You might be interested in

In our latest webinar, our document fraud solution experts Nico Martinez and Jan Indra took a deep dive into the main principles and practices businesses can use to successfully combat document fraud.

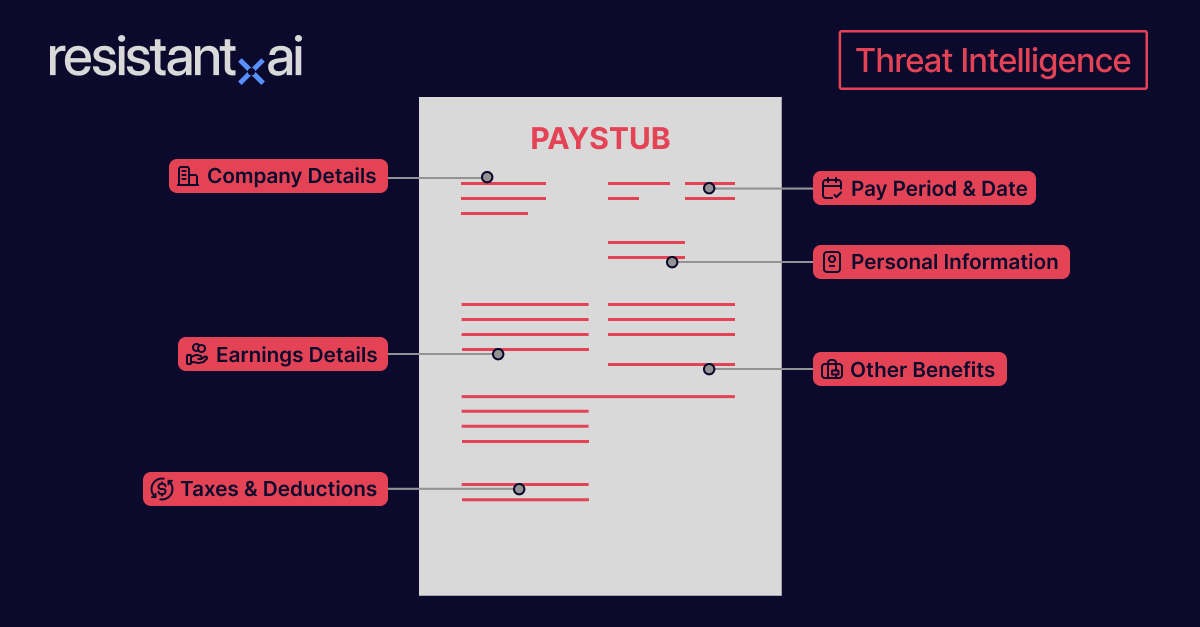

Through analyzing over 50 million documents, we estimate that 1 in 5 onboarding and underwriting documents show signs of tampering. Here’s a quick look into what tampering is and how it affects organizations:

Furthermore, over half of webinar attendees admitted that their companies still rely on manual review of document samples–which is costly, ineffective, and most importantly–it does not keep up with the rapidly evolving fraud landscape of high-quality template farms or genAI tools such as OnlyFake.

To keep up with the fraudsters, a layered approach of combining the expertise of professionals with advanced technology and a strategic document fraud solution is essential.

The good news?

You can easily gain invaluable tips by watching our webinar replay to learn how to enhance your document fraud detection framework.

To give you a little taste, here are the top 3 webinar takeaways:

The risk areas range from the type of documents to different document formats–and even how organizations weigh between the amount of risk they are willing to take on with the amount of friction they are comfortable adding on for the customer.

As Nico explained, “As a business, there will be documents you may or may not be familiar with, especially as you expand into different lines of business, use cases, regions of the world where you may not have enough baked in or tacit knowledge yet,” which is why 34% of the polled companies agreed that unknown documents is their most concerning risk area when it comes to detecting document fraud.

Even then, the risk levels vary. Here’s how they vary:

The next step is to be aware of how fraudsters work to plan for fraud prevention and risk mitigation. The five main defrauding methods are: physical modification, forgery on images, edited modifications on PDF documents, downloadable fake templates, and fabricated AI-generated documents like OnlyFake.

A great example of this is how fake templates can be impossible to detect by the naked eye as Nico goes into detail here:

To set your business up for success in fighting document fraud, here are the 4 main principles for businesses to kickstart the process:

The first key principle for companies is to ask the right questions on how to manage document fraud. From using an OCR vendor to read documents to being unsure of the role of documents in the end-to-end process–these questions can extend further to the document scope and friction in the customer process.

In this webinar, Nico summed it up perfectly for the latter, “You want to stop fraud. In the customer experience, they get an answer in three seconds. If you are going to add layers, that adds difficulty. Likewise, if they're waiting a day for a response and you want to add a fraud process–you need to make sure that process will improve or maintain the customer experience. So, understanding your world today becomes critical as a starting.”

The second principle is to know your company’s long-term goals. However, as Nico pointed out, “I think the best way to articulate this is that different use cases and customers have different problems, and thus, different goals.” Hence, the respective firms need to know what they are targeting, such as bad actors, process efficiencies, or increasing market share.

The third principle is to take a layered approach. Previously on the webinar, Nico explained how a layered approach is actually about building a comprehensive framework that incorporates different fraud detection and prevention mechanisms. “A layered approach is all about tackling the same problem from many angles at the same time. This protects you for the future, but it also gives you the mechanisms to detect different fraud typologies as they occur. So where a fraudster may be able to obfuscate or hide elements later, it will be caught by another. It's really about building a robust scheme that you can do this incrementally over time, a piece here and there, which builds a defensive posture.”

The last principle is to operationalize and balance automation in the framework. As Nico has explained, “You can have the greatest detection system owners but if you can't find a way to make it, operational and actionable for the business–there is no value.” Depending on the client’s profile such as auto financing, credit risk scoring, and payment processing, automation mustn't just ‘fly through a process.’ Businesses should assess the context of the situation to understand its risks fully before building these processes.

To learn more about how to combat document fraud, simply watch the replay to dive deep into actionable insights your organization can utilize to keep document fraud at bay.

For Onlyfake or generative AI fraud–gather more actionable insights from our first webinar.

Ready to prevent document fraud?