Solutions: Loan underwriting

Approve more loans safely with AI document fraud detection

Document fraud detection software that expedites underwriting while keeping your loan books clean.

3x

More fraud detection

5x

Faster underwriting

<20 sec

Decisions

Solutions: Loan underwriting

Approve more loans safely with AI document fraud detection

3x

More fraud detection

5x

Faster underwriting

<20 sec

Decisions

Document fraud detection software that expedites underwriting while keeping your loan books clean.

Ready to protect yourself from tenant fraud?

Benefits

Protection from sophisticated loan fraud

Today’s underwriters and risk teams face rising volumes of elaborate and dangerous fake documents. Advanced document fraud detection is the first line of defense against the most sophisticated attacks.

Reduce documents requests, customer interactions, and exposure to fraud.

Make evidence-based decisions that restore confidence and prove value.

Prove the integrity of every file by catching forgery, tampering, and synthetic identities before they hit your portfolio.

See how Resistant AI helps assess risk, verify borrower information, and prevent loan fraud

Document types

Spot fraud in any underwriting document

Bank statements

Pay stubs

Invoices

Balance sheets

Income statements

Certificates of incorporation

Articles of association

Business licenses

Asset purchase invoices

Property valuation reports

Vehicle registration certificates

Letters of credit

Bills of lading

Purchase orders

And more!

Automating your loan document reviews will save you thousands in seconds

Annual savings:

- Average out-of-the-box detection rate (pre-training) 86%

- Average reduction in manual reviews 92%

$5,000

20%

1,000

$10

Resistant documents

Our document fraud detection software can check your documents for fraud & authenticity in seconds — regardless of what they are or where they came from.

Reading

Learn more on our blog

Frequently asked questions

Loan underwriting FAQs

Want to learn more about document fraud in the loan underwriting process? Here are some of the most frequently asked questions from around the web.

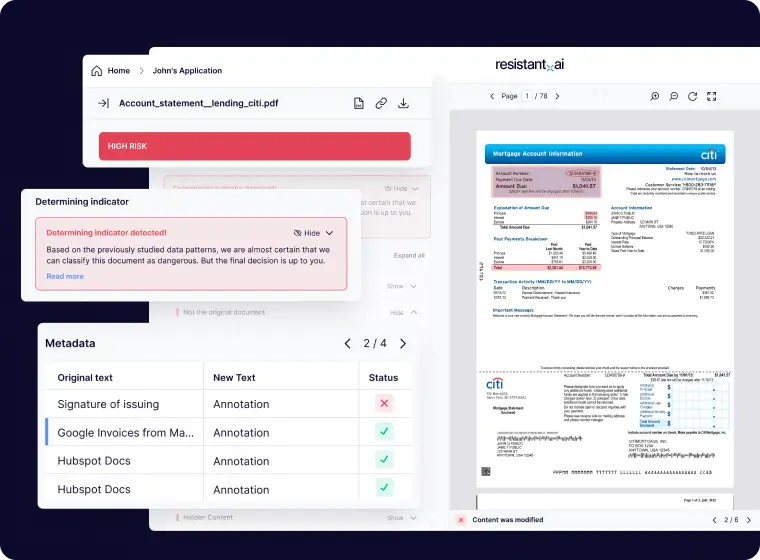

How does Resistant AI assist in detecting loan underwriting document fraud?

Resistant AI employs advanced AI-powered document verification to identify fraudulent activities in the income verification process. By analyzing documents for over 500 indicators of fraud, it ensures that manipulated or forged documents are detected swiftly, enhancing the integrity of the loan underwriting process.

What types of loan underwriting documents can Resistant AI check for fraud?

Resistant AI is capable of analyzing all documents, including PDFs and images. This includes documents like: balance sheets, bank statements, and pay stubs, ensuring comprehensive fraud detection across different document types, formats, languages, and countries.

How quickly can Resistant AI verify the authenticity of a loan underwriting document?

The system is designed for rapid verification, capable of analyzing and providing results in less than 20 seconds per document.

Can Resistant AI integrate with existing loan underwriting workflows?

Yes, Resistant AI offers flexible integration options, including APIs, allowing seamless incorporation into existing loan underwriting systems.

Who will this help at my company?

Resistant documents has numerous benefits to several roles in the in the lending industry:

- Underwriters. Verify borrower data and assess risk efficiently with reliable document analysis.

- Loan officers. Expedite loan approvals by quickly identifying fraudulent or inconsistent information.

- Risk managers. Monitor portfolio risks and detect emerging fraud patterns early.

- Compliance officers. Ensure loan applications comply with regulatory requirements and internal policies.

- Fraud investigators. Investigate suspicious loan applications and document anomalies.

- Operations teams. Streamline the underwriting process by reducing manual reviews and errors.

Is Resistant AI GDPR compliant?

Yes. Resistant AI doesn’t read, extract, or process the actual content or sensitive data within documents. Instead, it analyzes the structure, layout, and metadata of documents to detect fraud.

By focusing on how the documents are built rather than what they say, the service is architecturally GDPR compliant, and capable of detecting fraud on any loan underwriting document, in any language.