Industry insights

Secure LLM-driven processes in financial onboarding

Large language models (LLMs) are effectively transforming the modern business landscape. LLMs have recently become popular thanks to their ability to extract structured concepts from unstructured ...

Global Document Fraud Report 2026

What 170 million documents reveal about amateur and professional document fraud Document fraud has ...

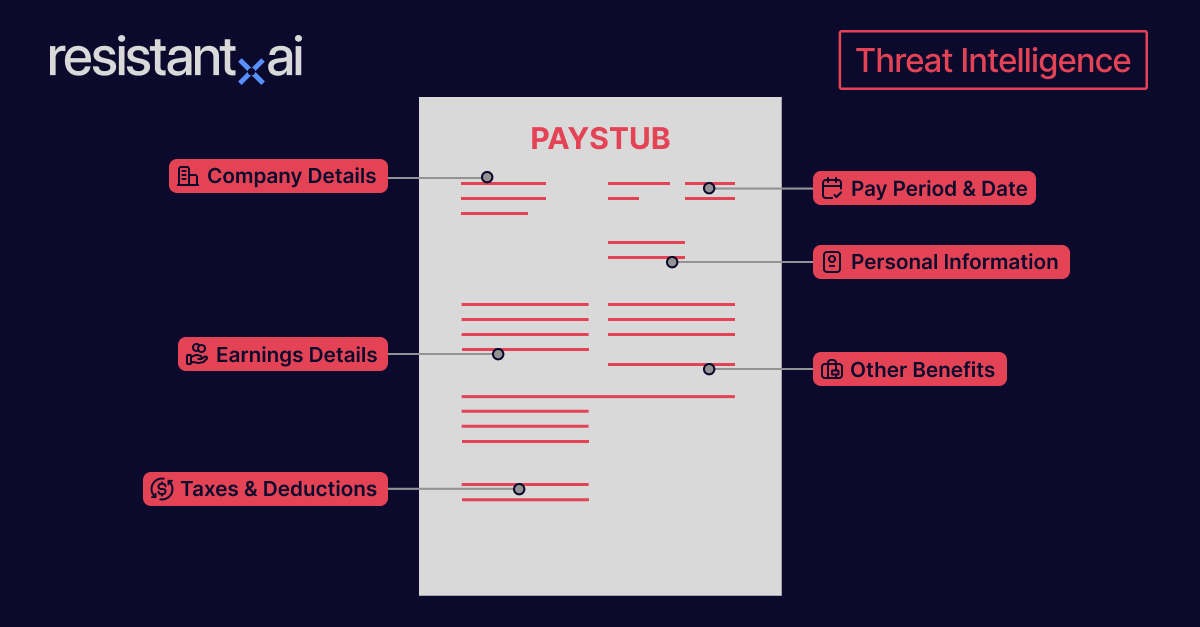

I’m working here...or am I? The threat of pay stub ...

Pay stub, pay slip, salary slip, earnings statement, proof of income... Whatever the designation, ...

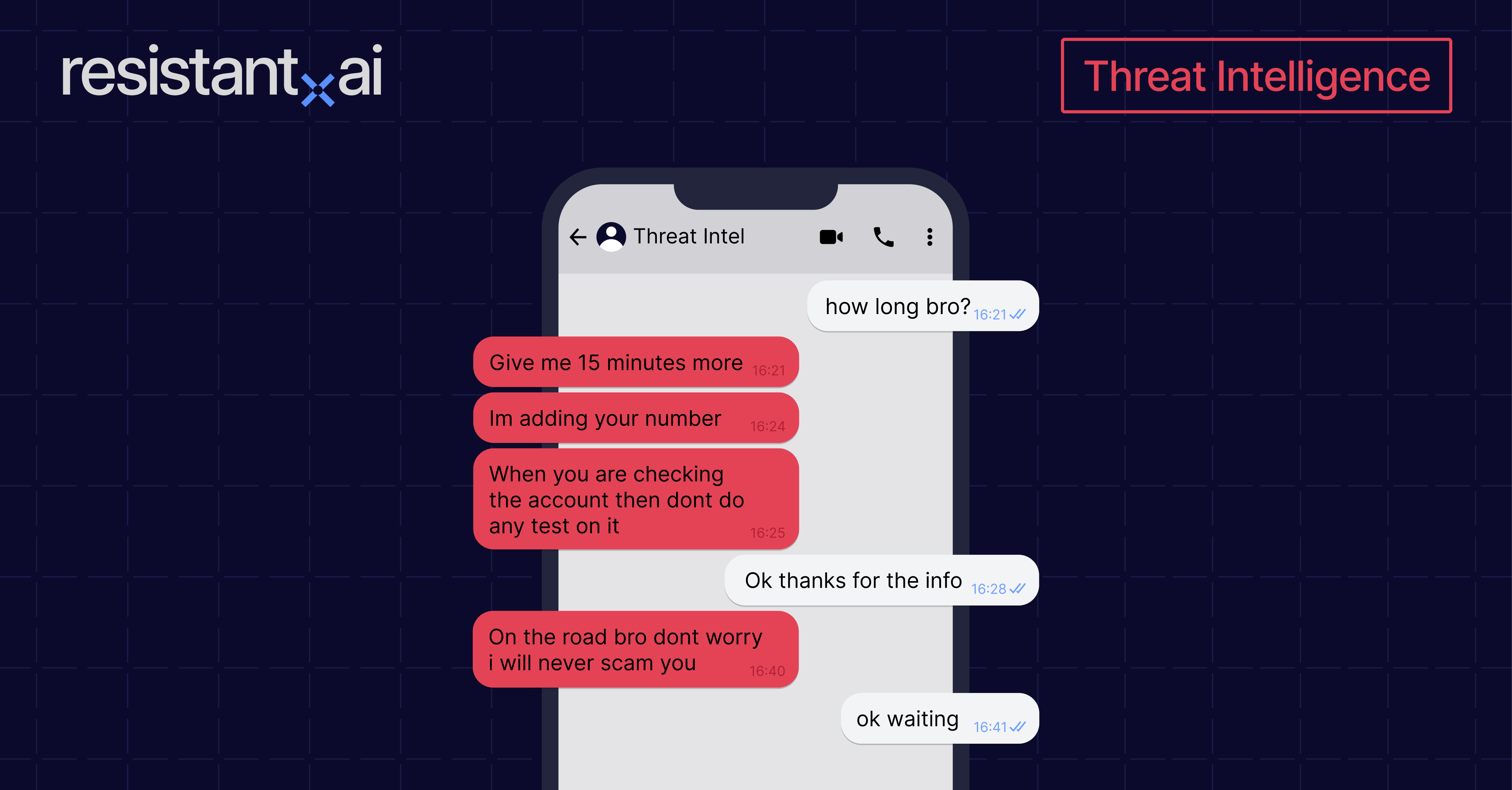

Top 7 quotes from our conversations with fraud enablers

Talking to criminals can feel like you’re watching a foreign film with imperfect subtitles: the ...

Disrupting muling activity: The good, the bad and how to prevent things from getting ugly

The prevalence of fraud in the UK has reached alarming levels, with 40% of all crime attributed to fraudulent ...

Ensemble modeling: A game-changer in financial crime detection

More than ever before, financial institutions and fintech companies are recognizing the need to adopt cutting-edge AI ...

How to better detect human trafficking activity from payments data

If you’re a bank, fintech company, payment institution, or money services business, it’s a hard truth that there are ...

AI and AFC: The future is now — are you ready for it?

Today, AI is as broad of a term as ‘mechanical engineering’. So what is it that we mean when we talk about AI? And more ...

Context is king: How AI uncovers hidden relationships & puts financial crime investigations in perspective

The ACAMS Annual AML & Anti-Financial Crime Conference held in Hollywood, Florida, is one of the most anticipated ...

APP fraud’s synthetic money mules: How tiny gaps in digital KYC drive existential risks for payment firms & neobanks

Authorized push payment (APP) fraud is the largest category of fraud in the United Kingdom, has been subject of ...