You might be interested in

We here at Resistant AI have been working with Fintrail for a while now, as we believe that their recognized expertise in anti-financial crime (AFC) consulting and our best-in-class analytical capabilities are perfect complements to one another. That's why we're excited to announce a new phase in our partnership in the form of a new service to answer an increasingly pressing question: Are your transaction monitoring controls effective and efficient? With Resistant AI's Transaction Forensics at its core, Transaction Monitoring Assurance Review will offer a holistic review and assessment of transaction monitoring systems and controls to identify areas of non-compliance, inefficiencies, and opportunities to enhance the effectiveness of companies' safeguards against financial crime.

The timing of this new joint offering is not arbitrary. In the face of high-profile failures of banks like SVB and mounting evidence that technology-driven financial crime is reaching epidemic levels, internal and external scrutiny of banks and payments institutions is only expected to grow. The most tangible example of this came in a recent letter to CEOs from the British Financial Conduct Authority (FCA): "We expect your firm to conduct regular reviews to assess its compliance with anti-money laundering obligations and sanctions requirements, and to work swiftly to remediate weaknesses identified." The consequences, of course, are potentially ruinous both reputationally and financially. So not only are reviews good practice in the face of a regulatory landscape that is evolving as fast as the threats they intend to counter, they are an absolute necessity that every entity—whether regulated or hoping to be—must now undertake with more commitment and more methodically than ever before. Technology, of course, is exceptional at performing methodical tasks, which is what makes an AI-driven review process the ideal way to comprehensively meet this requirement.

The Transaction Monitoring Assurance Review assesses four key components of an AFC framework: people, processes, technology, and governance. Reviews are holistic in that they measure how each component’s state holistically en route to measuring effectiveness of a firm's controls, uncovering gaps in both compliance and efficiency. By blending Fintrail’s expert insights with Resistant AI’s sophisticated machine learning, Reviews offers practical, actionable recommendations that will help institutions keep pace with the latest regulatory requirements, implement transaction monitoring best practices, and drive improvements in their risk assessments and responses.

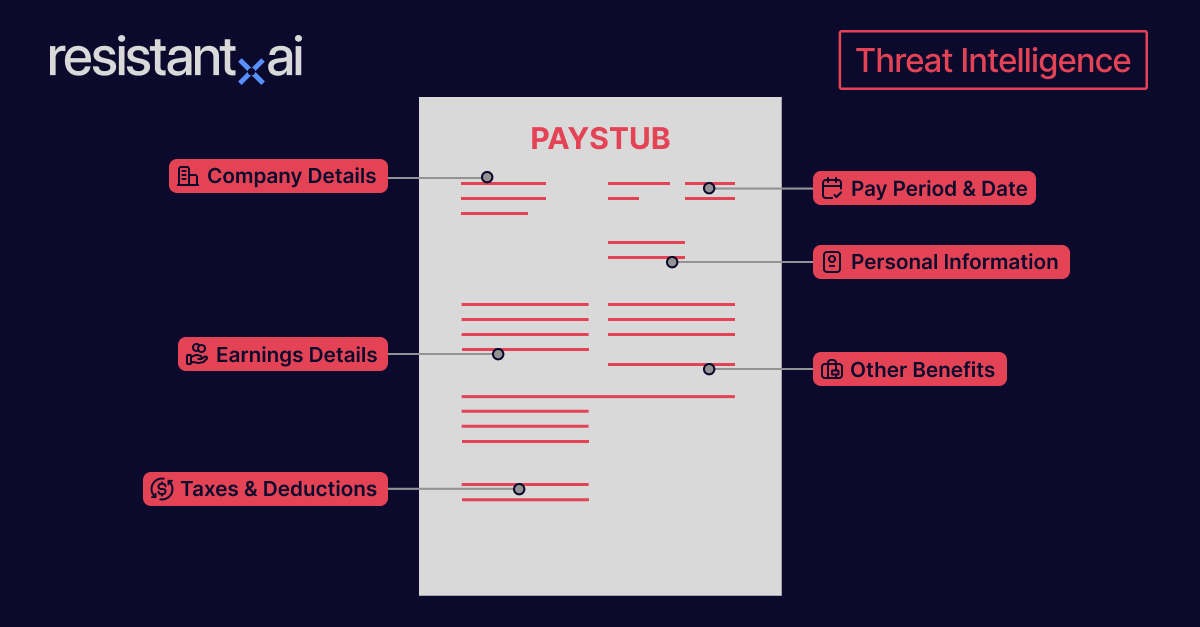

A review of transaction monitoring resources and capacity to suggest the optimal team structure and identify any existing gaps in knowledge or expertise.

A holistic review of current transaction monitoring processes, including associated documentation, appropriateness of rules, and alerts handling to assess compliance with regulation and identify opportunities for further enhancements and greater effectiveness.

An examination of current transaction monitoring system performance, including historic alert outcomes from rules to identify opportunities to boost investigative productivity, address the noise generated from ineffective rules, and reveal the risks hidden in your data.

A review of your existing financial crime governance model or the creation of an all-new model, including associated management information, aligned to the processes and technology.

Reviews are applicable to any regulated entity that is currently required to have transaction monitoring controls in place, regardless of size or complexity. By providing practical recommendations and examples, this comprehensive assessment of transaction monitoring measures aims to offer you peace of mind regarding your regulatory compliance while also equipping you with the knowledge to enhance the effectiveness of your transaction monitoring controls. Deliverables of Reviews include:

- Prioritized recommendations for remediation to address areas of non-compliance or secure operational efficiency gains

- A documented roadmap towards a suggested operating model based on continuous measurement and improvement

- Analytical reporting on current controls’ performance and recommended improvements, generated via the application of latest-generation AI to prioritize alerts, reduce false positives, and highlight missed evidence of financial crime

Financial institutions continue to grapple with the ever-evolving landscape of financial crime. Ever-more resourceful criminals and increasingly-stringent legislative demands put enormous pressure on organizations’ preventative measures, and traditional rule-based systems have become less effective in identifying suspicious activity.

Artificial intelligence is fast becoming a powerful tool in fighting financial crime and one that is increasingly recognized and supported by regulators and adopted by financial institutions. AI has progressed from theory and research to successful real-world use. Resistant AI is leading the charge with Transaction Forensics, which shows real benefits for enhanced transaction monitoring for AML and fraud that traditional systems alone can't match.

Fraudsters are constantly evolving their tactics, making it difficult for traditional rule-based AI systems to keep up unaided. Transaction Forensics is designed to augment traditional rule-based systems, ingesting their output to identify emerging fraud trends that may have been missed. The use of statistical analysis and anomaly detection by Transaction Forensics even means that suspicious patterns that have never been seen before will come through as signal rather than noise. This can help financial institutions identify and prevent financial crime more effectively, reducing the risk of regulatory fines and reputational damage.

Traditional rule-based systems are time-consuming and resource-intensive to set up and maintain. Resistant AI’s services, on the other hand, act as an overlay onto existing systems rather than a replacement. This means the benefits of AI can be deployed more quickly and maintained in a modular manner, allowing financial institutions to focus on other critical compliance tasks.

By providing more accurate, contextualized information on potential financial crime in real time, Resistant AI can help financial institutions to identify and mitigate potential risks more effectively. This can help to reduce the overall risk profile of the institution and improve its compliance posture.

Clients already employing Transaction Forensics have already reported case-level improvements as well as strategic advantages starting just weeks after implementation. Combining this with Fintrail's experience in and passion for combating financial crime, our joint Transaction Monitoring Assurance Review's comprehensive analysis of risk and compliance practices will bring organization-wide improvements and make the financial space safer for all.