Stop account fraud at the source

Document fraud detection software to quickly eliminate mule accounts, synthetic identities, and AI-generated fakes from your onboarding process.

Document fraud detection software to quickly eliminate mule accounts, synthetic identities, and AI-generated fakes from your onboarding process.

KYC for any risk, region, or regulation

Document types, regional regulations, and risk tolerances vary. Fraud and compliance teams need more than rigid tools that can’t adapt to internal workflows. They only add friction where speed and precision matter most.

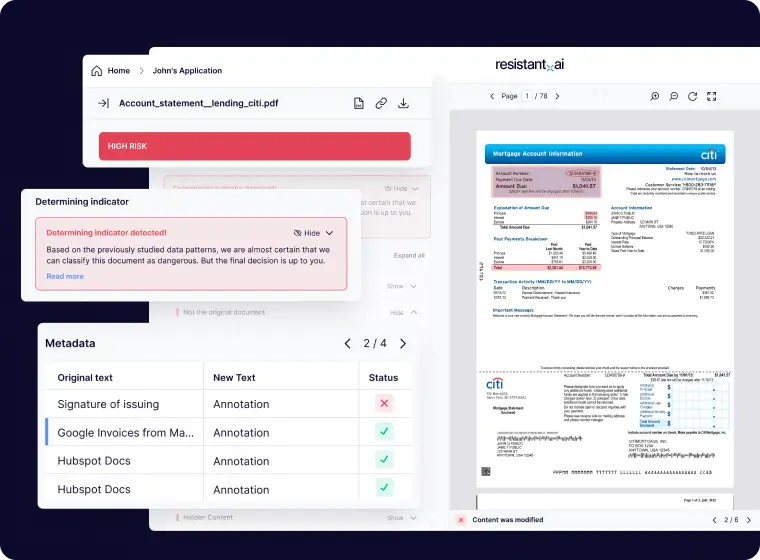

Spot fraud in any KYC document

Bank statements

Utility bills

Tax returns

Pay slips

Employment verification letters

Lease agreements

And more!

Automating your KYC reviews will save you thousands in seconds

- Average out-of-the-box detection rate (pre-training) 86%

- Average reduction in manual reviews 92%

Resistant documents

Our document fraud detection software can check your documents for fraud & authenticity in seconds — regardless of what they are or where they came from.

Learn more on our blog

Yes. Resistant AI offers flexible integration options, including APIs, allowing seamless incorporation into existing KYC document processing systems. This ensures minimal disruption while enhancing fraud detection capabilities.

Resistant documents has numerous benefits to several roles in the KYC process:

- Compliance officers. Ensure regulatory requirements are met with reliable identity verification processes.

- Fraud analysts. Detect synthetic identities and forged documents early in the onboarding process.

- Customer onboarding teams. Speed up customer acceptance with automated, accurate KYC checks.

- Risk managers. Assess identity-related risks and monitor for emerging fraud patterns.

- Customer service representatives. Resolve identity verification issues quickly to improve customer experience.

- IT and security teams. Integrate KYC tools securely into existing systems, maintaining data privacy and compliance.

Yes. Resistant AI doesn’t read, extract, or process the actual content or sensitive data within documents. Instead, it analyzes the structure, layout, and metadata of documents to detect fraud.

By focusing on how the documents are built rather than what they say, the service is architecturally GDPR compliant, and capable of detecting fraud on any KYC document, in any language.

.png)