How to spot no claim discount fraud

Claims-free discounts (AKA no-claims discounts or “NCDs”) remain one of the most important pricing signals in motor insurance in 2026.

Drivers who go multiple years without filing a claim can earn significant premium reductions. For customers moving between insurers, it’s an opportunity to have a huge impact on the pricing model.

That’s why spotting claims-free discount fraud is an essential part of any modern insurance fraud detection strategy. Without it, insurers run the risk of awarding favorable rates to risky customers with lengthy claims histories.

Still, relying on customer-supplied documents such as renewal notices, cancellation statements, or formal no-claims discount letters to verify eligibility will always present some risks.

These documents are often reviewed under tight time constraints to onboard as many new customers as possible in highly competitive provider switching scenarios. The result prioritizes speed and customer experience, but can mistakenly underestimate the threat of document fraud.

Template farms (online document marketplaces) and automated document-generation tools have made it easier to produce convincing insurance paperwork at scale. These new-age fakes survive cursory checks and exploit gaps between insurers, brokers, and verification systems.

In this article, we break down how claims-free discount fraud works in practice: the documents insurers rely on, the tactics fraudsters use to abuse them, and the detection approaches that actually help identify risk in this workflow.

If you’d like to learn more about document fraud across the spectrum, check out our “how to spot fake documents” blog to learn more about common document forgeries.

What is a no claim discount?

A no claim discount (NCD), no-claims discount, or no claim bonus is a pricing mechanism most commonly used in auto insurance.

Policyholders who have gone a defined period of time without making an insurance claim can leverage that information to reduce their premium when switching insurers. Sometimes by as much as 60%.

In many markets, drivers accrue additional discount levels for each consecutive year they remain claim-free, making claims history one of the most influential signals in motor insurance underwriting.

Outside of the auto industry, other insurance lines also consider past events when pricing or underwriting policies, but they rarely formalise that history into a transferable, document-backed discount in the same way.

In property or commercial insurance, for example, claims history may influence eligibility or pricing, but verification is more likely to happen through internal databases, loss runs, or insurer-to-insurer communication rather than consumer-provided documents.That’s why NCD fraud is a problem almost exclusively of the auto industry.

For example:

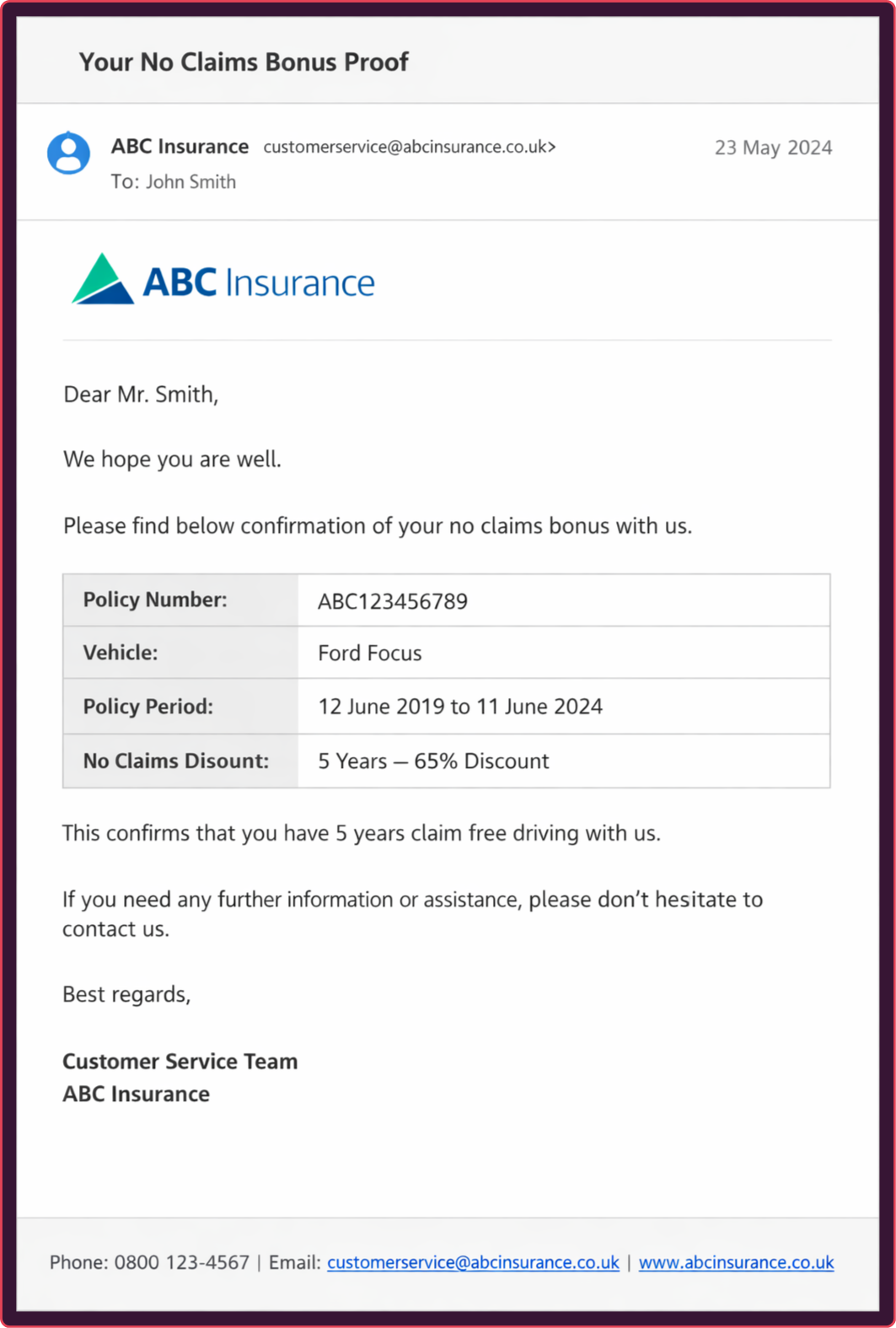

A driver switching insurers may declare several claim-free years during the underwriting process. The insurer will typically ask for documented proof of that claims-free history (such as a no-claim discount letter from the previous insurer). The driver requests that proof from their previous insurer and supplies it to the new one. Once accepted, the insurer can adjust the premium accordingly.

From an insurer’s perspective, the logic is straightforward: past claims are treated as a proxy for future risk. A driver who has not filed a claim over several years is assumed to be less likely to generate losses going forward, and the claims-free discount reflects that assumption directly in pricing.

Since claims-free discounts typically occur when drivers switch providers, insurers must verify customer’s claims-free history that originates outside their own systems. To do that, many insurers rely on the customer-supplied proof we mentioned in our example (such as renewal notices, policy cancellation statements, or formal claims-free letters issued by the previous insurer).

What is claims-free discount fraud?

Claims-free discount fraud is a type of fraud that occurs when a policyholder misrepresents their claims history in order to secure a lower insurance premium, typically by providing false or misleading proof of having gone claim-free.

Rather than fabricating an entirely new identity or staging a loss, this form of fraud targets the documents mentioned above, manipulating them during a provider switch to achieve a better rate.

The fraud is usually subtle (a few extra years added, a claim quietly omitted, or a document adjusted just enough to pass an initial review) rather than an obvious attempt to create a policy from scratch. They rely on the subjective nature of the documents involved to pass checks, hoping insurers won’t notice an off template from one of their rivals.

While the documents are issued by official insurers, they’re always provided by the customer themselves. Document verification occurs under tight time constraints, and can be split across multiple systems and teams.

For example, a claims-free document may be uploaded through a customer portal, checked for completeness by a policy administration team, and only later reviewed by underwriting or fraud teams using different systems and context.

That creates a narrow but repeatable window where false claims-free histories can slip through, especially when verification is delayed, incomplete, or deprioritized.

Unlike claims fraud, where losses are immediate and visible, the impact of claims-free discount fraud is often gradual. The harm shows up as mispriced risk rather than a single fraudulent payout, making it harder to detect and easier to rationalize as a “small” misrepresentation.

If the system is insecure from fraud, a company could potentially award thousands of lower-premiums before it ever shows up on the balance sheet.

How does it work?

Below you’ll find a step by step explanation of how an individual commits claims free discount fraud:

.png?width=1200&length=1200&name=NCD%20fraud%20slide%201%20(1).png)

.png?width=1200&length=1200&name=NCD%20fraud%20slide%202%20(1).png)

.png?width=1200&length=1200&name=NCD%20fraud%20slide%203%20(1).png)

1. Policy shopping. A driver compares insurers and declares their no-claims discount (NCD) years during the quote process. This declaration is typically self-reported and not verified until the policy is set.

2. No claim quote. The insurer calculates a quote assuming the declared NCD is accurate, with pricing explicitly subject to underwriting verification. Different insurers apply different caps and discount scales to the same number of claim-free years.

3. Proof request. To verify the declaration, the insurer asks for supporting documents such as an NCD letter, renewal notice, or cancellation statement from the previous insurer. These documents are often uploaded through customer or broker portals.

4. Document manipulation. Legitimate insurance documents are altered or recreated to overstate claim-free years or continuity without fabricating an entire policy history. Changes are typically incremental to remain plausible.

5. Document verification. Documents are reviewed under time and volume pressure, often across multiple systems or teams, limiting deep cross-document validation. Reviewers may prioritize completeness over deeper plausibility checks.

6. Discount confirmed. Underwriting confirms the claims-free discount based on the submitted proof, resulting in an inflated discount and mispriced risk. Once confirmed, this mispricing persists for the life of the policy unless later corrected.

But what can we learn from the documents in this workflow?

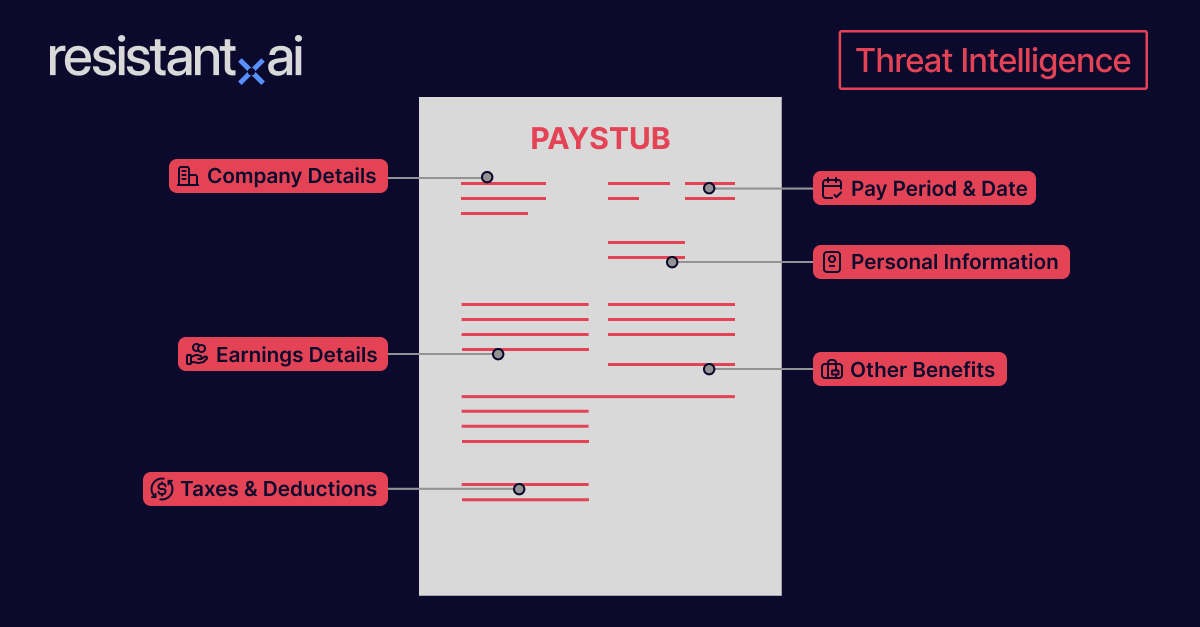

Documents used to prove claims-free history

In auto insurance, claims-free discounts are rarely verified through a single, centralized system. Instead, insurers rely on a small set of documents that summarize a driver’s prior coverage and claims activity. Each of these documents plays a different role in the claims-free verification workflow, carrying a distinct fraud risk profile based on who issues it, how it’s used, and how standardized it is across the industry.

No claim discount/Claims-free letter

Insurance renewal notice

A renewal notice is a document issued ahead of a policy’s renewal date summarizing the expiring policy and proposed renewal terms. It often includes coverage dates, vehicle details, and indicators of whether any claims were made during the policy period.

Insurer correspondence

This category includes formal emails or letters from an insurer explicitly confirming a policyholder’s claims-free history, often issued in response to a customer request.

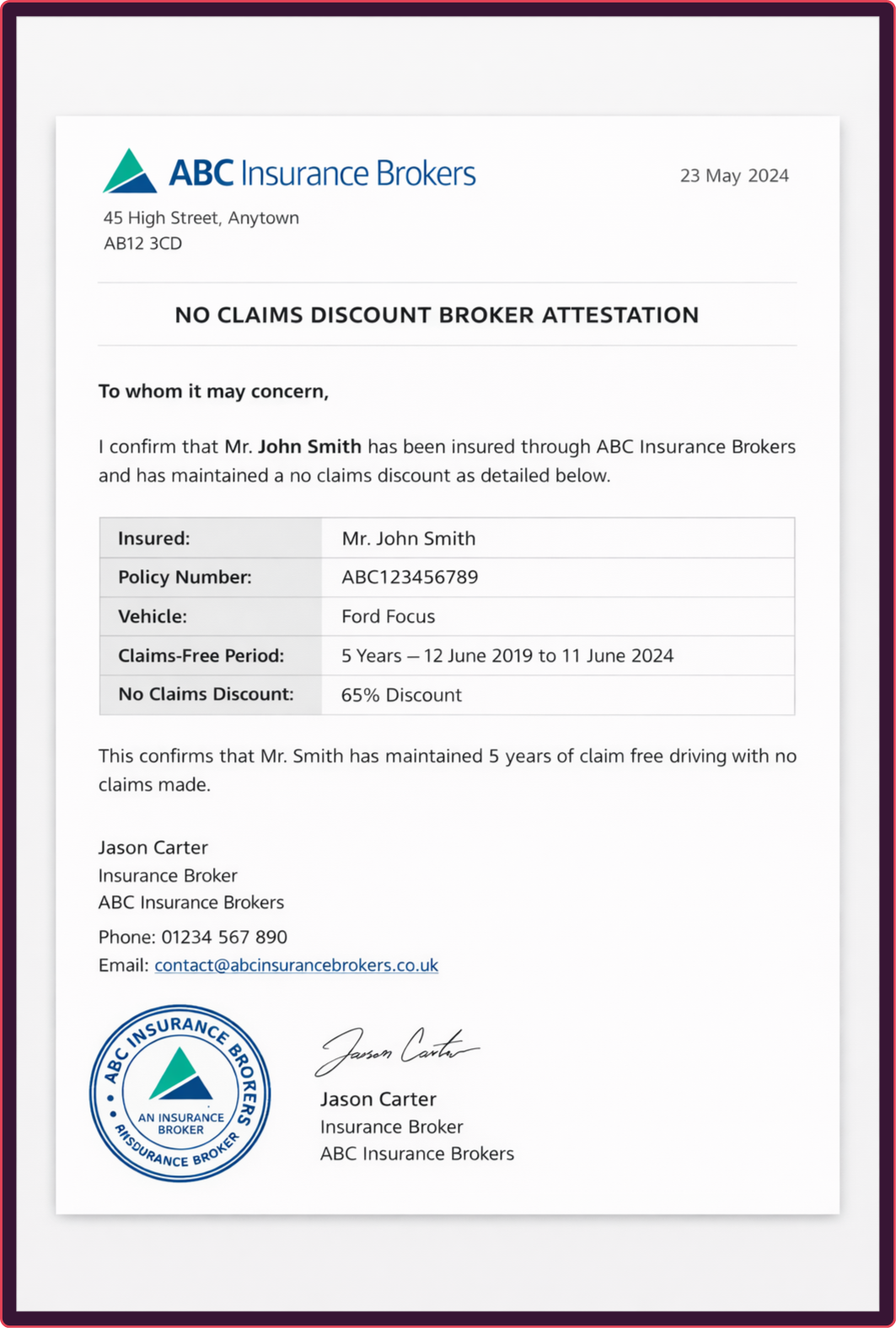

Broker attestations or letters

In some cases, brokers provide letters or attestations summarizing a client’s insurance history based on their records.

Highly variable, reflecting differences in broker systems, branding, and record-keeping practices. There is no consistent structure across firms.

Claims-free discount fraud tactics

Fraudster works by inflating, extending, or misrepresenting claims-free history at the moment it matters most: pricing and onboarding. Here are some of the tactics they employ to get away with the crime:

Exploiting post-bind verification windows

When a policyholder declares a number of claim-free years, the discounted premium may be granted immediately, with verification deferred until after the policy is live.

Fraudsters use this window to:

- Submit altered or fabricated documents after binding

- Rely on delayed or incomplete follow-up

- Bet that discrepancies won’t be chased unless a claim is later filed

Because the cost of immediate friction is high (cancellations, customer complaints, operational overhead) questionable proof may survive longer than it should.

Targeting unstandardized documents

Fraud concentrates on documents that are accepted as proof but lack a single, standard format. Claims-free letters and renewal notices are designed to summarize insurance history for transfer between insurers, but their structure, wording, and layout vary widely by issuer. That variability allows fraudsters to manipulate small details without having to recreate an entire policy lifecycle.

Leveraging ambiguity in “acceptable proof”

Insurers often accept multiple document types as proof of claims-free history, even though those documents were not created for the same purpose. Renewal notices, cancellation statements, and insurer correspondence may all be treated as interchangeable evidence, despite some not explicitly confirming the absence of claims in a customer's history.

This allows misrepresentation to hide behind interpretation (like assuming a document without claims history indicates a claims-free history) rather than outright forgery.

Exploiting cross-insurer and cross-market gaps

Claims-free discounts are portable precisely because insurers don’t share a single, universal view of claims history.

Fraudsters can present claims-free proof from systems that cannot be easily verified or contacted due to time differences, international communication, differences in terminology or documentation norms, and what constitutes equivalent proof.

In these cases, fraud relies on operational uncertainty and incomplete context.

Taking advantage of NCD fraud’s low-risk perception

Claims-free discount fraud is often perceived as a low-risk offense.

There is no immediate payout, no staged loss, and no obvious victim at the point of onboarding. That perception encourages repeatable abuse: small misstatements that individually seem minor but collectively distort underwriting outcomes.

No claim discount fraud detection

Best practices for no claim discount fraud involve a comprehensive approach. Single file submissions cannot reliably prove that a driver went claim free on their own. What really matters is whether the documents, timelines, issuers, and verification steps make sense together.

Effective detection combines document review with process awareness: understanding what should exist at each stage of the workflow, and where misrepresentation is most likely to enter.

Here are some detection tips for the fraud team at your auto insurance company:

Validate eligibility before reviewing proof

Before reviewing any document, it’s important to confirm whether the declared claims-free history is even eligible under the insurer’s own rules.

Check:

- Whether the number of declared claim-free years exceeds what the insurer recognizes.

- Whether coverage has been continuous.

- Whether claims-free history is transferable in that specific switching or cross-market scenario.

- Whether the no claim history is transferable from the previous insurer or jurisdiction to the desired one.

If the declared history doesn’t qualify, document review becomes irrelevant.

This step is often skipped because eligibility rules live outside the document review workflow — embedded in pricing logic, underwriting guidelines, or legacy systems that operational teams don’t directly see.

As a result, reviewers are asked to “check the proof” without first confirming whether the underlying declaration makes sense. Fraud survives in that gap: documents are assessed in isolation, while implausible claims-free histories pass through unchecked.

Assess documents based on their role (not just their appearance)

Each document type plays a different role in the workflow and should be evaluated accordingly.

For example:

- NCD / claims-free letters. Should explicitly confirm claim-free years and be traceable to a legitimate insurer

- Renewal notices. Should align with policy periods and claims status, even if they don’t state claims-free years directly

- Cancellation or closing statements. Should support, not replace, claims-free assertions

Documents that imply claims-free history rather than stating it should trigger more scrutiny, not less.

Look for consistency across documents, not perfection within one

Claims-free discount fraud rarely hinges on a single obvious error. More often, it relies on documents being reviewed independently.

Check for consistency in:

- Policy dates across renewal, cancellation, and claims-free proof.

- Vehicle details remain consistent across documents.

- Claim-free years are supported by coverage duration.

Inconsistencies that seem minor in isolation often become meaningful when documents are compared side-by-side.

Treat issuer authority as a first-class signal

Not all documents carry the same authority. Claims-free proof should originate from entities that are legitimately authorized to attest claims history. But authority alone is not sufficient. The issuer must also plausibly operate in the market and coverage context described by the document.

Detection efforts should distinguish between:

- Insurer-issued documents.

- Broker-issued attestations.

- Informal or ad hoc correspondence.

Beyond that initial classification, issuer credibility should be evaluated in context. This includes whether the insurer actually underwrites policies in the claimed geography, whether the line of business matches the coverage described, and whether the insurer’s market presence aligns with the policy details being presented.

A claims-free letter from a legitimate insurer can still be suspicious if it references jurisdictions, vehicles, or coverage types that fall outside that insurer’s typical footprint.

Recognize when speed creates blind spots

Claims-free proof is often reviewed under tight time constraints, particularly in high-volume switching workflows. Fraud detection improves when processes explicitly account for this pressure instead of assuming every case will receive the same level of scrutiny.

In practice, this means:

- Deferring final confirmation of the discount until proof has been verified. Even if provisional pricing is shown upfront.

- Explicitly flagging unresolved or incomplete proof. Rather than allowing it to age out of the workflow unnoticed.

- Revisiting claims-free assertions during later lifecycle events. Such as policy amendments, renewals with a new insurer, or claim intake.

Many cases of claims-free discount fraud are not actively missed. They are deferred, deprioritized, and never revisited once the initial onboarding window closes.

Manual vs. automated detection of no claim discount fraud

Claims-free discount fraud can be detected manually. Experienced underwriters and fraud teams know how to review claims-free proof, interpret renewal documents, and spot inconsistencies when something feels off.

In low volumes or high-touch cases, manual review can be effective, especially when reviewers have time, context, and access to follow-up channels.

However, it also has its shortcomings:

- Time pressure during verification. When proof must be reviewed quickly, manual checks default to surface-level validation, making it impractical to pause, cross-check, or escalate without disrupting the workflow.

- Isolated document review. While reviewers can compare documents manually, doing so across multiple files, timelines, and submissions is time-intensive and error-prone, making it difficult to apply consistently at scale.

- Limited scalability of manual review. As volume increases, manual processes can only reduce depth or coverage, forcing tradeoffs that systematically deprioritize edge cases where claims-free misrepresentation is most likely.

- Difficulty assessing issuer authority and context. Manually determining whether an issuer, format, and coverage context align requires historical and cross-market knowledge, lengthy look-ups on registries, and calls to actual insurers that individual reviewers cannot consistently retain or apply at scale.

The problem is that the claims-free discount workflow is not designed for careful, case-by-case scrutiny. It’s built for speed, scale, and customer convenience, with proof arriving asynchronously and often being reviewed across multiple systems and teams.

In that environment, consistent detection depends less on individual expertise and more on automation that can enforce rules, surface inconsistencies, and direct human attention where it’s actually needed.

Why automation and AI is better suited to claims-free discount fraud detection

Automation enforces consistency and context at scale. These checks run the same way regardless of volume, timing, or familiarity with a specific insurer’s historical formats.

This shift doesn’t remove human effort, it just focuses how it's applied. Instead of reviewing every claims-free proof that gets submitted, fraud teams can focus on cases where risk is concentrated such as:

- Unusually long claims-free declarations (i.e., ones that would incur the maximum discount).

- Documents that rely on inference rather than explicit confirmation (like a cancellation notice).

- Verification gaps that cannot be resolved through trusted databases, or issuer signals that fall outside expected patterns.

In this model, automation doesn’t decide fraud; it decides where human attention is most valuable.

But automation is only the beginning. Unlike traditional, rules-only automation, AI-driven document fraud detection allows insurers to move from reactive verification to proactive control, adapting to emerging threats and improving the current system as time unfolds.

Claims-free discount fraud thrives when verification is inconsistent, deferred, and fragmented, and outdated. AI removes those conditions without slowing the business down.

Conclusion

Claims-free discounts play a central role in auto insurance pricing, but insurers rely on unstandardized documents submitted by customers and issued by third parties, creating a narrow but repeatable opportunity for abuse.

Claims-free discount fraud hides in these small misrepresentations, subtle document manipulation, and verification gaps that are easy to rationalize individually and costly to ignore at scale.

Resistant Documents validates document structure and cross-document consistency at scale. It helps insurers surface subtle misrepresentation and risk signals, focusing human review where risk is actually concentrated without slowing onboarding.

Scroll down to book a demo.

Frequently asked questions (FAQ)

Hungry for more no claim discount fraud content? Here are the most frequently asked questions about no claim discount fraud from around the web.

How do insurers verify claims-free discounts?

Verification typically happens after a policy is bound and may rely on customer-submitted documents such as renewal notices, cancellation statements, or no-claim discount letters. In some cases, insurers can also verify claims history through internal or shared databases.

Can claims-free discount documents be faked?

Yes. Because these documents are often handled directly by customers and reviewed under time pressure, they can be forged or altered before submission.

What happens if claims-free discount fraud is detected?

If proof does not support the declared claims-free history, insurers may remove the discount, adjust the premium, or cancel the policy. In some cases, misrepresentation can also trigger broader fraud investigations.

Is this only an issue in auto insurance?

Claims-free discounts are most formalized in auto insurance. Other insurance lines may consider past claims, but they typically rely on different verification mechanisms and don’t use the same portable, document-backed discount model.

How does document verification help detect fraud in insurance workflows?

Document verification helps ensure that submitted documents are authentic, complete, and consistent with expected formats and issuers. AI document fraud detection is even more effective by spotting flaws in documents the human eye might miss.

How do I check my NCD?

The discount applied depends on the insurer you’re quoting with. To check your NCD, you typically declare your claim-free years during a quote, then confirm them using proof from your previous insurer (such as a renewal notice or NCD letter). The new insurer applies the discount according to its own rules, which may cap or scale claim-free years differently.

Can I lose my no claim bonus?

Yes. Making a claim can reduce or reset your no-claims bonus, depending on your insurer’s rules. Some insurers offer no-claims bonus protection, which allows a limited number of claims without losing the discount.

How many years of no claims do I need?

You usually start earning a no-claims discount after one claim-free year. The discount increases with each additional year, up to a maximum set by the insurer, commonly between five and nine years.