Solutions: Income verification

Verify income instantly

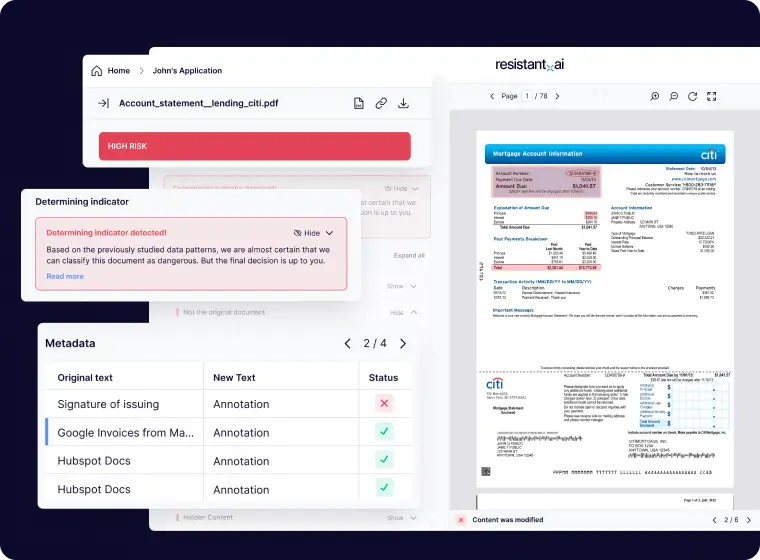

Document fraud detection software that requires fewer documents and quickly delivers the income verification answers you need.

3x

More fraud detected

5x

Faster underwriting

<20 sec

Decisions

Solutions: Income verification

Verify income instantly

3x

More fraud detected

5x

Faster underwriting

<20 sec

Decisions

Document fraud detection software that requires fewer documents and quickly delivers the income verification answers you need.

Ready to protect yourself from tenant fraud?

Benefits

Income verification without bottlenecks

Income verification delays frustrate applicants and increase drop-offs. Streamlined, automated checks help you verify income quickly without sacrificing accuracy or increasing risk.

Automatically validate income documents, reducing manual effort and speeding up the application process.

Verify an applicant's income directly from their submitted documents, enabling decisions and bypassing credit data when it isn't available or necessary.

Even applicants with limited credit history can have their income verified from payslips, bank statements, and alternative documents.

Stop forged documents, tampered files, and synthetic identities at the door of your application process.

See how Resistant AI helps verify income, prevent fraud, and protect financial integrity

Document types

Spot fraud in any income verification document

Bank statements

Tax returns

Pay stubs

Employer contracts

Invoices

Lease agreements

And more!

Automating your income verification process will save you thousands in seconds

Annual savings:

- Average out-of-the-box detection rate (pre-training) 86%

- Average reduction in manual reviews 92%

$5,000

20%

1,000

$10

Resistant documents

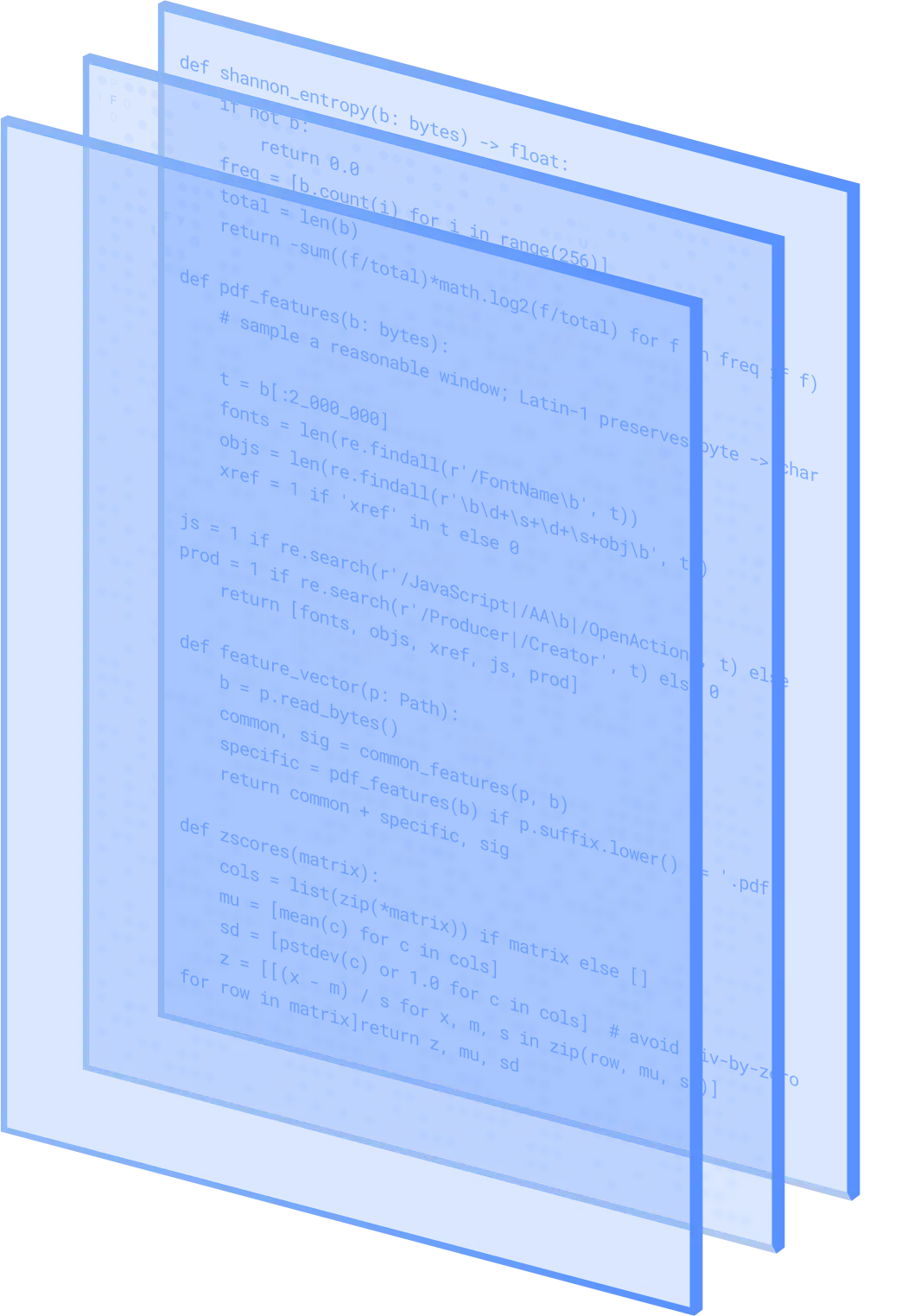

Our document fraud detection software can check your documents for fraud & authenticity in seconds — regardless of what they are or where they came from.

Reading

Learn more on our blog

Frequently asked questions

Income verification FAQs

Want to learn more about document fraud in the income verification process?

How does Resistant AI assist in income verification?

Resistant AI employs advanced AI-powered document verification to identify fraudulent activities in the income verification process. By analyzing documents for over 500 indicators of fraud, it ensures that manipulated or forged documents are detected swiftly, enhancing the integrity of the tenant screening.

What types of income verification documents can Resistant AI check for fraud?

Resistant AI is capable of analyzing all documents, including PDFs and images. This includes documents like: bank statements, employer contracts, and identification proofs, ensuring comprehensive fraud detection across different document types, formats, languages, and countries.

How quickly can Resistant AI verify the authenticity of an income verification document?

The system is designed for rapid verification, capable of analyzing and providing results in less than 20 seconds per document.

Can Resistant AI integrate with existing income verification workflows?

Yes, Resistant AI offers flexible integration options, including APIs, allowing seamless incorporation into existing income verification systems.

Who will this help at my company?

Resistant documents has numerous benefits to several roles that need to verify income:

- Loan officers. Quickly validate income documents to speed up credit decisions and reduce fraud risk.

- Underwriters. Assess applicant financial stability with accurate and reliable income verification.

- Compliance teams. Ensure adherence to regulatory requirements for income validation and fraud prevention.

- Fraud investigators. Identify forged or manipulated income documents to prevent financial losses.

- Customer onboarding specialists. Streamline application processes by automating income document checks.

- Risk managers. Monitor income verification data for anomalies and emerging fraud trends.

Is Resistant AI GDPR compliant?

Yes. Resistant AI doesn’t read, extract, or process the actual content or sensitive data within documents. Instead, it analyzes the structure, layout, and metadata of documents to detect fraud.

By focusing on how the documents are built rather than what they say, the service is architecturally GDPR compliant, and capable of detecting fraud on any income verification document, in any language.