Reference |

Third-party confirmation of applicant’s past behavior or reputation. |

Reference letter. |

|

Travel verification |

Confirms authenticity of travel arrangements and bookings. |

Itineraries, visas, |

|

Medical verification |

Validates medical histories, conditions, or treatment details. |

Medical records, |

|

Claim verification |

Validates supporting documents submitted during insurance claims. |

Accident reports, |

What types of documents need verification?

You can essentially verify any kind of document, as long as you have some information about its characteristics and historical data indicating how the document should look.

For AI driven document verification solutions, you don’t even need that much information. Focusing on the “quality, classify, and trust” layers, these models can detect fraud on documents they’ve never seen before by looking for fraud typologies.

For example, if there is a font change on one digit in the middle of a number, that can indicate fraud regardless of the document type.

However, in our experience as document verification software provider, these are the 21 most common documents we encounter:

-

Balance sheet

-

Asset purchase invoice

-

Property valuation/appraisal report

-

Vehicle valuation/appraisal report

-

Vehicle registration certificate

-

Commercial invoice

-

Purchase order

-

Employment contract/letter

-

Supplier contract

-

Passport

-

ID

-

Driver’s license

Future trends and a brief history of document verification

The first versions of document verification emerged in ancient and medieval societies. Merchants and nobles would use seals and signatures to watermark important documents as legitimate.

This persisted for hundreds of years. With all documents in a physical format, trained personnel would need to inspect each document individually. Entire professions emerged from this demand. Art enthusiasts could spot a forgery from the opposite side of a room. Tax collectors could hand-verify hundreds of documents throughout one day of work.

Once digital documentation arrived the need for efficient verification exploded. Suddenly, accessibility expanded and brought with it huge volumes of new documents to check. It also made it easier to commit fraud — creating a fake is as simple as copy, paste, alter.

Computers needed to learn the tactics of their human predecessors through extensive rule libraries and pattern analysis. It also removed the messenger from the equation. Evaluators could no longer rely on a “wink and a handshake” to seal the deal. Perhaps more secure, but they also lost this layer of human to human verification.

Fast forward to the present day and automation and AI have made fakes nearly indistinguishable from their real counterparts. The human element of document verification has been made almost obsolete. No rule set can keep up with the ever evolving nature of criminal activity. Digital fraud is invisible to the naked eye.

Models must rely on machine learning and document agnostic approaches to spot discrepancies in document structure.

If a fraudster alters a pdf you won’t be able to notice just by looking at it. You’ll need to at very least check metadata but that’s the bare minimum as it can easily be faked as well. With Bad AI also in the realm of possibilities, it's easy to see how humans can get quickly overwhelmed.

What will the future hold? Some document verification software trends to keep an eye on in the coming years:

-

Blockchain technology. Provides a decentralized, impregnable ledger to ensure document authenticity and integrity. However, this technology is slightly “over-hyped” in the verification space. Blockchain is very poorly adopted in the general industry and simpler, networked databases are sufficient in 99% of cases.

-

Consortium/network verification. Bigger banks and other institutions are banding together into massive international information sharing agreements to consolidate information for cross-referencing purposes.

-

Gen AI. Generating fake documents via prompts has never been easier. However, they still have some limitations in terms of cleanly imitating the actual contents of a document and replicating standardized formats. They perform better with the overall look and random documents than word for word, perfect fakes.

-

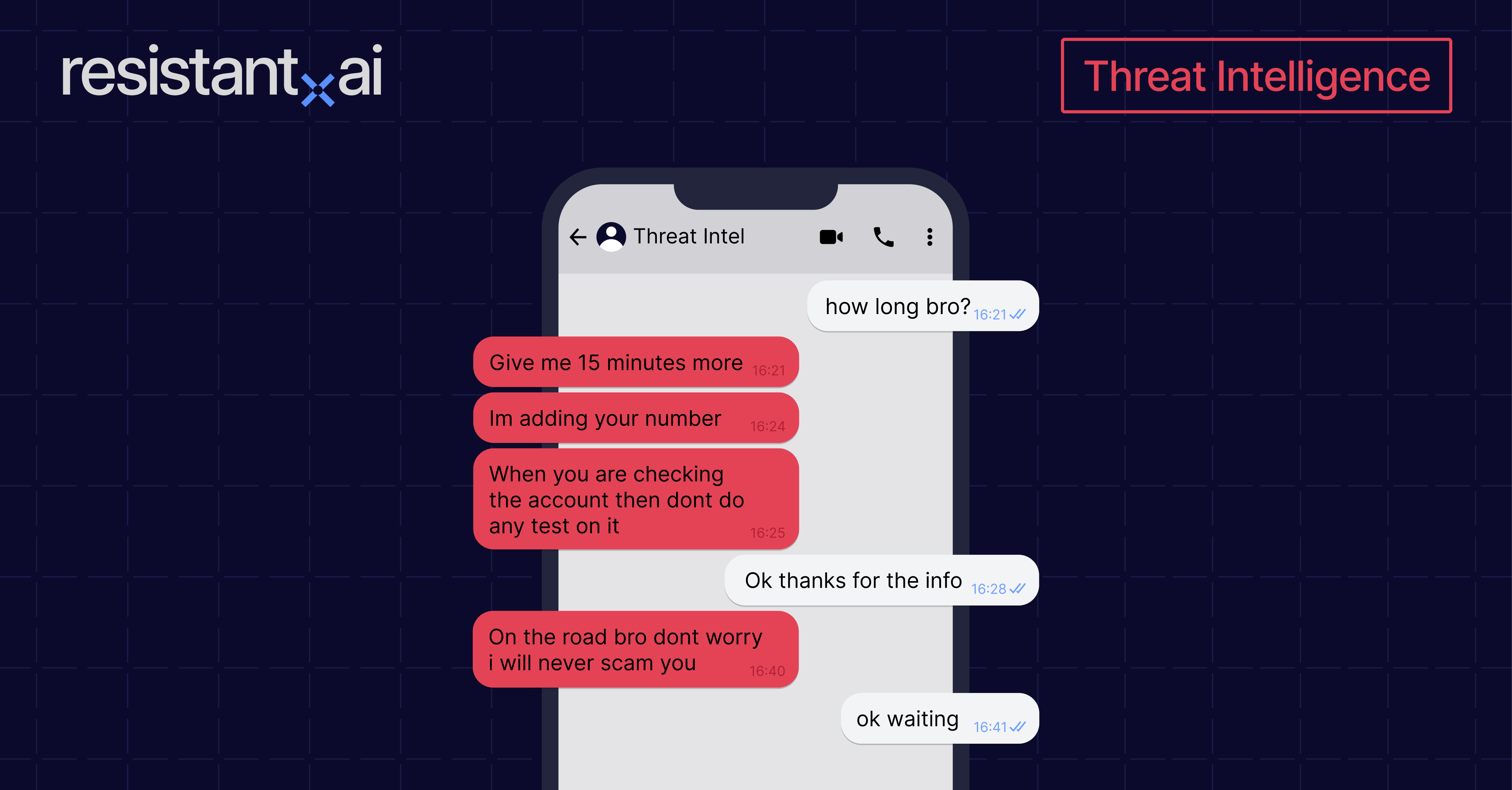

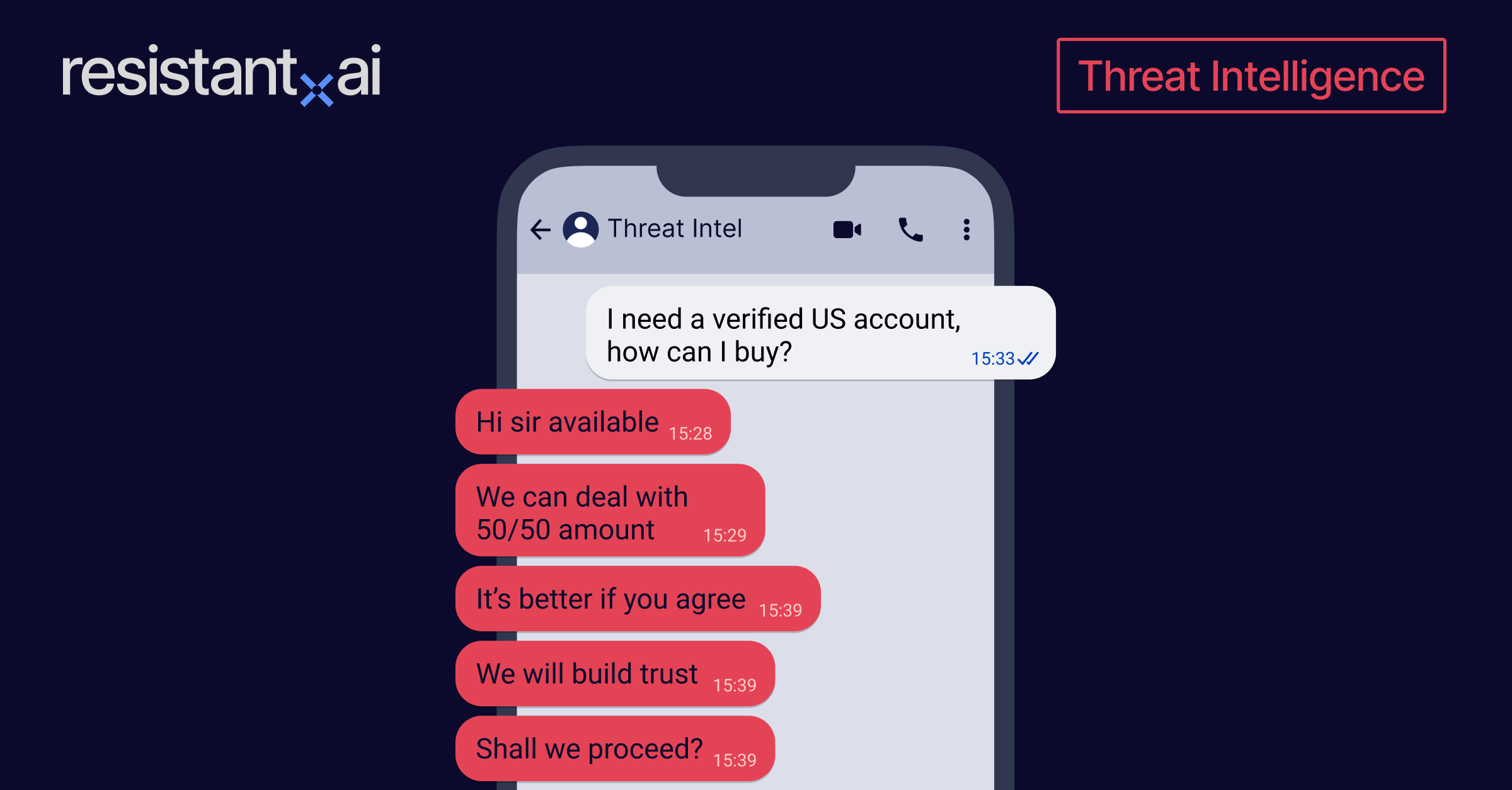

Template farms and hubs. At Resistant AI we’ve recently become experts on the topics of template farms and hubs — immense repositories for fraudsters to advertise and sell illegal document templates online.

What industries benefit the most from document verification?

There are a few highly regulated industries where document verification software is a must. If you work in one of these industries you should be aware of the requirements and the common use cases:

|

Industry |

Document verification use cases |

|

Banking and Finance |

Customer onboarding, |

|

Payment firms & E- Commerce |

Seller onboarding, |

|

Lenders |

Loan application processing, |

|

Insurance |

Claims processing, |

|

Real estate & property management |

Tenant screening, |

Banking and finance

Document verification services are mandatory for complying with KYC and AML regulations. It also safeguards against massive fraud and identity theft. The primary reasoning is for anti-terrorism efforts, supercharged after the 9/11 attacks. Sometimes the term “AML” is even replaced by “CFT” or “countering the financing of terrorism.

Payment firms and E-Commerce

Verifying documents prevents fraud and ensures secure transactions. Onboarding merchants and verifying buyers is very document heavy and susceptible to fraud.

Lenders

Especially in B2B settings, document verification is an essential capability for lenders, such as trade finance and mortgage/car financing. Tools can authenticate borrower information, mitigating fraud risks and minimizing poor loans. Lenders can make informed decisions, streamline loan processing, and improve financial transaction trust.

Insurance

Helps businesses authenticate policy holder information and prevent fake accounts from being opened in another person’s name. Also helps reduce financial losses due to faulty claims and streamlines claims processing.

Real estate and property management

From verifying proof of income and identity during tenant onboarding to authenticating ownership documents in property sales, the integrity of each document directly impacts financial risk, legal exposure, and operational efficiency.

Conclusion

Document verification serves as the backbone of digital trust. Once a manual process reserved for the skilled few — it has blossomed into a thriving, critical, scalable, and deeply technical industry powering companies to a safer future.

Fraud will only become more advanced. For document verification to keep pace we need to understand its value, follow its best practices, and accept its challenges as a reality.

Organizations should view it as a competitive advantage. Not only will it protect them from risk but also build their reputation and operational efficiency. Businesses that embrace document verification will be best equipped to thrive in a digitally verified world.

Want to be one of those businesses? Scroll down to book a demo.

Frequently asked questions about document verification

Still hungry for more document verification content? At Resistant AI we want our readers to be as informed as possible. Below you’ll find some of the most frequently asked questions about document verification.

How does online document verification work?

Online document verification is how most document verification takes place these days — entirely online. The client/customer submits their documents via a secure platform where its data is extracted via technologies like OCR. The system then checks its validity using a trusted database or an AI algorithm for detecting tampering.

This method is more secure and accurate than physical verification.

What technologies are used for document verification?

Document verification is a technologically complex process that combines a variety of tools and capabilities to achieve its end goal. Some of the most common technologies are:

-

AI & ML

-

Pattern recognition

-

Document template matching

-

Digital watermarking

-

Metadata analysis

-

Database cross-referencing

-

Optical character recognition (OCR)

-

Intelligent character recognition (ICR)

-

Geolocation & device fingerprinting

What is an automated document verification system?

Automated document verification occurs when the document verification solution or API is integrated into the document collection process. Documents are verified automatically instead of the tool being used manually on a case by case basis.

How does document verification integrate with existing KYC?

One way document verification integrates with KYC is through identity verification (IDV). However, these use cases can vary based on institution.Depending on the use, it can also encompass other parts of the KYC process such as verifying documents like utility bills (proof of address), pay stubs (proof of income), employment contracts (proof of employment), to assess the risk they pose to an organization.

What are best practices for document verification security?

Since document verification typically involves sensitive information, security is a key priority.

Some best practices to keep in mind:

-

Explainable verdicts. Institutions must be able to identify the model’s decision and some reasoning behind it to remain compliant, adapt/improve the model for future situations, and address liability concerns.

-

Secure data transmission and storage. End-end encryption, encrypted databases, compliance with GDPR, CCPA, and other standards.

-

Role based access control (RBAC). Control who has access to prevent documents from ending up in the wrong hands.

-

Human review. Use humans to verify AI decisioning.

-

Audit trails and data lineage. Track usage and log every action in the verification process.

-

Test, audit, and update regularly. Security is only possible if constantly maintained.

Document verification vs. ID verification

ID verification only deals with forms of personal identification: IDs, passports, drivers licenses, etc. Document verification encompasses the entirety of documents and their legitimacy from hotel bookings to Walmart recipes.

What is digital document verification?

Document verification for digital documents. Digital document verification is now the most common type of verification since the onset of smartphones and online transactions. It was heavily accelerated by the COVID-19 pandemic.