How to spot fake articles of association

A company’s articles of association (U.K.), or articles of incorporation (U.S.), can become a battleground for corporate control. This pivotal document dictates who can sign multi-million dollar contracts, who can dilute your shareholding, and who is authorized to act on the company's behalf.

For this reason, fake articles of association are a prime target for forgers in 2026. As foundational documents for any business, its no surprise when even small updates to these documents reach major news headlines.

A skillfully forged version can be used to appoint illegitimate directors or grant fraudulent powers, creating a seemingly legitimate vehicle for committing massive fraud.

Before you can "know your business (KYB)," you must first know if their constitutional documents are real.

Read on to learn what articles of association are, how they’re being forged, how to identify fake Articles of Association, and how AI-powered verification solutions can help spot them automatically.

Check out our “How to spot fake documents” blog to learn about more common document forgeries.

What are articles of association?

Articles of association are legal documents filed by corporations to formally establish the company's purpose, rules of governance, shareholder responsibilities, and internal management structure. Typically submitted during the incorporation process, these documents serve as a constitution for the company, outlining essential operational protocols.

Core elements of articles of association include:

- Company name and registered address. Establishes the legal identity and primary location.

- Objectives and business scope. Defines the activities the company is authorized to undertake.

- Share capital structure. Details the authorized share capital, classes of shares, and shareholder rights.

- Directors and officers. Specifies roles, responsibilities, appointment methods, and governance procedures.

- Meeting rules. Outlines protocols for shareholder and board meetings, voting rights, and decision-making processes.

This document serves as the primary source of truth for a company’s internal power dynamics. It provides verifiable proof of who has the legal authority to act on the company's behalf, the specific rights and limitations tied to share ownership, and the official procedures that govern all major decisions

Articles of association are long (20+ page) documents. Here is an example of their table of contents so you can get an idea of what they contain (for illustrative purposes only).

Articles of association vs. other documents

While the term “articles of association” is widely used in the UK, Commonwealth countries, and parts of Europe, similar documents exist globally under different names.

In the United States, for example, companies adopt “bylaws” to govern internal management, while “articles of incorporation” serve as the legal formation document. Despite these naming differences, nearly every jurisdiction requires some form of written constitution to regulate a company’s operations.

Across Australia, India, Singapore, and many other countries, “articles of association” (often paired with a “memorandum of association”) serve a similar purpose, whereas in continental Europe, such documents might be referred to as “statutes” or a “company constitution.”

Although the legal terminology varies, the substance—setting out the rules, procedures, and structures of the organization—remains largely consistent worldwide.

For clarity: Throughout this blog, we will use the term “articles of association” to refer to all such foundational documents, regardless of their specific title in any given country. The principles for identifying potential fraud or governance issues within these documents are broadly the same, no matter where a company is based.

Why are articles of association important?

Articles of Association validate the structural legitimacy and compliance of corporations, essential for document verification processes across industries:

- Banking and finance. Verifying corporate credentials during account opening, loan processing, and credit evaluations.

- Regulatory compliance. Confirming the authenticity of company structures for regulatory filings and audit purposes.

- Investment and acquisition. Providing due diligence transparency in mergers, acquisitions, and investor assessments.

- Legal proceedings. Used in legal disputes, contract verifications, or litigation involving corporate governance.

Institutions prize articles of association because, as the primary legal instrument filed with a public registry, it is the single, foundational charter that officially dictates a company's internal power structure and legal authority.

If you’d like to know how fraudsters are creating all these fake Articles of Association, check out our “Types of fraud” blog to learn more about their tactics.

Understanding fake articles of association

When it comes to spotting fake articles of association, it’s important to understand the distinction between first-hand fraud and fraud involving third-party or altered documents.

First-hand fraud cannot be spotted with typical red flags

The biggest challenge with first-hand fraud is that these documents are typically created by the company itself, so they often appear perfectly legitimate on the surface. Even "official templates" are often distributed as editable HTML pages or even Microsoft word documents.

The usual red flags (like mismatched fonts or suspicious formatting) are far less likely to reveal a fake if you’re only looking at the document in isolation.

Government registries could be the answer

This is where government registries become a dead giveaway. Even if a company creates its own articles, the gold standard for legitimacy is seeing those documents stored in an official registry, such as Companies House in the UK or the relevant Secretary of State’s office in the US.

A genuine company will have its articles of association (or incorporation) on file with the proper authority, and anyone can cross-check the details against these public records. If the articles aren’t there, or the details don’t match, that’s a clear warning sign.

However, it’s important to note that this verification process only works regionally. A business or bank in Wisconsin will know exactly what official articles for a Wisconsin company should look like, but may have no way to directly verify articles from a company registered in Germany, India, or elsewhere.

Keep in mind: Registries reliability can vary. Their own controls aren’t perfect. For example, 20% of Companies House registrations could be considered problematic or potentially criminal.

This limitation makes cross-border fraud detection significantly more challenging and increases reliance on secondary verification methods or local expertise.

When do structural red flags help spot articles of association fraud?

Fraudsters commonly use fake or altered articles to create shell companies (entities that exist on paper but have no real operations) for purposes such as money laundering, tax evasion, or concealing illicit activities.

Another frequent scheme is impersonating legitimate businesses: fraudsters steal or modify genuine articles from real companies (often inactive or obscure ones) to open bank accounts, pass onboarding checks, or build credibility with partners and clients.

In these scenarios (where there is an official, registry-stored version available for comparison) structural red flags like formatting inconsistencies, digital tampering, or unusual signatures become relevant again, as any manipulation or forgery can be detected by comparing the suspicious document against the original in the registry.

Fraudulent AoA submissions frequently reference amendments, share restructures, or special resolutions that do not appear in the official SH01/SH02 filings or corresponding confirmation statements.

We increasingly see forged documents that include updated clauses on share classes or director authorities without any matching capital update or resolution timestamp in the registry record.

Another high-signal indicator is version drift: model articles references that don’t align with the incorporation year, or amendment wording that predates Companies House template updates. When the constitutional document claims changes that the public filing trail does not support, that mismatch is often the clearest sign of fabrication.

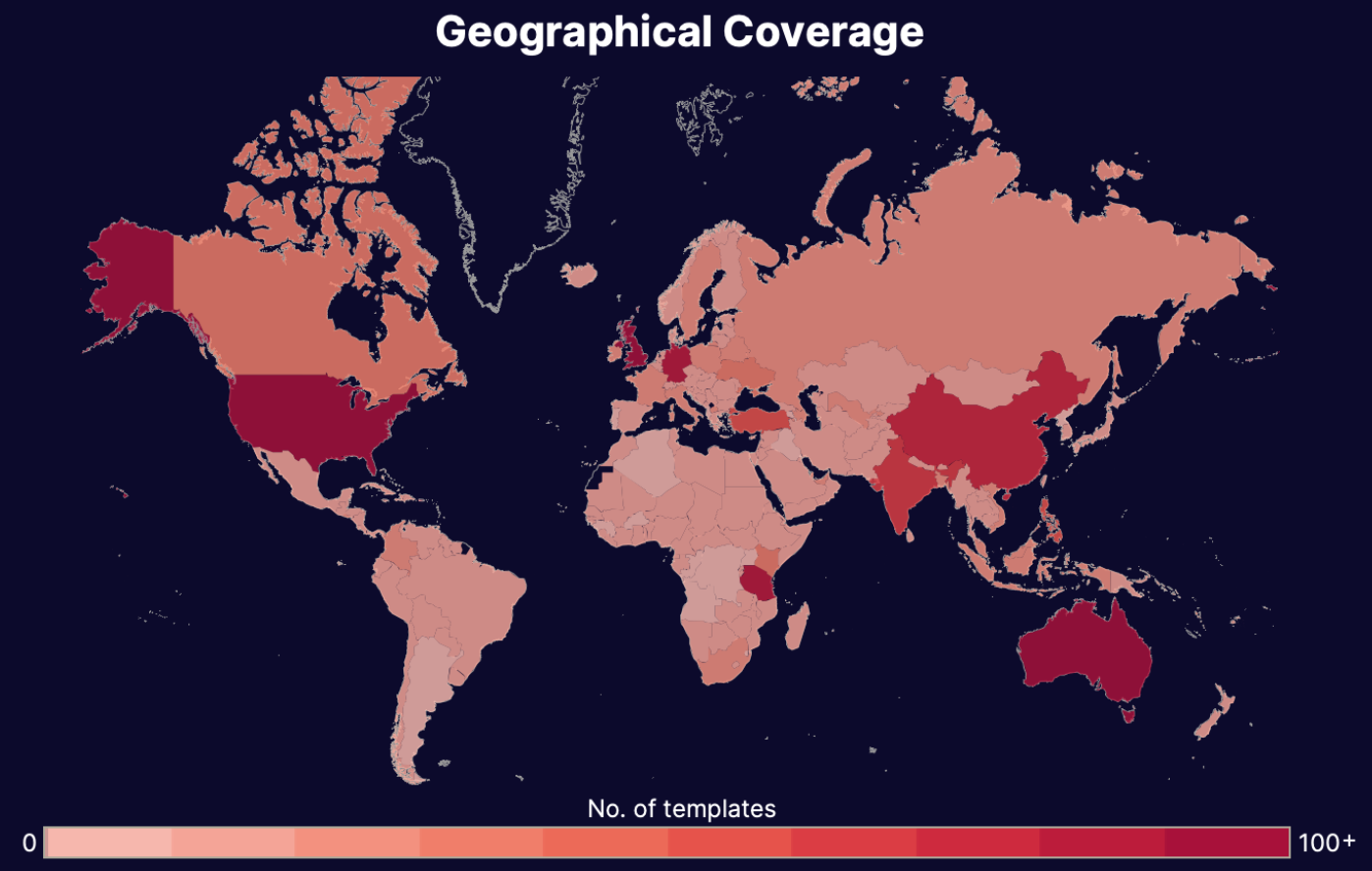

Threat intel: Template data about fake articles of association

Our Threat Intelligence Unit collects data about template farms which make and distribute fake document templates for fraudulent purposes.

Below, you'll find an infographic containing data about fake articles of association templates, their availability, their distributors, the institutions or "issuers" whose documents have been exposed, and how much it costs to buy one.

Threat intel stats: Company information

Articles of association are in our "company information" dataset: documents that contain information about a company like certificates of incorporation, articles of incorporation, professional licenses, company bylaws, etc.

5 signs of forged or fake articles of association

An authentic articles of association document is the constitutional backbone of a company, defining its purpose and governance.

A forged version can be used to misrepresent director powers, dilute shareholder rights, or create a shell company for illicit purposes. Leading organizations are turning to AI-powered document verification to analyze documents at scale with forensic accuracy.

As we mentioned before, these red flags won’t be all that valuable for spotting first-hand fraud, or articles of association created from scratch. However, here are some signs that the document may be an illegitimate copy or forgery of an official document.

1. Inconsistent formatting

Fraudsters often focus on getting the core information right but get lazy with presentation, making sloppy formatting the quickest visual giveaway of doctored articles of association.

- Clause and sub-clause numbering. Is broken or contains skips (e.g., jumping from article 14 to article 16).

- Spacing and layout mishaps. Margins, line spacing, and paragraph alignment shift dramatically between pages or even within the same section.

- Official crests and stamps. such as from a notary or government registry like Companies House, appear pixelated, blurry, or low-resolution.

- Page numbering. Inconsistent, missing, or uses a different style on some pages compared to others.

2. Incorrect or misleading information

Forgers often gamble that you won't cross-reference the document's claims with official public records, leaving a trail of verifiable errors.

- Official company number. Does not match the number listed in the official government registry (e.g., Companies House).

- Registered office address. Points to a mail-forwarding service, is a known high-risk address, or is inconsistent with the public record.

- Director and subscriber names. Are misspelled, incomplete, or entirely different from the individuals listed on the official company register.

- Adoption date. Precedes the company’s official date of incorporation, which is chronologically impossible.

- Legal citations. Refer to obsolete, repealed, or irrelevant corporate laws for the stated jurisdiction.

3. Bad math and uncharacteristic figures

Even meticulous forgers can be tripped up by the specific numerical and logical rules governing corporate structure, creating glaring mathematical impossibilities.

- Share capital allocation. The sum of shares assigned to initial subscribers does not equal the total allotted share capital stated in the document.

- Quorum logic. The number of directors required for a quorum makes passing a resolution with a specified voting threshold mathematically impossible.

- Undefined share values. The document creates multiple classes of shares (e.g., ordinary, preference) but fails to assign a nominal value to each.

- Director count conflicts. The articles specify a minimum or maximum number of directors that contradicts the number of directors actually named within the same document.

- Incorrect voting thresholds. The definition of a "special resolution" uses a percentage that conflicts with the legal standard required by the relevant Companies Act.

4. Articles of association inconsistencies

Sophisticated forgeries often contain internal contradictions where one clause invalidates another, or they simply omit legally required sections entirely.

- Missing mandatory clauses. Legally required sections, such as those detailing director conflicts of interest or rules for general meetings, are completely absent.

- Contradictory director powers. One article grants a director sole authority to enter contracts, while another requires full board approval for the same action.

- Ambiguous legal terms. The "Interpretation" section fails to define critical terms like "special resolution" or "shareholder," leaving them legally vague.

- Unexplained model article deviations. The structure deviates significantly from the standard Model Articles for that jurisdiction without an attached resolution authorizing the amendments.

- Signatory mismatches. The names of the signatories on the final page do not match the initial directors or subscribers listed earlier in the document.

5. Metadata discrepancies

A document’s digital footprint often reveals a story the forger tried to hide.

- Unprofessional author fields. The "Author" listed in the file properties is a personal name or a generic device ID instead of a law firm or corporate entity.

- Excessive recent edits. The file metadata reveals a long history of recent modifications to what should be a static, foundational legal record.

- Hidden layers or objects. The file contains hidden layers, comments, or annotations from the forgery process that were never flattened or removed.

Disclaimer: Relying on human review to catch sophisticated document fraud is becoming an unwinnable battle. Fraudsters leverage advanced software to create forgeries that are visually indistinguishable from the real thing, often producing them at a speed and scale that overwhelms manual verification teams.

Modern fraud requires a modern defense; scalable, AI-powered solutions essential to forensically analyze every document and stay ahead of these evolving threats.

How to verify articles of association

When verifying articles of association, you typically have two choices: manual verification or automated.

Manual verification methods can certainly help, but AI verification provides greater accuracy and scalability. Instantly identifying inconsistencies and hidden discrepancies humans typically miss.

However, some situations still demand manual review for regulatory or procedural reasons. Here’s how to manually verify articles of association effectively:

Manual verification of articles of association

To manually verify the authenticity of articles of association, use the list of red flags we mentioned about. To go a step beyond, here are a few strategies:

- Government registries. We’ve already mentioned the need for cross-referencing company details (registration numbers, dates, owners) with official registries. Some important databases to keep in mind:

- Companies House (UK)

- Secretary of State websites (US). This is different for each state.

- European Business Registers Interconnection System (EU).

- Australian Securities and Investments Commission (AUS).

- Receita Federal (Brazil).

- Verify signatures and seals. Authenticate signatures and official seals by comparing them against specimens available through official notaries or company registries.

- Confirm document version and formatting. Validate the formatting, fonts, and section headers by comparing with official templates or documents previously verified by trusted sources.

- Contact issuing authorities directly. Reach out to official bodies or notaries who authorized or filed the original document to confirm its authenticity and obtain certified copies if necessary.

Keep in mind: While these manual steps can help identify obvious fakes and inconsistent information, sophisticated fraud often slips through due to subtle inconsistencies and high-quality forgeries.

As document fraud evolves, manual verification alone becomes increasingly inadequate. For robust and scalable detection, AI-driven verification is essential for protecting your organization from advanced document manipulation threats.

Using AI and machine learning to spot fake articles of association

AI-powered document verification tools provide robust, scalable solutions to detect fake articles of association, drastically improving both speed and accuracy compared to manual checks.

Benefits include:

- Pattern and template recognition. Machine learning algorithms analyze countless authentic articles to understand standard formatting and legal language patterns, instantly flagging deviations.

- Real-time anomaly detection. AI systems detect subtle anomalies in fonts, layout, metadata, and content consistency, identifying tampering that human reviewers might overlook.

- Reduced false positives. Continuous learning allows AI to adapt to new forgery techniques, improving accuracy over time by distinguishing between legitimate document variations and fraudulent alterations.

Automation vs. AI

It’s important to understand the nuances between legacy automation tools and their AI-powered counterparts.

Traditional automation can handle repetitive, rule-based checks like validating fields or formats. However, they falter when faced with nuanced forgeries that require contextual understanding.

AI systems go beyond automation by learning from diverse data inputs, recognizing context, and adapting to new fraud tactics. Unlike basic automation, AI can detect previously unseen forms of fraud and continuously improves by learning from each new verification.

Leveraging AI for verifying articles of association ensures your business remains secure and compliant, even as fraud techniques evolve.

Conclusion

The risk posed by fake articles of association has never been higher, especially in 2026, with sophisticated forgeries becoming commonplace due to AI-generated tools and readily available online templates. While manual verification methods still hold some value, they simply can’t keep up with the complexity, speed, and scale of today’s document fraud landscape.

Resistant AI's document fraud detection offers learning capabilities, rapidly recognizing structural inconsistencies, metadata anomalies, and subtle deviations humans overlook.

Ready to ensure your organization isn’t compromised by fake articles of association? Take the proactive approach and see Resistant AI’s powerful detection tools in action.

Scroll down to book a demo today.

Frequently asked questions (FAQ)

Hungry for more fake articles of association content? Here are some of the most frequently asked questions about fake articles of association from around the web.

How to spot fake articles of association with AI?

AI detects fake articles of association by analyzing document structure, formatting, metadata, and subtle inconsistencies. Advanced machine learning models can identify forgeries that human reviewers might miss, such as template anomalies, incorrect legal terminology, and manipulated digital signatures.

What’s the difference between articles of association, memorandum of association, and certificate of incorporation?

The Certificate of Incorporation is the official government-issued "birth certificate" proving a company legally exists. The Memorandum of Association is the simple, one-time declaration by the first shareholders of their intent to form the company, while the Articles of Association are the detailed internal rulebook that governs how the company is run on an ongoing basis.

- Articles of association

- Issuer: Drafted internally by company founders; filed with government registry.

- Characteristics:

- Detailed regulations on share capital.

- Shareholder roles, board structure, and voting rights.

- Governs internal rules and operational procedures.

- Memorandum of association

- Issuer: Company founders submit during incorporation.

- Characteristics:

- Lists company objectives.

- Initial shareholders, and authorized capital.

- Formalizes the company's existence and purpose.

- Certificate of incorporation

- Issuer: Government regulatory authority (e.g., Companies House, Secretary of State).

- Characteristics:

- Simple document with official seal.

- Incorporation date and registration number.

- Confirms the official formation of a legal business entity.

Is there software to detect fake articles of association?

Yes. Resistant AI’s document fraud detection software automatically identifies fake articles of association by analyzing document layout, metadata, and structural inconsistencies at scale—protecting your business from fraudulent submissions.

Who needs to check for fake articles of association?

Many roles and industries rely on articles of association for compliance, due diligence, and verification processes. These include:

- Financial institutions. Loan underwriters verifying corporate structure.

- Law firms. Conducting legal due diligence during mergers and acquisitions.

- Compliance officers. Ensuring accurate corporate governance for regulatory requirements.

- Investors. Validating legal structures before funding companies.

- Procurement teams. Confirming vendor legitimacy and corporate authority.

Is making fake articles of association illegal?

Absolutely. Creating or submitting fake articles of association constitutes document fraud and is punishable by law across multiple jurisdictions. Penalties can include significant fines, regulatory sanctions, civil lawsuits, and even criminal prosecution with potential imprisonment, especially when used for fraudulent financial or legal gain.

What are model articles of association?

Model articles of association are standardized templates provided by regulatory authorities (e.g., Companies House in the UK) that outline default rules for company governance. They serve as a starting point for companies during incorporation and can be adopted wholly or modified to suit specific needs.

Can articles of association be amended?

Yes, articles of association can be amended post-incorporation. Amendments typically require a special resolution passed by shareholders, often needing a 75% majority. This allows companies to adapt their governance structures as they evolve.

Where can I find a company's articles of association?

In many jurisdictions, such as the UK, a company's articles of association are filed with a government registry (e.g., Companies House) and are publicly accessible. You can search the respective registry's website to obtain copies of these documents.