Check any document, from any country, for fraud

Catch fake, tampered, or AI-generated documents in seconds with AI-powered document fraud detection

3x

More fraud detected

>90%

Fewer manual reviews

5x

Review speed

<20

Seconds per document

Check any document, from any country, for fraud

3x

More fraud detected

>90%

Fewer manual reviews

5x

Review speed

<20

Seconds per document

Catch fake, tampered, or AI-generated documents in seconds with AI-powered document fraud detection

Join 8,000+ fraud and compliance analysts who use Resistant AI to detect fraud

See how it works

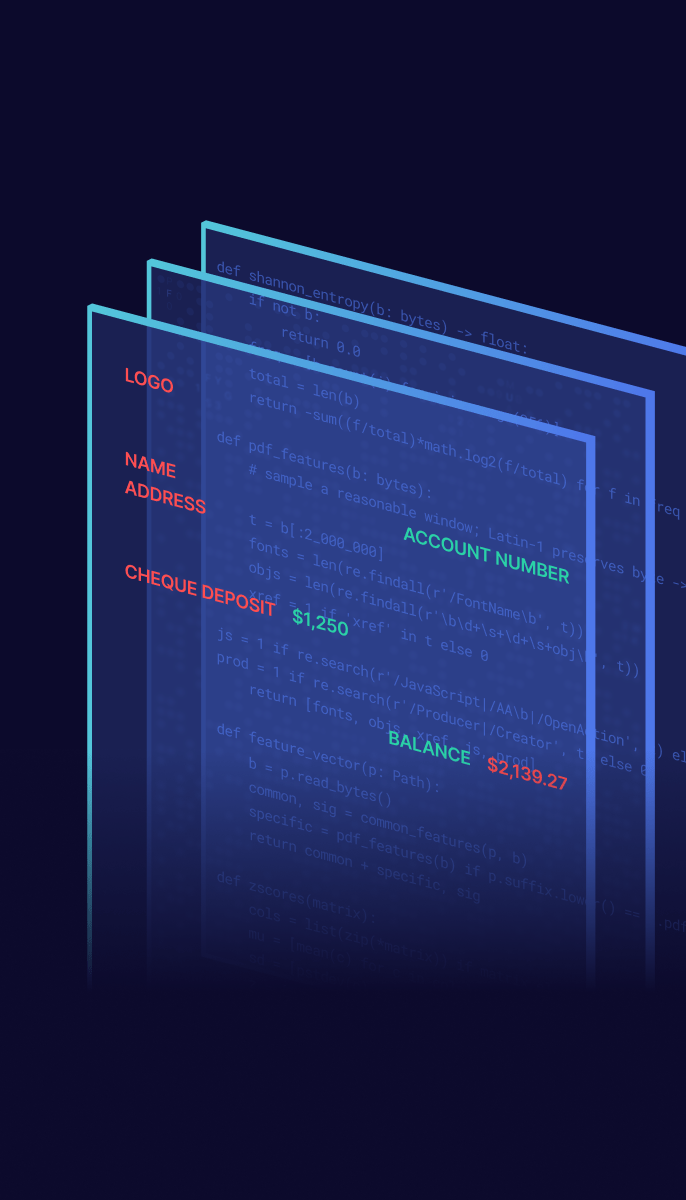

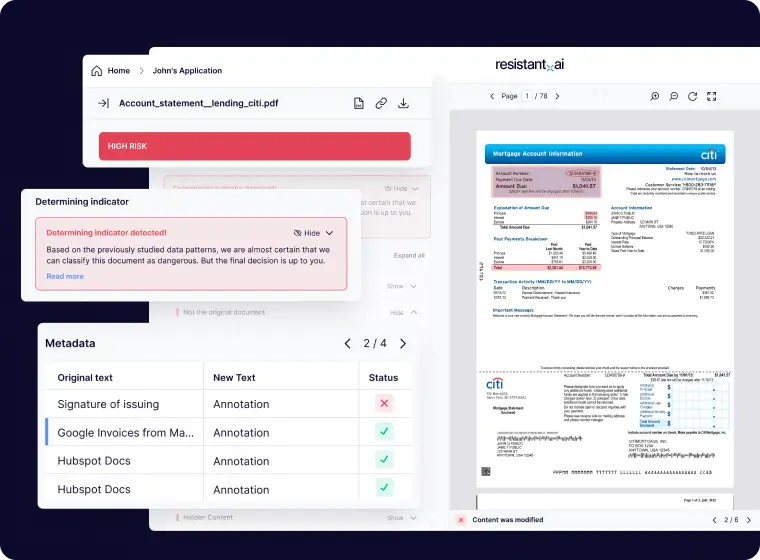

Resistant Documents

Use AI to detect document fraud your eyes can't see

Document fraud detection software that can check your documents for fraud & authenticity in seconds — regardless of what they are or where they came from.

Merchant onboarding

AI-powered fraud checks for faster approvals, fewer manual reviews, and decisions in under 20 seconds.

Learn more

Loan underwriting

Approve more loans, detect more fraud, and give underwriters clarity to approve with confidence.

Learn more

Claims processing

Automate document checks to keep fakes out and your best investigators focused where it counts.

Learn more

The AI upgrade for your existing transaction monitoring system

Catch more novel fraud and money laundering behaviors with less — without replacing your existing tech stack.

5x

Analyst productivity

3x

More risk coverage

<100

Millisecond detection

The AI upgrade for your existing transaction monitoring system

5x

Analyst productivity

3x

More risk coverage

<100

Millisecond detection

Catch more novel fraud and money laundering behaviors with less — without replacing your existing tech stack.

Resistant Transactions

80+ off-the-shelf models designed by AI and fincrime experts

Improve your rule-based transaction monitoring system with fully explainable AI ready to detect advanced fraud and money laundering behaviors. All without replacing your existing tech stack.

AML

Boost AML risk coverage with AI that triples risk visibility and slashes alert fatigue.

Learn more

APP Fraud

Stop scams in real time with AI that detects mule accounts, fake payees, and risky transactions.

Learn more

BNPL

Detect synthetic identities, and risky behaviors, and other frauds before approval not after default.

Learn more

Connecting the dots to outsmart criminals

Combine documents, transactions, behaviors, and identities for unparalleled fraud and fincrime prevention

Defense in depthReading

More knowledge. Better defense

Verify any document for fraud

3x more fraud detected

90% cut in manual reviews

Thousands saved in seconds

“Resistant Al's can do approach and passion is not something you often see from vendors—let alone after the sale.”

Aharon Weissman

Senior Product Manager at Payoneer

Clients

Clients

Book time with our experts

.png)