How to spot fake export declarations

As global trade volumes rise and customs processes continue to shift online, fake export declaration risks are a harsh reality of 2026.

China has already begun taking action. They introduced new export-compliance rules at the beginning of this year, banning the use of third-party documents to declare goods at customs. Surely these regulations will be accompanied by increased scrutiny of such documents, and your business should do the same.

These documents play a central role in verifying shipments for trade finance, sanctions screening, and cross-border logistics, which means even a single forged declaration can distort risk decisions, inflate payouts, or mask illicit exports.

At the same time, generative AI tools, freely available document fraud templates, and easy-to-use PDF editors have made it simpler than ever for fraudsters to fabricate export paperwork that appears authentic.

Banks, freight forwarders, manufacturers, and compliance teams now face a surge of export declaration fraud designed to slip through manual review.

To protect your business, it’s essential to understand what export declarations contain, how forgers manipulate them, and the signs that indicate something isn’t right.

Read on to learn what export declarations are, how they’re being forged, how to spot a fake, and how AI-powered tools can help verify them automatically.

Check out our “how to spot fake documents” blog to learn about more common document forgeries.

What is an export declaration?

An export declaration is a formal submission to a national customs authority that:

- Records the details of goods leaving a country.

- Confirms that the shipment complies with export laws, trade controls, and statistical reporting requirements.

These documents are generated through regulated customs platforms that enforce fixed schemas and mandatory data fields. Common systems include AES (Automated Export System) in the EU, AESDirect and ACE (Automated Commercial Environment) in the United States, CDS (Customs Declaration Service) in the United Kingdom, CERS in Canada, and ICS in Australia.

Now that we're in 2026, customs systems worldwide are continuing to evolve beyond fixed schemas toward greater digital integration, automated risk analysis, and real-time data exchange, which strengthens the reliability of regulated trade documentation while also raising the bar for compliance and fraud detection.

Modern initiatives (such as expanded AI-assisted screening and harmonized electronic interfaces across single-window platforms like ACE in the U.S. and the Automated Export System in the EU) are transforming customs controls from static entry points into dynamic compliance hubs that can detect inconsistencies earlier and more accurately.

Although the printable layout can differ between countries, real export declarations almost always include core elements that follow internationally recognized rules, making export declarations reliably verifiable across different jurisdictions.

These standardized components typically found in an export declaration include:

- Exporter details. Name, address, tax ID, and registration numbers such as EORI or EIN.

- Consignee information. Full details of the receiving party and destination country.

- Commodity description. HS codes, material descriptions, and export control indicators.

- Customs procedure information. Procedure codes, export type, and declarant references.

- Shipment value. Declared value, currency, and associated INCOTERMS.

- Transport information. Vessel name, flight number, container ID, or other mode details.

- Document reference numbers. MRN, ITN, or equivalent customs-generated identifiers.

- Customs office data. Office of exit, date of acceptance, and routing information.

- Additional information. Packaging counts, weights, volume, or safety declarations.

These documents are used to confirm/verify the legal export of goods, the identity of the trading parties, and the compliance status of the shipment.

.png?width=1033&height=1337&name=export%20declaration%20demo%20doc%20(1).png)

An example of an export declaration for illustrative purposes only

Why are export declarations important?

Export declarations play a crucial role in international trade because they verify: what is being shipped, who is shipping it, and whether the movement complies with customs, sanctions, and export control rules.

Many industries rely on them as foundational evidence of shipment legitimacy, value accuracy, and cross-border compliance.

Here’s how export declarations are used for document verification across specific industries:

- Trade finance. Banks use export declarations to validate shipment details before releasing funds tied to letters of credit or invoice financing.

- Logistics and freight forwarding. Forwarders confirm that the declaration aligns with the goods they are transporting and that all customs data is accurate.

- Manufacturing exporters. Companies rely on declarations to prove the lawful export of controlled goods or dual-use materials.

- Customs compliance and sanctions teams. These teams use export data to ensure that shipments do not violate embargoes, export controls, or destination-based restrictions.

Because export declarations come directly from customs systems and follow standardized data rules, they are widely trusted as proof that a shipment is legitimate and compliant.

If you’d like to know how fraudsters are creating all these fake export declarations, check out our “Types of fraud” blog to learn more about their tactics.

Threat intel: Template data about fake export declaration

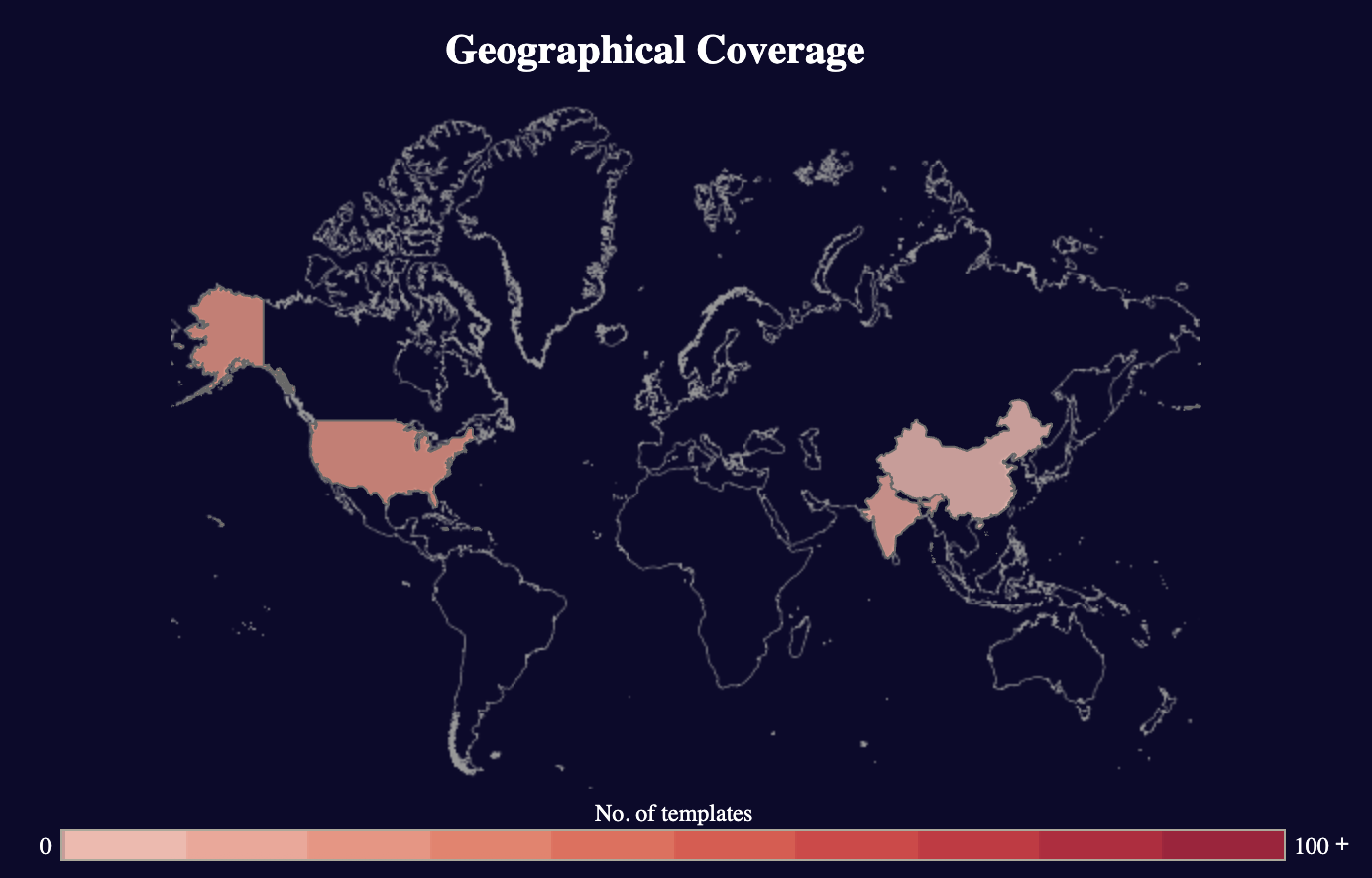

Our Threat Intelligence Unit collects data about template farms which make and distribute fake document templates for fraudulent purposes.

Below, you'll find an infographic containing data about all the fake export declaration templates we've found: their availability, their distributors, the institutions or "issuers" whose documents have been exposed, and how much it costs to buy one.

Threat intel stats: Export declarations

Find more information about the threat these farms pose in our threat intel blog and webinar content.

5 Signs of a forged or fake export declaration

Spotting a fake export declaration manually requires deep familiarity with how real customs documents are structured.

Fraudsters often rely on template packs, recycled paperwork, or AI-generated layouts that look indistinguishable to the naked eye.

At scale, these fakes can distort trade finance decisions, mask illicit shipments, or create false evidence for cross-border transactions. The only way to deal with them en masse is an AI document fraud detection software.

Still, if you’re trying to verify export declarations manually, here’s what to watch for:

1. Inconsistent formatting

Real export declarations follow regulated schema logic generated by customs systems. If your document doesn’t match these templates, something is usually wrong.

- Incorrect MRN or ITN formatting. MRNs with the wrong digit count or structure, or ITNs missing the AES “X2026…” prefix sequence.

- Customs office codes in the wrong position. Office codes placed in header areas where customs systems never display them.

- Misaligned column structures. Commodity, value, and procedure columns spaced inconsistently or stacked in unusual orders.

- Barcode or QR placement errors. Barcodes that appear too low, too small, or without matching reference numbers nearby.

- Layout compression issues. Pixelation or squeezed text blocks that suggest screenshots or image-based reconstructions instead of system-generated PDFs.

2. Incorrect or misleading information

Many fakes rely on mixing real trade data with fabricated or incompatible details.

- Invalid HS codes. Codes that don’t follow the harmonized six-digit base or don’t match the commodity description.

- Non-existent exporters or consignees. Businesses missing from registries like EORI, IRS databases, or national company registers.

- Impossible trade routes. Sea exports routed through land-locked countries or airline codes that don’t operate in listed regions.

- Destination country inaccuracies. ISO country codes mixed with spelled-out names or mismatched country/city combinations.

- Unrealistic weights or package counts. Examples include multi-ton shipments listed with only “1 package” or heavy goods with implausibly low weights.

3. Bad math and uncharacteristic figures

Fraudsters often miscalculate or misunderstand the financial and logistical fields required.

- Value-to-weight mismatches. Low-value goods listed with unusually high weights or high-value goods listed as nearly weightless.

- INCOTERMS inconsistencies. Example: a cost, insurance, freight (CIF) shipment with no insurance charges or a free on board (FOB) shipment missing a port of loading.

- Duplicate or conflicting totals. Different sections listing different declared values or package counts.

- Unrealistic currency conversions. Values converted incorrectly against the export date’s exchange rate.

- Missing required statistical values. EU declarations lacking “statistical value” fields where they are mandatory.

4. Export declaration inconsistencies

Internal contradictions often reveal that different parts of the document were edited or stitched together.

- Container numbers that violate ISO 6346 format. Wrong check digit or incorrect four-letter owner prefix.

- Transport modes out of sync. A sea vessel name listed alongside a commercial flight number.

- Procedure codes that don’t belong together. Combinations of customs procedure codes that are never used in the same transaction.

- Office of exit that doesn’t match route. A shipment “exiting” through a port hundreds of kilometers away from the actual departure.

- Timestamp conflicts. Acceptance date occurring after the listed departure or export date.

5. Metadata discrepancies

Sometimes the most tell-tale signs of fraud are hidden within the document’s metadata.

- Created with design software. Metadata showing Photoshop, Canva, or similar tools instead of a customs system or broker platform.

- Metadata language mismatches. A US export filing with metadata set to “fr-FR” or an EU declaration tagged as “en-US.”

- Missing XML or structured objects. Many customs PDFs include embedded XML layers; fakes often flatten everything into an image.

- Reused PDF layers. Copy-pasted signatures, container numbers, or HS code blocks left as separate image layers under inspection.

Disclaimer: Fraudsters now rely heavily on AI tools and high-quality template replicas to generate export declarations that look authentic even up close. Because manual inspection cannot reliably detect structural tampering, subtle inconsistencies, or synthetic document patterns, organizations increasingly require scalable AI document verification to stay ahead of modern export declaration fraud.

How to verify an export declaration

Export declarations are commonly reviewed by trade finance teams, freight forwarders, customs brokers, sanctions and compliance analysts, and internal logistics departments manually or using automated systems, but the reliability of each approach varies significantly.

Manual verification is becoming increasingly difficult to rely on because modern fraud tools allow criminals to modify data fields, recycle old declarations, and generate convincing AI-produced replicas that mimic customs layouts. Human reviewers often struggle to identify subtle inconsistencies in HS codes, routing data, or MRN/ITN formats, especially when volumes are high or when documents come from multiple jurisdictions.

AI-powered automation offers a more scalable and consistent alternative. Advanced systems can detect structural anomalies, verify code logic, analyze metadata patterns, and flag subtle irregularities that are almost impossible to identify visually. Automation also accelerates verification workflows by analyzing documents in seconds rather than minutes.

Still, many organizations continue using manual review because of legacy processes, regulatory expectations, or cross-department workflows that were designed before AI-based tools were widely available. If manual checks are part of your process, here are specific actions that help improve accuracy.

Manual verification of export declarations

If you’re still manually reviewing export declarations, start with the 5 signs we mentioned above. Then you can try some of the sources below:

- Verify MRN or ITN numbers. Use official customs portals (such as the EU’s MRN tracking tools or the U.S. Census AES portal) to confirm that reference numbers exist and match the exporter and date.

- Check exporter and consignee records. Validate EORI, EIN, or national registration numbers against government directories to ensure both parties exist and match what appears on the declaration.

- Confirm HS codes and classifications. Cross-check HS codes against the official tariff schedule of the exporting country to see if the code matches the described goods.

- Validate transport information. Compare vessel names, flight numbers, or container IDs against carrier schedules or tracking tools to ensure the shipment route is plausible.

Keep in mind: Manual review cannot reliably detect structural manipulation, synthetic document creation, or coordinated fraud patterns across multiple submissions. As volumes grow and fraud techniques evolve, manual verification alone cannot scale to meet real-world risk levels.

Using AI and machine learning to spot fake export declarations

AI plays a critical role in identifying fake export declarations because it can analyze structural, behavioral, and metadata signals that human reviewers do not see. Rather than reading or storing the document’s content, advanced AI models examine how the file was built, which systems created it, and whether its internal patterns match what genuine customs platforms typically produce.

Here are the key benefits of AI in spotting export declaration fraud:

- Deep structural analysis. AI evaluates layout logic, embedded objects, internal schemas, and file construction to catch inconsistencies invisible to manual inspection.

- Template-agnostic validation. Because structural analysis doesn’t depend on content or regional templates, AI can detect fakes in PDFs, scans, images, and customs formats the model has never seen before.

- Cross-document pattern detection. AI identifies repeated templates, reused MRNs, or shared structural fingerprints across multiple submissions to uncover serial or organized export fraud.

Automation vs. AI

Basic automation can perform useful rule-based checks, such as confirming whether an MRN field is filled, a barcode is present, or a required section exists. However, automation cannot understand whether an MRN follows the correct format for the jurisdiction, whether an HS code matches the described goods, or whether the document structure aligns with real customs output. Its accuracy is limited by predefined rules and templates.

AI, on the other hand, learns from evolving fraud patterns and adapts to new document types, editing techniques, and generative AI outputs. It examines the full structure and behavior of the file, not just the visible fields, and can detect subtle manipulation patterns (including GenAI-generated artifacts) that automation and human reviewers routinely miss. Resistant AI also uses specialized layout models, generative AI detectors, and cross-document intelligence to uncover complex, multi-submission export fraud that traditional approaches cannot see.

Conclusion

Fake export declarations hide illicit shipments, distort trade finance decisions, and undermine compliance across international supply chains.

Resistant Documents offers a faster and more reliable alternative, analyzing the deep structure of export declarations forensically to detect hidden anomalies in layout, metadata, context, image consistency, and hundreds of other indicators across multiple submissions.

Reduce manual effort and stay ahead of increasingly well-made export fraud. Scroll down to book a demo.

Frequently asked questions (FAQ)

Hungry for more fake export declaration content? Here are some of the most frequently asked fake export declaration questions from around the web.

How do I check if an export declaration is genuine?

You can verify a declaration by confirming the MRN or ITN through the appropriate customs portal, automated tools, AI, or the 5 red flags we mentioned above.

Can export declarations be verified online?

Yes, but only partially. Some jurisdictions allow MRN validation through customs tracking portals, while others require access through registered brokers or exporters. Online verification is usually limited to reference number checks, not full document authenticity.

Are fake export declarations common in trade finance?

Yes. Fraudsters frequently use fabricated export declarations to support inflated invoices, create phantom shipments, or justify financing for goods that never existed. This makes them a known risk in trade finance and supply chain verification.

How to spot fake export declarations with AI?

AI detects fake export declarations by analyzing structural patterns, metadata traces, and submission logic rather than reading sensitive content. By examining how the file was created, which systems generated it, and whether its internal components match real customs output, AI can flag risks far more accurately than manual review.

What’s the difference between an export declaration, a bill of lading, and a commercial invoice?

Export declarations, bills of lading, and commercial invoices each document a separate stage of cross-border trade: the export declaration reports shipment data to customs, the bill of lading records the carrier’s receipt and transport of the goods, and the commercial invoice details the sale and pricing of the shipment.

Export declaration. Records shipment data, HS codes, exporter details, customs procedure codes, and MRN/ITN references.

- Issuer: National customs systems or authorized brokers.

- Characteristics:

- Used for legal compliance and export control verification.

- HS code and customs procedure blocks arranged in standardized tables.

- Office codes, acceptance timestamps, routing data appear in fixed locations on the form.

Bill of lading. Serves as a contract of carriage, a receipt for goods, and sometimes a document of title.

- Issuer: Carrier or freight forwarder.

- Characteristics:

- Vessel information.

- Container IDs.

- Routing details.

Commercial invoice. Lists the goods, quantities, prices, INCOTERMS, and payment details.

- Issuer: The exporter or seller.

- Characteristics:

- Seller-issued formatting.

- Itemized pricing table.

- Payment and contract fields.

Is there software to detect fake export declarations?

Yes. Resistant AI provides document-agnostic, structural analysis that identifies manipulated export declarations, detects reused templates, and flags anomalies invisible to human reviewers. It does this without relying on databases or reading sensitive content, preserving privacy while improving accuracy.

Who needs to check for fake export declarations?

Several roles are directly responsible for verifying export declarations and ensuring that shipments, values, and classifications are legitimate:

- Trade finance analysts. Review export declarations to validate shipment details before approving letters of credit, invoice financing, or factoring requests.

- Customs brokers. Check declarations for accuracy in HS codes, procedure codes, and routing information before filing them with customs authorities.

- Freight forwarder documentation specialists. Confirm that the declaration matches the physical shipment, carrier bookings, and export routing.

- Export compliance officers. Review declarations for export-control issues, sanctions risk, and accuracy of exporter and consignee data.

- Manufacturing export coordinators. Verify declarations prepared by third-party brokers or logistics partners to ensure they reflect correct product data and values.

- Fraud and risk investigators. Examine declarations for signs of manipulation, identity misuse, or mismatched shipment information linked to financial or supply-chain fraud.

Is making or using a fake export declaration illegal?

Yes. Creating, altering, or submitting a fake export declaration is illegal in nearly every jurisdiction. In the United States, fraudulent filings can trigger penalties under federal customs laws and export control regulations. In the EU and UK, submitting falsified declarations can lead to fines, cargo seizures, criminal charges, or export-license suspension. Penalties escalate significantly when the fraud involves sanctions evasion, dual-use goods, or financial gain.