Using a fake P60 form to inflate income and spoof mortgage applications is not a rare occurrence. Even members of the popular tv show UK apprentice have attempted this kind of fraud.

Fraudsters know these documents carry weight. They’re official, employer-issued year-end summaries, making them prime targets for manipulation. If a convincing fake slips past manual checks, it can lead to wrongful approvals and costly payouts.

In 2026, Generative AI and document fraud templates are only going to make the fake P60 problem worse. With polished documents now easily available online and models continuing to improve, organizations that rely on these documents as proof of income and tax compliance are more exposed than ever.

Read on to learn what a P60 is, why it matters, how fake P60 scams work, and how AI-powered verification can help you spot them automatically.

Check out our "How to spot fake documents" blog to learn about more common document forgeries.

What is a P60 form?

A P60 is an official document issued by UK employers at the end of each tax year. It provides a record of an employee’s pay and the tax deducted under the Pay As Your Earn (PAYE) system.

The PAYE system is a His Majesty’s Revenue and Customs (HMRC) mechanism for collecting income tax and National Insurance directly from wages, so the P60 serves as the year-end confirmation that these deductions have been correctly applied. It must be given to every employee working on 5 April (the last day of the tax year).

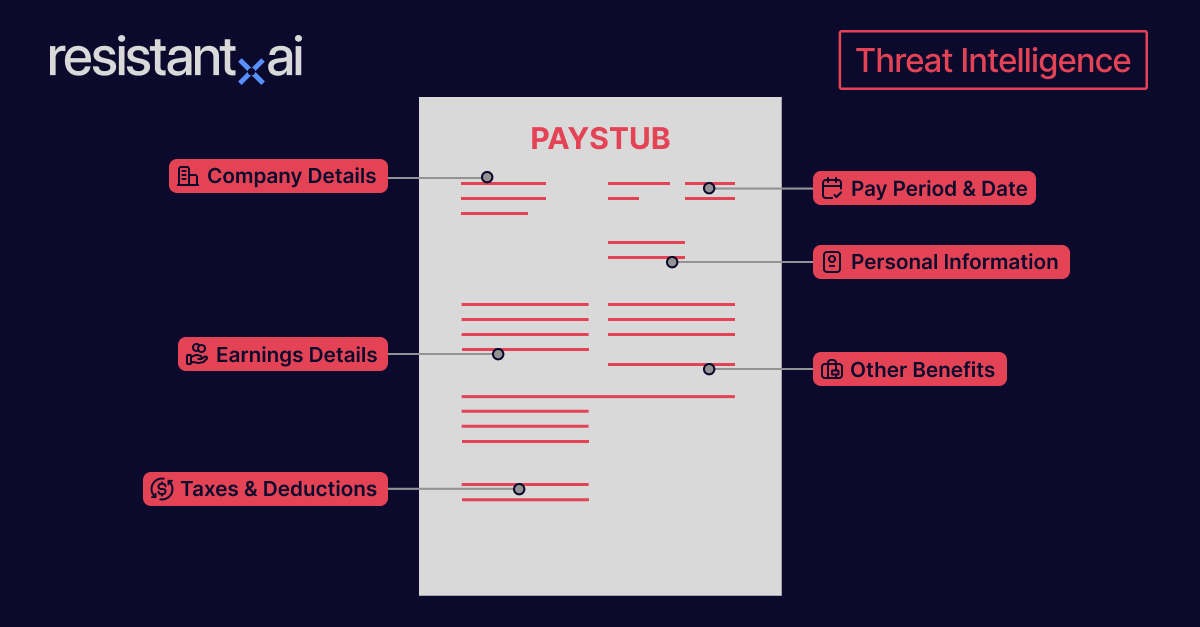

Key elements of a P60 form include:

- National insurance number & works/payroll. Identifies the relevant insurance and payroll numbers.

- Employee details. Includes full name, National Insurance number, and payroll ID.

- Tax year. The relevant April–April period.

- Gross pay. Total earnings before tax for the year.

- Tax deducted. PAYE income tax withheld.

- National Insurance contributions. Employee’s NI deductions for the year.

- Statutory payments. Such as maternity pay, sick pay, or other benefits.

- Student loan deductions. If applicable.

- Final figures. Cumulative totals for pay and deductions up to 5 April.

- Additional information. Employer contact details, HMRC helpline references, or notes on special deductions.

Together, these details confirm proof of employment, income earned, and taxes paid in a specific year.

An example of a P60 form for illustrative purposes only

Why are P60 forms important?

Employers use P60 forms to summarize annual pay, income tax, and National Insurance contributions under PAYE for each employee at year-end.

Employees use them to confirm their total earnings, file or reconcile their taxes with HMRC, and provide trusted proof of income in processes like mortgage applications or benefit claims.

Here’s how they’re used for document verification across industries:

- Banking and lending. Lenders use P60s to verify borrower income when assessing mortgage or loan applications.

- Landlords and property managers. For rental applications, Landlords may ask for P60s to verify a potential tenant’s income and ensure they can afford rent. For lease renewals landlords might check P60s to confirm that the tenant’s financial situation has not changed.

- Immigration services. Home Office and visa authorities often request P60s as part of residency or work permit checks.

- Government benefits. Used to confirm eligibility for tax credits, Universal Credit, or other state support.

- Corporate HR and payroll. Employers reference P60s during audits, compliance reviews, and employee disputes.

- Tax authorities. HMRC uses P60s as part of PAYE reconciliation and to cross-check records of employee earnings and deductions.

Because P60s come directly from employers and are tied to HMRC records, they’re widely trusted as reliable proof of both income and tax compliance.

These documents are one of the primary avenues to commit home and mortgage fraud in the UK. By inflating their income (or inventing it altogether), they can get better interest rates or have loans approved that never should have been.

As this type of fraud continues to grow in 2026, fake spotting fake P60 forms is an essential capability for any home loan or mortgage business.

If you’d like to know how fraudsters are creating all these fake P60 forms, check out our “Types of fraud” blog to learn more about their tactics.

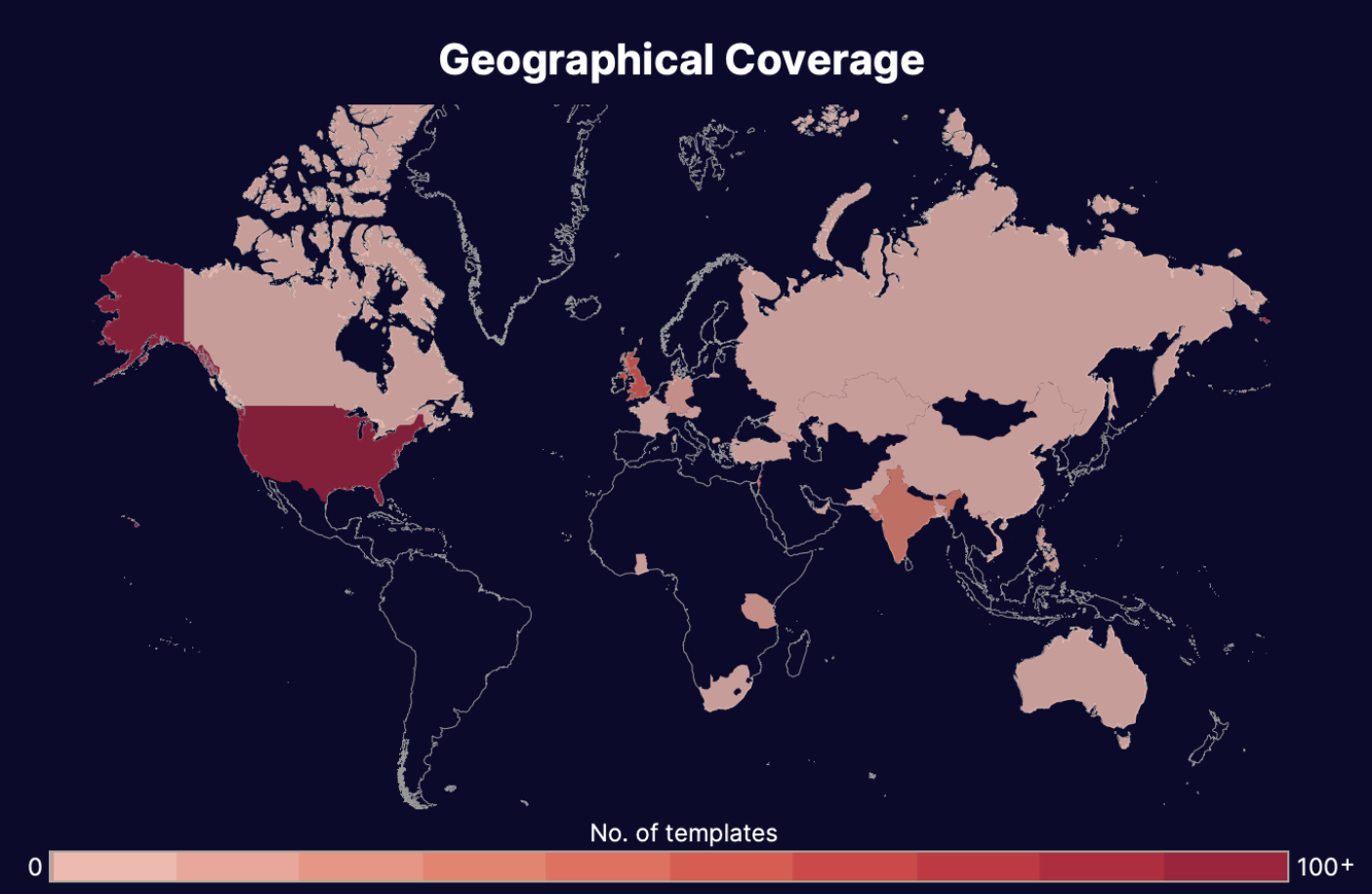

Our Threat Intelligence Unit collects data about template farms which make and distribute fake document templates for fraudulent purposes.

Below, you'll find an infographic containing data about fake P60 form templates, their availability, their distributors, the institutions or "issuers" whose documents have been exposed, and how much it costs to buy one.

P60 forms are contained in our "tax forms" dataset: documents that contain information for government agencies for the purpose of taxes: W-2 forms, 1099-NEC, P45, etc...

5 Signs of a forged or fake P60 form

Overlooking a fake P60 isn’t a small mistake. It can distort affordability checks, let applicants access benefits they’re not entitled to, or create a false history of employment.

Fraudsters know that many reviewers skim these documents, so they exploit small but telling mistakes. The best way to spot fakes is with document fraud detection software.

But many institutions still try to spot fake P60s manually. Here are the key red flags to look out for:

1. Inconsistent formatting

Real P60s follow HMRC’s standard template, with rigid tables and box structures. Deviations stand out quickly.

- Wrong section titles. A genuine P60 uses fixed wording like “Pay and Income Tax details” or “Final tax code”; counterfeits often use generic terms like “Earnings Summary.”

- Misaligned columns. Figures in “Tax deducted” or “Total pay for year” not sitting correctly under their headers.

- Incorrect tax year format. Genuine P60s state the full phrase “Year ending 5 April 2024.” A fake may just show “2024” or “Tax year 2023/24,” which doesn’t follow HMRC’s required style.

- Missing HMRC references. The official P60 includes statutory notes and HMRC helpline information; fakes often leave this off.

- Outdated layouts. For example, using the 2017 version of the P60 (with different box numbering) for a 2024/25 tax year.

2. Incorrect or misleading information

Errors in core identifiers and HMRC references are a common giveaway.

- Invalid National Insurance number. A format like “ZZ123456X” which HMRC does not issue.

- Wrong PAYE reference. Real references follow the “123/AB456” pattern; anything else is suspect.

- Employer inconsistencies. A listed employer name that doesn’t match the PAYE reference prefix.

- Non-UK addresses. Employee or employer address showing a non-UK postcode format, which is never valid on a P60.

3. Bad math and uncharacteristic figures

P60s summarise an entire year of pay, tax, and deductions. Unrealistic figures are often the clearest fraud signals.

- Incorrect tax banding. For 2024/25, income above £12,570 should be taxed; a gross salary of £25,000 showing £0 tax is not credible.

- Rounded totals. Earnings of exactly £30,000 and deductions of exactly £5,000, which rarely align with real PAYE calculations.

- Wrong National Insurance deductions. Class 1 NICs for employees kick in at £12,570. A fake might show NI on income below that.

- Student loan repayment errors. Plan 2 repayments start once income exceeds £27,295; a fake may show deductions on lower salaries or none at all when they should exist.

- Unrealistic refunds. A “Tax refund £2,000” line item (genuine P60s don’t include refund values; refunds come directly from HMRC).

4. P60-specific inconsistencies

Some giveaways are unique to the P60 format itself.

- Extra fields. Genuine P60s don’t include employer signatures or HR approval boxes — if they’re present, the template is fake.

- Terminology errors. Using “Taxpayer ID” instead of “National Insurance number.”

- Duplicate entries. “Total for year” appears twice in separate boxes with different values.

- Wrong employer/employee placement. The employer’s PAYE reference entered in the employee NI box.

- Omitted statutory notes. HMRC-issued P60s always include a footer reminding employees to keep the form safe; missing this line is a giveaway.

5. Metadata discrepancies

The digital trail of a P60 can reveal more than the visible content.

- Creation software. A real P60 generated by payroll tools (e.g., Sage, Xero, QuickBooks) should not show “Microsoft Word” or “Adobe Photoshop” in the metadata.

- Timing errors. File creation date later than the statutory 31 May deadline for issuing P60s.

- Author mismatch. Metadata crediting an individual user instead of the payroll system.

- Locale settings. “English (US)” as the default language instead of “English (UK).”

- File naming anomalies. Genuine payroll exports use structured filenames (e.g., “P60_2024_Employee123.pdf”); suspicious ones may use vague names like “taxdoc_final.pdf.”

Disclaimer: While manual reviewers can catch obvious mistakes, sophisticated fakes often blend in with authentic payroll outputs. At volume, these errors can evade controls, making AI-powered document fraud detection essential for organizations relying on P60s.

How to verify a P60 form

Banks, mortgage lenders, immigration authorities, government benefits teams, and corporate HR departments check p60s in two ways: manual and automated.

Manual checks can struggle to catch the subtle errors hidden in fabricated P60s, especially when reviewing them at scale.

That’s why organizations are shifting toward AI-powered verification, which can analyze a document for fraud in seconds.

Still, manual review persists.

Manual verification of P60 forms

If you’re checking P60 forms manually, begin by using the red flags we mentioned above. Once you’ve exhausted those, you can turn to the following resources:

- Cross-reference salary bands. Compare reported gross pay with the official tax year bands published on gov.uk website to confirm deductions are realistic.

- Contact employer payroll departments. Call the employer using official contact details (not those on the document) to confirm whether the P60 was issued.

- Compare against other years. Where available, review past P60s for consistency in employer details, NI number, and progression of salary and deductions.

Keep in mind: Manual checks can help catch obvious fakes, but they don’t scale. Fraudsters operating at volume produce near-perfect templates that look identical to genuine payroll outputs. Without automation, even skilled reviewers risk approving fraudulent submissions hidden among a pile of legitimate entries.

Using AI and machine learning to spot fake P60s

AI doesn’t rely on static templates or database lookups, it can adapt to new layouts, content updates, and even generative AI forgeries in real time.

Benefits of AI-powered P60 verification include:

- Deep structural checks. Examines how the P60 was built to assess fraud directly, rather than relying on external databases. This approach verifies authenticity without exposing or processing personal information.

- Linked-document intelligence. Connects anomalies across multiple P60 submissions to reveal reused templates, coordinated fraud rings, or serial scams that would appear legitimate in isolation.

- Adaptive decisioning. Configures verification thresholds to match your risk appetite, reducing false positives while tightening security where it matters most.

- Audit-ready evidence. Provides clear, explainable signals and logs so compliance teams can defend verification decisions with confidence.

Automation vs. AI

Basic automation can perform useful checks on P60s — confirming that required fields exist, numbers add up, or a tax year is correctly formatted. But automation breaks when fraudsters generate polished forgeries that follow the rules on the surface while altering core values underneath or use new tactics your rules weren't prepared for.

AI goes further. By learning how genuine P60s are structured and adapting to new fraud tactics, it can flag anomalies that humans and scripts would miss. From linking reused templates across multiple applications to spotting subtle manipulations, AI provides a defense that keeps pace with evolving fraud tactics.

Conclusion

Fake P60s are a direct threat to financial integrity, immigration processes, and public benefits. Fraudsters exploit the document’s trusted status to slip inflated incomes, fabricated employment, or false tax histories into high-stakes workflows.

Manual checks might catch a typo or missing field, but they won’t scale against professional forgeries designed to mimic HMRC-compliant payroll outputs.

Resistant documents, our document fraud detection software, brings a structural, document-agnostic approach that spots patterns, links fraud across submissions, and adapts to your decision flows (all the AI benefits we described above).

Want to see it in practice?

Scroll down to book a demo and explore how your organization can detect fake P60s before they cause financial or reputational harm.

Frequently asked questions (FAQ)

Hungry for more fake P60 content? Here are some of the most frequently asked fake P60 questions from around the web.

What if my P60 is wrong or contains errors?

If you spot mistakes (wrong NI number, gross pay mismatch with your payslips, incorrect employer details), you should first contact your employer and ask them to issue a corrected form or provide a written erratum.

If your employer refuses or you can’t resolve it, you can raise the issue with HMRC. Some lenders or authorities may accept a corrected statement plus correspondence as interim proof.

What’s the difference between a genuine P60 and a fake P60?

At a glance, both seem similar — same layout, same fields. But genuine P60s:

- Use strict HMRC-approved formatting and tax year box structure

- Match employer PAYE references to HMRC records

- Pass document fraud detection checks.

Can automation alone detect fake P60s, or is AI necessary?

Automation (rules, templates) checks surface-level correctness — e.g. “does box 1 exist?” or “is the tax year in range?.” They can also account for pre-existing/well known tactics, but fraudsters can create forgeries that pass those rules.

AI goes deeper: it learns how genuine P60s are built, catches mismatches across multiple documents, spots anomalies, and adapts to new fraud patterns as they emerge.

How long should someone keep their P60s?

You should keep records about your pay, tax, and related documents for at least 22 months after the end of the tax year (if you’re not filing Self- Assessment)

If you are filing, or if your tax return is late, HMRC requires longer retention periods.

Additionally, many advisors suggest holding onto them for 4 to 6 years as proof for audits, loan applications, or tax disputes.

Can I get a copy if I lose my P60?

Yes. You can ask your employer to re-issue it (or issue a statement of earnings). You can also view and print the equivalent figures via your HMRC personal tax account.

How to spot fake P60s with AI?

AI analyses how the P60 was built. Layout logic, payroll-system fingerprints, and hundreds of other indicators can expose forgeries in seconds.

What’s the difference between a P60, a P45, and a tax return?

P60s and P45s are both tax-related documents but serve different purposes and jurisdictions. They’re both issued by one’s employer but the P60 is a yearly income tax deduction while P45 is only issued once an employee is terminated.

- P60. Summarizes total pay and deductions for the April–April UK tax year.

- Issuer. Employer at year-end.

-

- Characteristics:

- Used as proof of income and compliance.

- Required for completing a Self Assessment tax return if you file one.

- Often requested by banks, lenders, or immigration authorities as supporting evidence.

- P45. Details pay and tax deducted up to leaving/termination date.

- Issuer. Employer at the point of employment termination.

-

- Characteristics:

- Required by new employers and benefits offices.

- Ensures the correct tax code is applied when starting a new job.

- Prevents overpayment or duplication of tax when moving between employers.

Is there software to detect fake P60s?

Yes. Resistant AI analyses document construction rather than contents and scales verification across thousands of P60s in real time.

Who needs to check for fake P60s?

Several industries rely on them as proof of income and compliance:

- Banks and mortgage lenders. Use as income verification for loans.

- Immigration authorities. Uphold residency and visa eligibility.

- Government benefits teams. Eligibility checks.

- Corporate HR and payroll. Audit and dispute resolution.

Is making a fake P60 illegal?

Yes. Creating or using a forged P60 is fraud under the UK Fraud Act 2006. Penalties can include fines, liability for false claims, and prison sentences of up to 10 years.