Products

Use Cases

Documents

Merchant Onboarding

Verify KYB documents in under 20s

Loan Underwriting

Confidently approve more loans with fewer defaults

Tenant Screening

Check applicant documents for misrepresentation

Claims

Escalate fake claims and process real ones instantly

Marketplaces

Strengthen seller onboarding in seconds

Customers

Resources

Products

How to get started with Resistant Documents

Jump right in — get an overview of the basics and get started on building.

Watch now

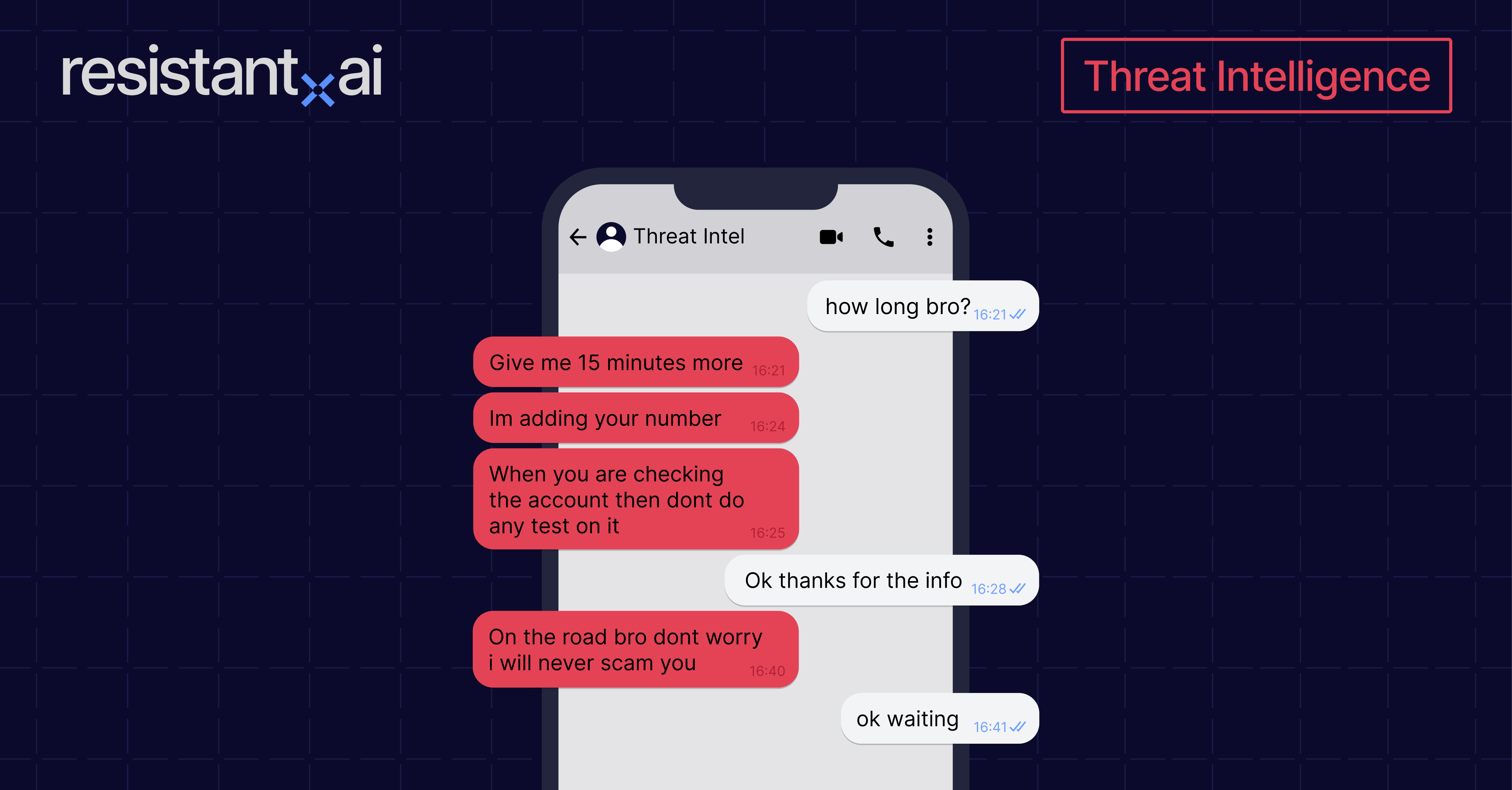

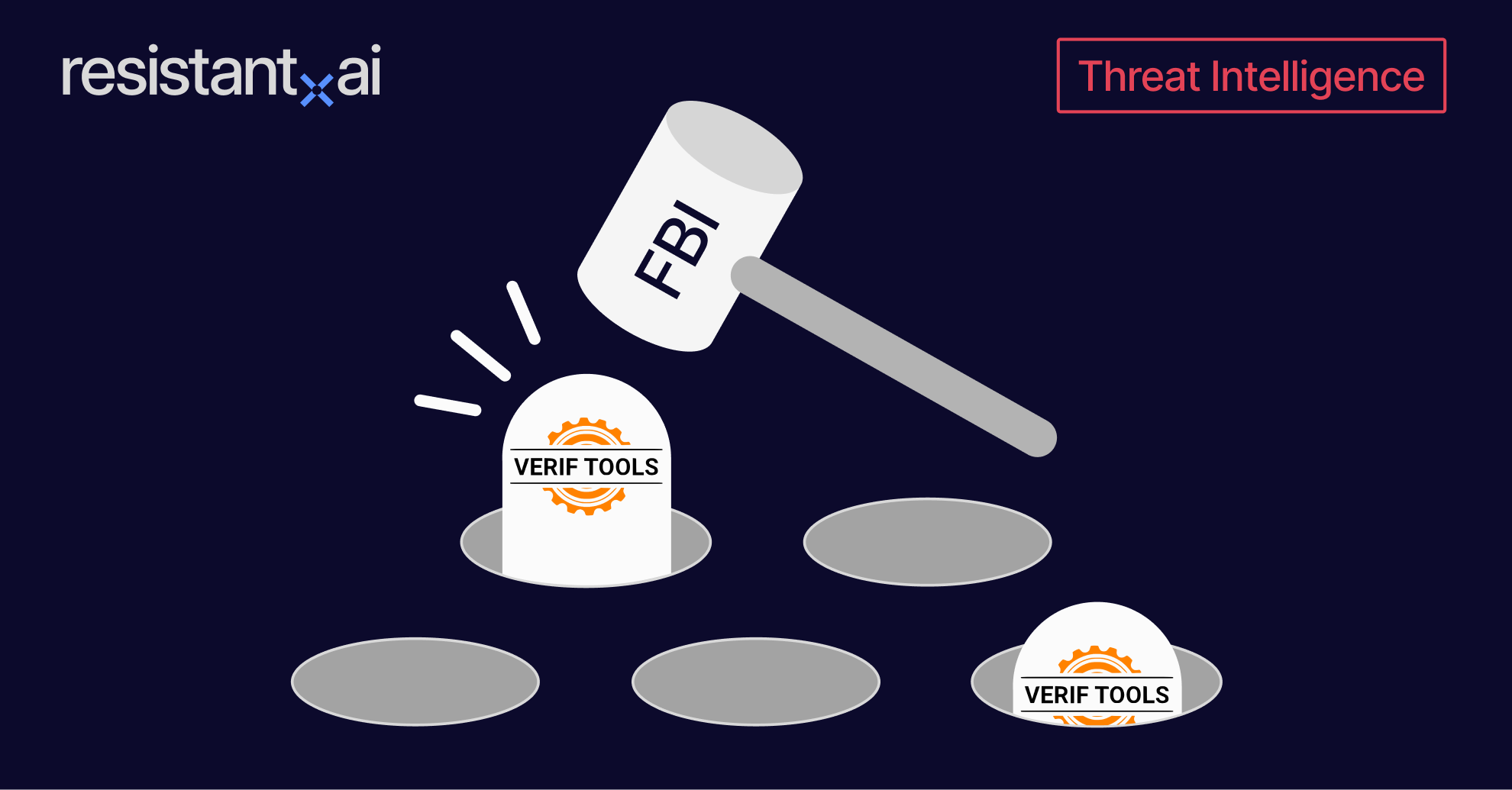

The Threat of Serial Fraud

Documents

Merchant Onboarding

Verify KYB documents in under 20s

Loan Underwriting

Confidently approve more loans with fewer defaults

Tenant Screening

Check applicant documents for misrepresentation

Claims

Escalate fake claims and process real ones instantly

Marketplaces

Strengthen seller onboarding in seconds

Transactions

Webinar

Webinar

Resources

Support

Webinar

Webinar