AI and AFC: The future is now — are you ready for it?

Today, AI is as broad of a term as ‘mechanical engineering’. So what is it that we mean when we talk about AI? And more importantly, how can it be used in combating anti-financial crime (AFC)?

In a recent two-part bootcamp series, our team clarified the role of AI in tackling financial crime, its benefits, its limitations, and how to deploy it effectively. Check out the full recordings of Day 1 and Day 2 of the event (please note that it’s necessary to register for these sessions).

Exploring the fundamentals of AI

According to poll responses collected by our team, it’s a general lack of understanding of AI applications that holds many organizations back from deploying AI to fight financial crime.

In order to fully leverage AI in financial crime frameworks, let’s begin by taking an in-depth look at how AI can be used to enhance detection, prevention, and investigation processes.

What to know about classification

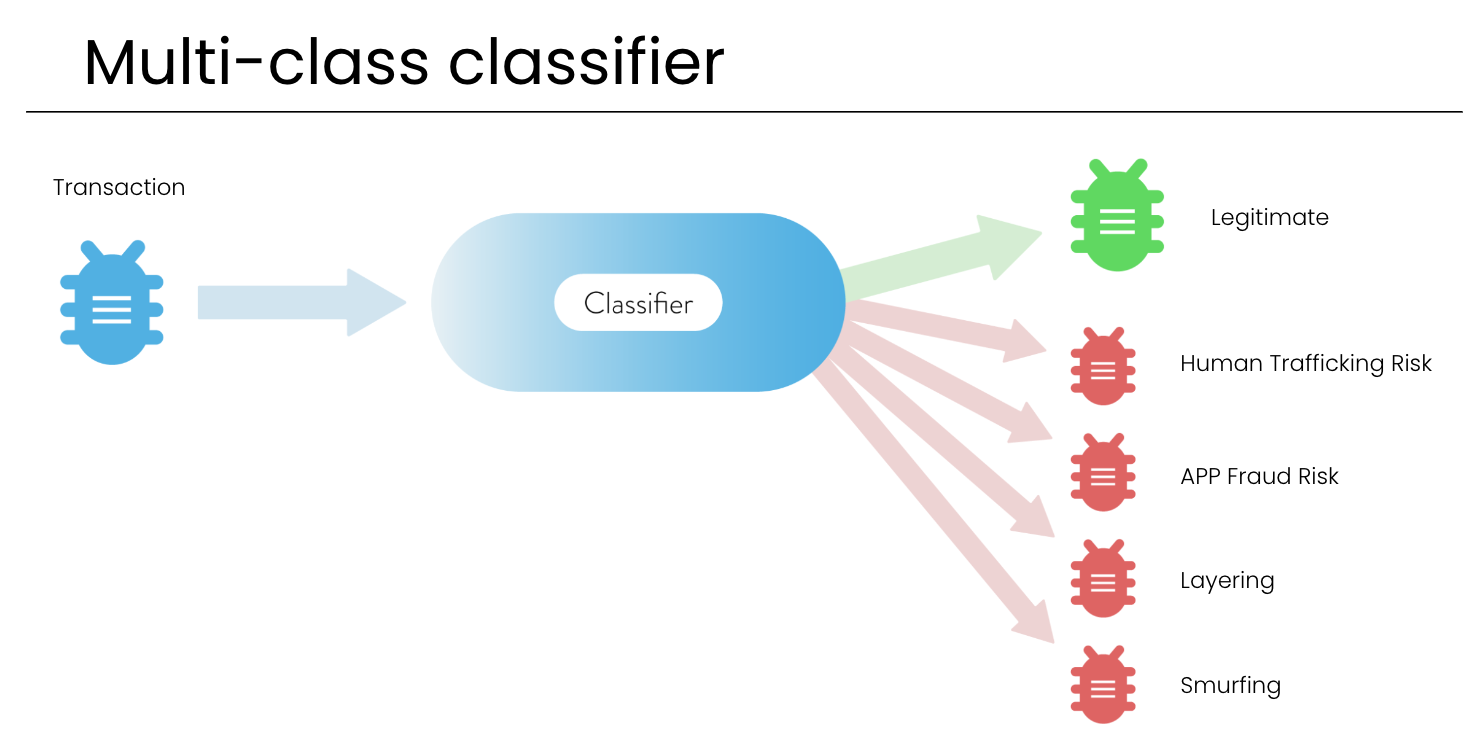

In the context of AI and AML, classification involves determining whether a transaction, person, or customer belongs to a specific class (such as legitimate, criminal, or a specific type of crime). There are different approaches to classification, including supervised, unsupervised, and semi-supervised methods, each with its advantages and challenges.

Resistant AI makes good use of semi-supervised classification techniques, as they bring together the best parts of both supervised and unsupervised classification methods.

Replication and generalization

There’s somewhat of a contradiction that exists when working with AI, as there’s the concepts of both replication and generalization to keep in mind. Replication is the process of replicating previous decisions in very similar situations, and it’s great for explainability, compliance, and so on. Then, there’s generalization — the ability to make decisions about the unknown based on past knowledge and experience. For AI, it’s both a robust and risky capability.

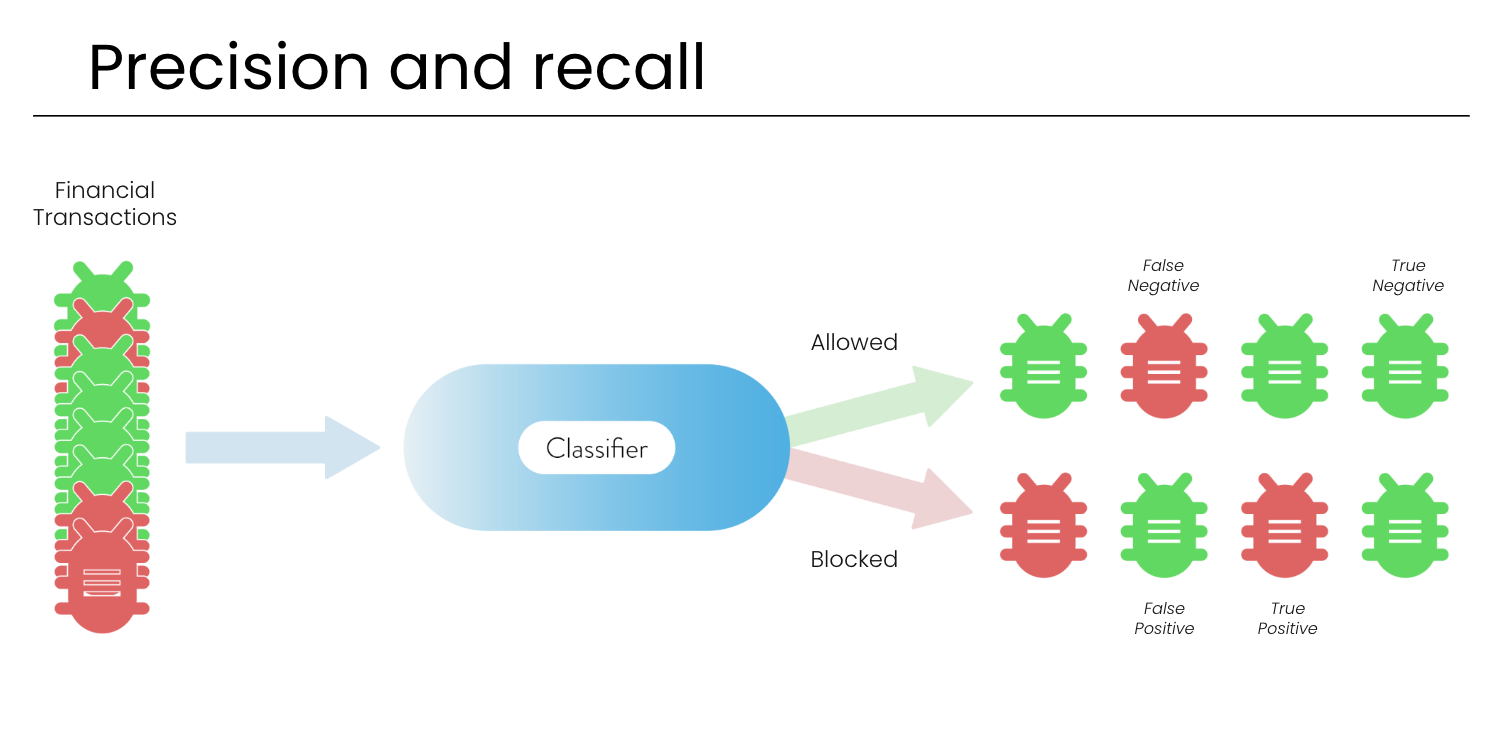

While we want to encourage replication in AI as we want to demonstrate consistent decision making, we also must allow AI systems some flexibility to catch new criminals and crime techniques. This also relates to the trade-offs between precision (what percentage of the positive outputs are actually bad?) and recalls (what percentage of malicious inputs are caught?) in identifying financial crimes. Finding a balance between these requirements is key in building a reliable AI system.

Using AI in AFC

Given the increasing sophistication of cybercriminals’ techniques, it’s now more crucial than ever before that AI is properly utilized in financial crime detection. At Resistant AI, we’re passionate about catching criminals and use distinct techniques to identify different categories of crime:

- Known bad: Very precise classifiers that are trained on specific intelligence about one person or one gang and maintained automatically.

- Known unknowns: Precise classifiers and well-defined workflows that target a whole category of attacks.

- Unknown unknowns: Generalizing classifiers (and very experienced people).

Automation is essential for dealing with repetitive known bad cases efficiently, as criminals are increasingly using automation scripts and AI techniques.

Finally, it’s important to ensure that your AI is constantly evolving and adapting. Choosing the right classifiers and regularly updating AI models are crucial for achieving effective financial crime prevention. We aim to support organizations in staying informed about system updates and learning from the experiences of others when selecting an AI system for financial crime detection.

Preparing for AI adoption

Many organizations feel that when it comes to AI, they have some basic knowledge but still have a long way to go before being able to properly leverage its capabilities.

When it comes to implementing AI to combat financial crime, we’ve got a few key pieces of advice for businesses that are getting started out:

- Don’t wait for the perfect data moment: There’s no such thing as a perfect data moment, and businesses shouldn’t let imperfect data hold back their adoption of AI.

- Start small: It’s perfectly acceptable to begin small and gradually expand AI usage over time. The most important thing is to start somewhere!

- Stay transparent: Being open and transparent with vendors and partners is paramount, as AI adoption is a journey that requires ongoing collaboration.