Verify any document, from anywhere, for fraud

Your bionic eyes to detect tampered and fraudulent documents

Resistant AI's Document Forensics is trained on over 5M documents a month, and works with any document, from anywhere in the world, making it the most effective way to stop fake bank statements, tax forms, invoices, utility bills, certifications, ID documents, and more.

Verify documents in PDFs and image format in seconds

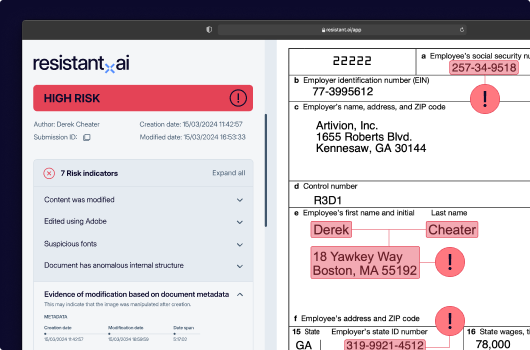

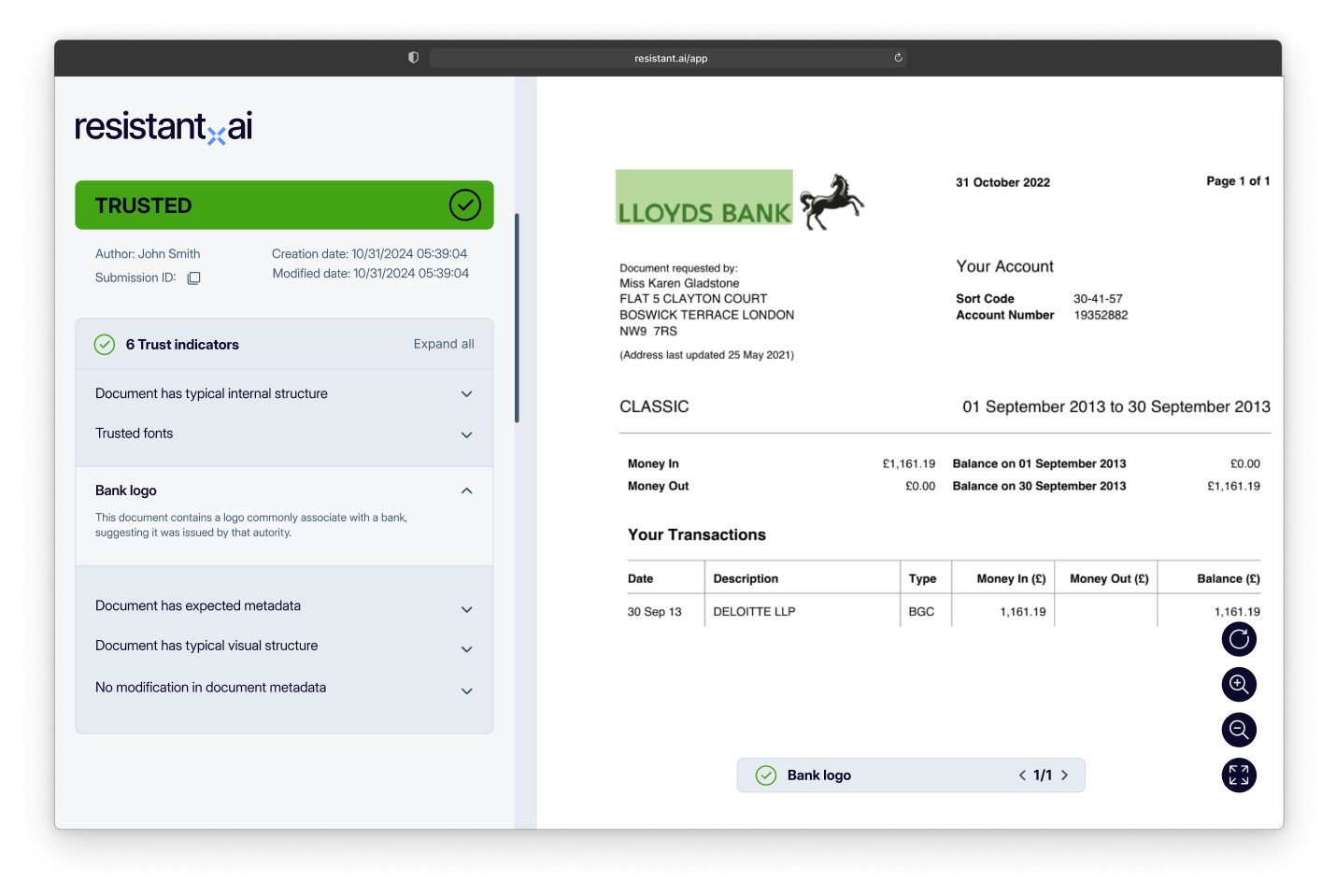

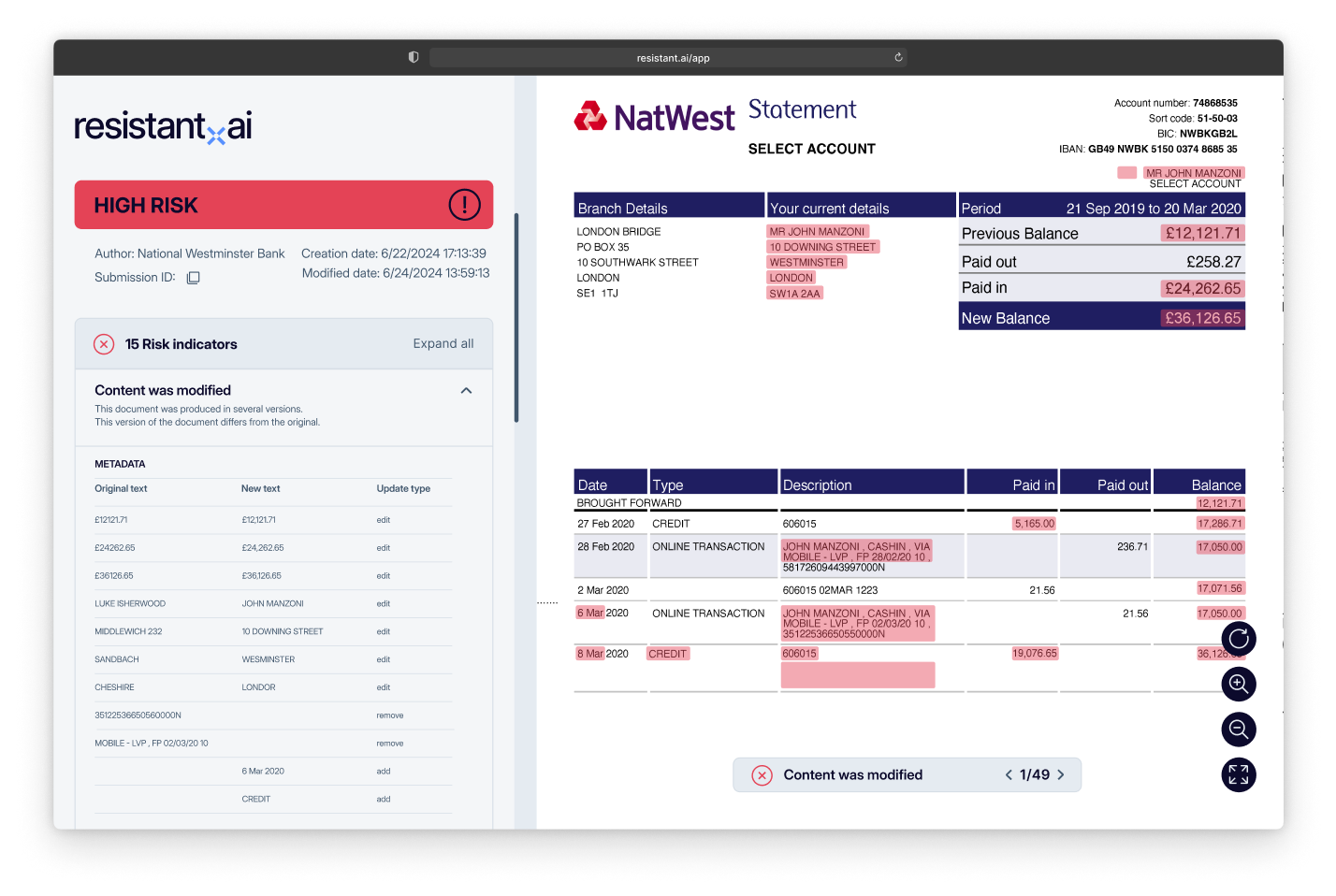

Metadata, internal structures, image inconsistencies, fonts in use… Document Forensics checks every document over 500 ways for signs of fraud to ensure high precision and help you speed up your reviews, reduce your risk, and serve more good customers.

Spot reused, template farmed, and gen AI document fraud

1 in 5 onboarding and underwriting documents are tampered with, and up to 2% are based on reused or generated documents. Detect the most advanced document fraud tactics to prevent large-scale first-party fraud and targeted attacks by organized crime rings.

Any document, in any language. Total privacy

Resistant AI is document and language agnostic. It doesn’t need to know a document beforehand to check it for fraud, nor does it need to read the content of the documents: It looks at how a document is built, rather than what it says — ensuring your customer’s privacy at all times.

Work with actionable verdicts, not “risk scores”

What do you do with a 68% vs an 82% risk score? Cut out the noise and get a clear verdict recommendation (Trusted, Warning, High Risk) complete with fully explainable evidence to help you make the right decisions every time.

Perfectly match your risk tolerance with granular control

Don’t want to accept screenshots? No problem. Create customized verdicts that match your risk appetite and business goals with 99.2% accuracy using any aspect of a document—from what it is, to who issued it, to the modifications it underwent.

Document fraud prevention for any financial service

Stop fraudulent documents your way

Drag and Drop

the fraud away

See how our clients detect and prevent document fraud

Document Forensics FAQs

What document formats can Resistant AI analyze?

Resistant AI can detect document fraud in PDF, JPEG, PNG, TIFF, and other image formats. Different formats have different risk profiles, and we can help you set up a policy that matches your risk appetite.

What types of documents can Resistant AI check for fraud?

Resistant AI is document agnostic, meaning it checks for fraud signals in any document it analyzes — whether it's seen it before or not.

That means it works with any document, from anywhere — including:

- Tax forms and other tax documents,

- Bank statements and account statements

- Invoices

- Business certificates or incorporation documents

- Pay stubs

- Utility bills

- Bill lading,

- IDs documents and passports,

- and more

What languages does Resistant AI support?

Resistant AI analyzes documents in any language, because it doesn’t read the content of the documents to catch fraud. It detects fraudulent documents by examining the structure of the document, its composition, and context of the document. Simply put, we look at how the documents are made, not what they say.

Verify any document for fraud

3x more fraud detected

90% cut in manual reviews

5x faster customer onboarding

Thousands saved in seconds