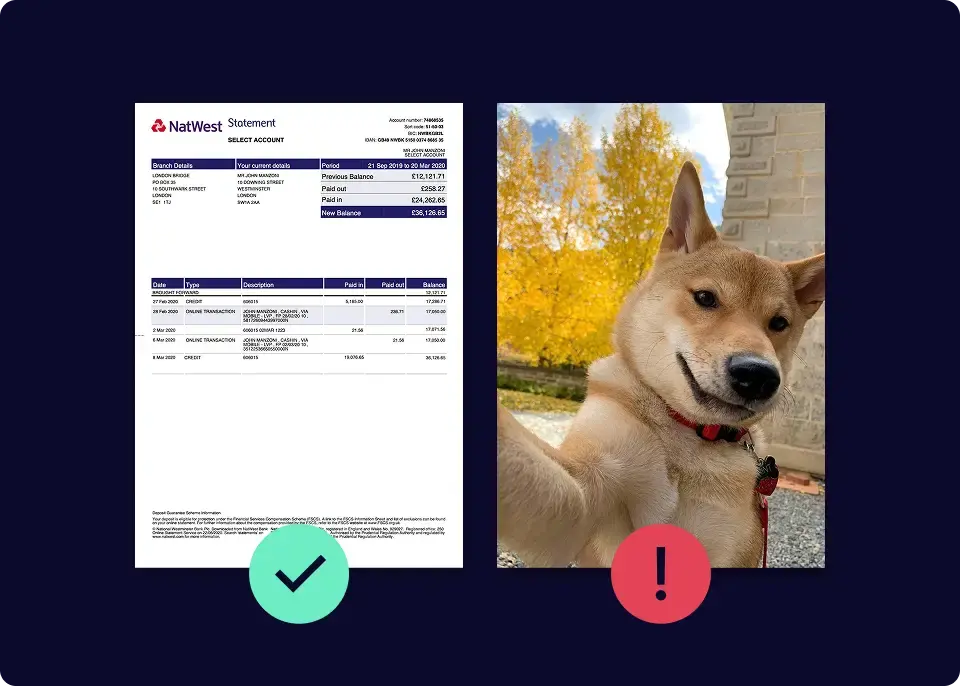

Detect fraud in any document from any country

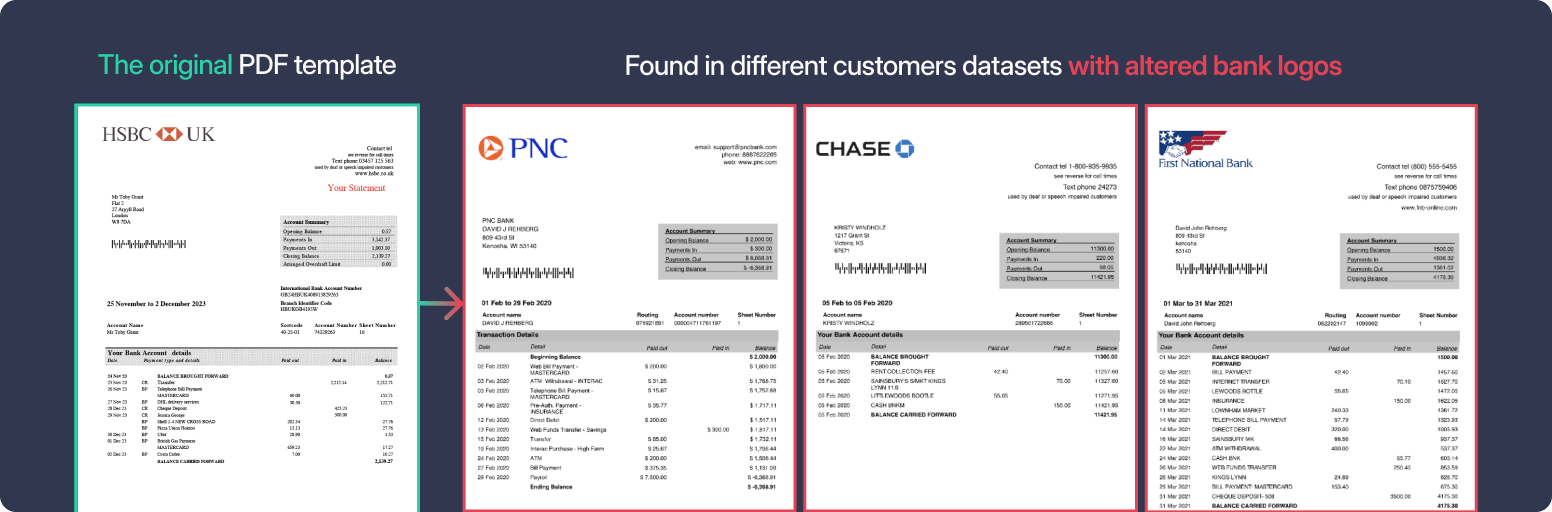

Detect the most sophisticated document fraud typologies

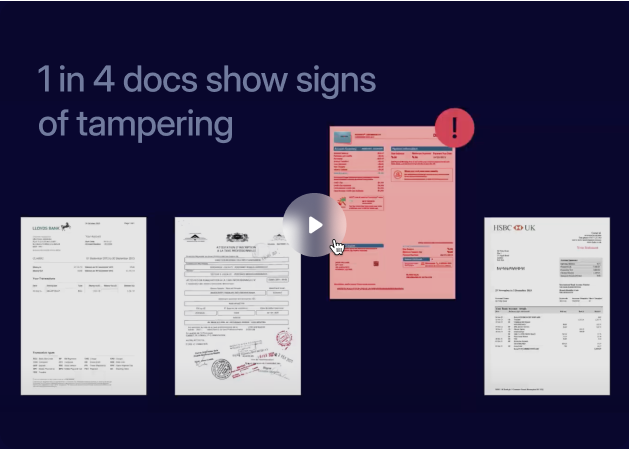

1 in 4 financial documents is tampered with, and 1 in 50 are reused or AI-generated. Resistant Documents checks every document over 500 ways, and constantly learns to detect fake bank statements, utility bills, tax forms, articles of incorporations, invoices, and more.

The document fraud detection filter all workflows or LLMs need

If you’re automating your document processes without fake documents in mind, you’re automating fraud. Don’t settle for bolt-on solutions. Resistant Documents is the only solution that makes document fraud a priority.

Any document. Any language. Total privacy

Resistant Documents is document and language-agnostic: It doesn’t need to know a document or read it to detect fraud. It looks at how a document is built, not what it says — ensuring your customer’s privacy at all times.

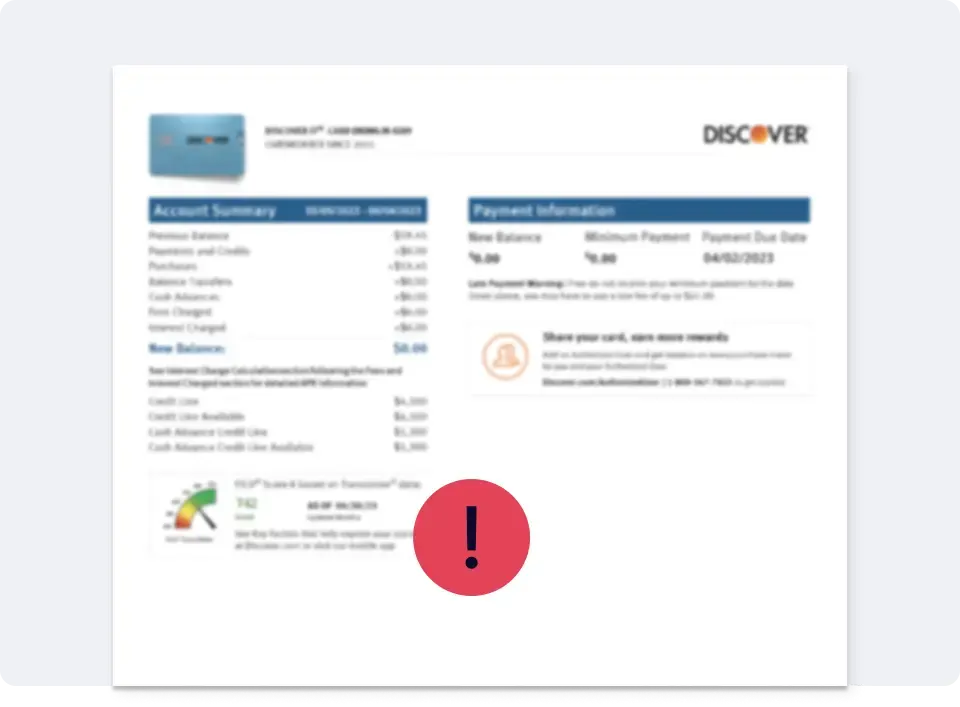

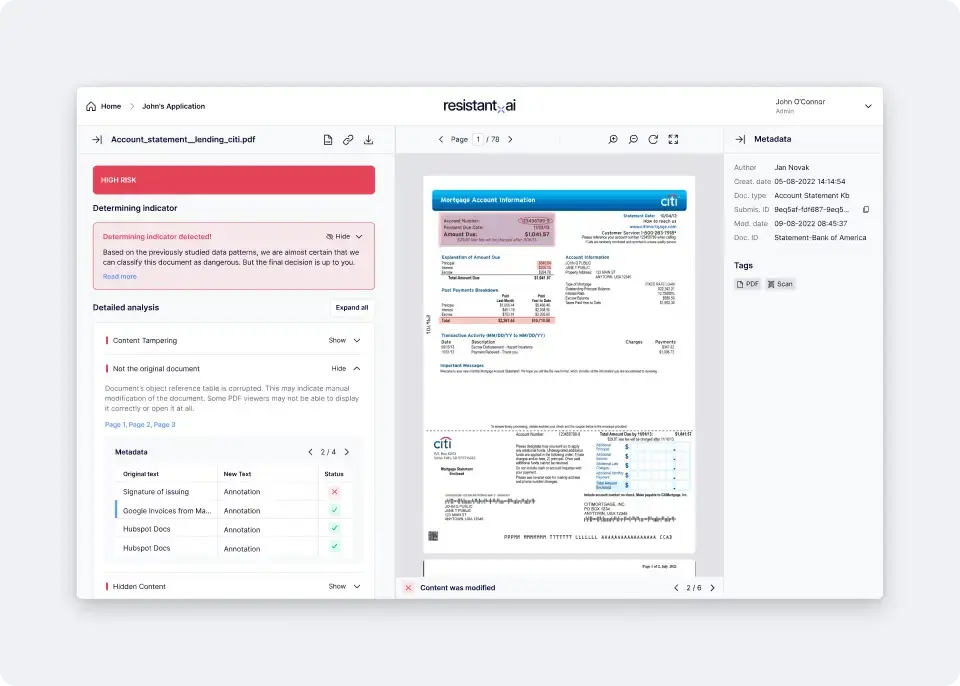

Work with explainable verdicts, not “risk scores”

What do you do with a 68% vs a 82% risk score? Cut out the noise with clear verdict recommendations (Trusted, Warning, High Risk) and fully explainable evidence to help you make the right decisions every time.

Decisioning that matches your risk appetite

Don’t want to accept screenshots? No problem. Customize verdicts to your risk appetite and business goals with 99.2% accuracy using any document feature: from what it is, to who issued it, and the modifications it underwent.

Enrich detections with behavioral data

Look beyond the documents themselves. Enrich your decisions with behaviors and device fingerprints to detect up to 30% more fraud than analyzing the documents alone — and leverage those signals elsewhere in your risk tech stack.

Resistant AI has helped us to drastically reduce both the time it takes to catch fraud, and the amount of fraud that makes it past us to lenders.

- Ryan Edmeades MLRO and head of financial crime

Resistant AI has significantly helped prevent specific types of credit fraud, and enhances our ability to defend against document fraud attacks.

- Petr Volevecký Head of Credit Fraud Risk

Probably the best tool in our review flow. Resistant are our bionic eyes.

- Katarina Demchuk Identity Verification PM

Resistant AI perfectly complement FINOM's AML and Anti-Fraud program with its explainable AI, ensuring transparency to AML analysts as well as the regulator.

- Sergey Petrov Co-founder, COO

With Resistant AI, we can manage our known risks more efficiently while also identifying and adapting to previously unknown risks.

- Valentina Butera Head of AML & AFC Operations

Resistant AI prevents the manipulation of invoices submitted to our marketplace. It allows out investors to trade in security and saves my team a huge amount of manual work.

- Alexandra Belková Head of Operations

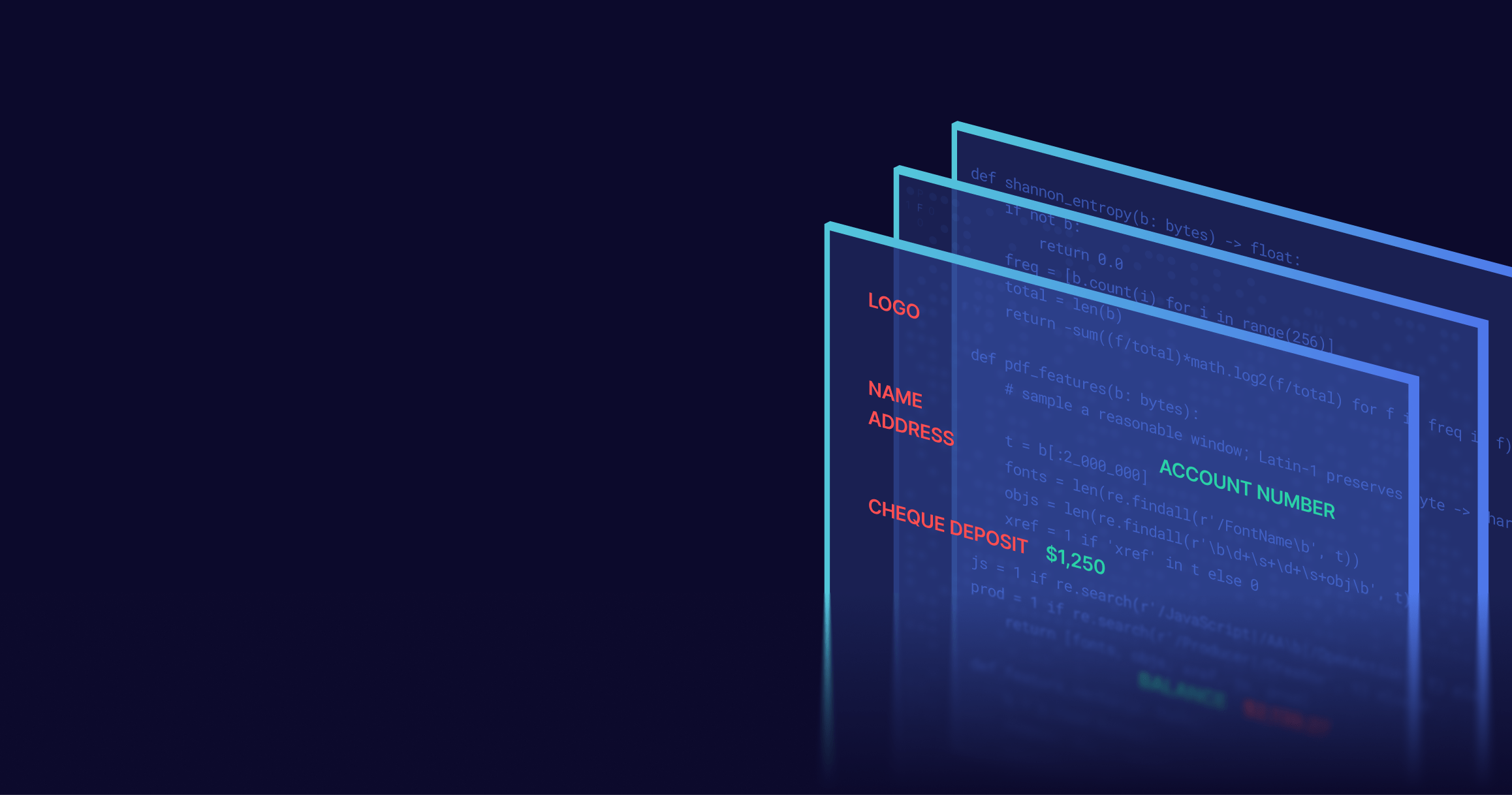

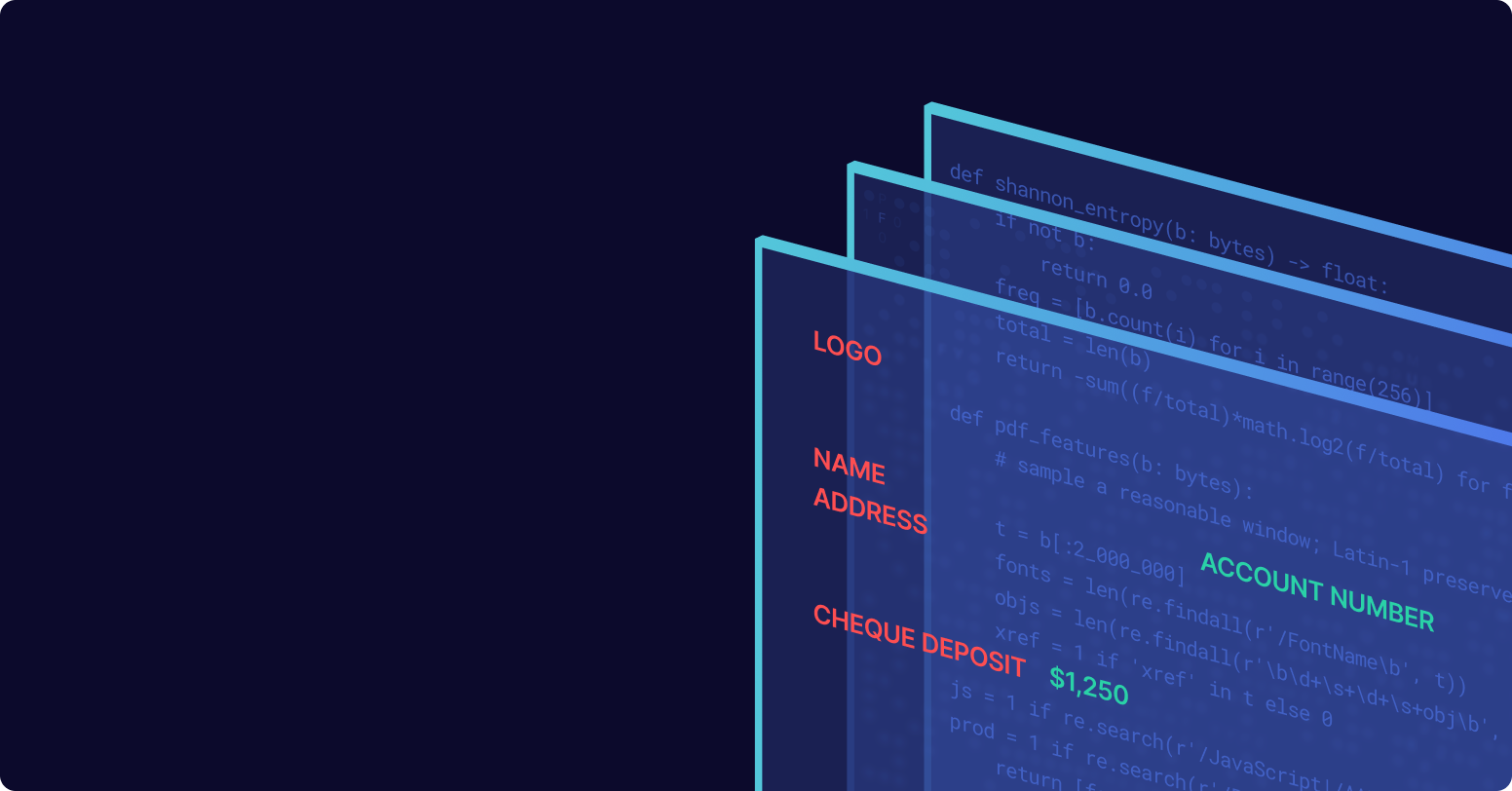

How it works

Use our drag and drop web interface immediately, or deploy our APIs to run automatic checks on all incoming documents.

Is the document readable?

Is this the right kind of document?

Is the document authentic or fraudulent?

Does the document meet your specific risk and compliance policies for approval, rejection or escalation?

Document fraud detection: Secure your key processes

KYB

Speed up compliance reviews to detect fake certificates of incorporation, income statements, articles of association, and other KYB documents. Learn more

Loan underwriting

Make confident decisions on which borrowers to work with (and which to deny). Learn more

Income verification

Get actionable data on income documents like pay stubs and invoices. Learn more

Claims processing

Stop leakage from false, exaggerated, or duplicate claims, and focus on good customers. Learn more

KYC

Perform in-depth fraud analysis on ALL KYC documents (not just passports and driver's licenses). Learn more

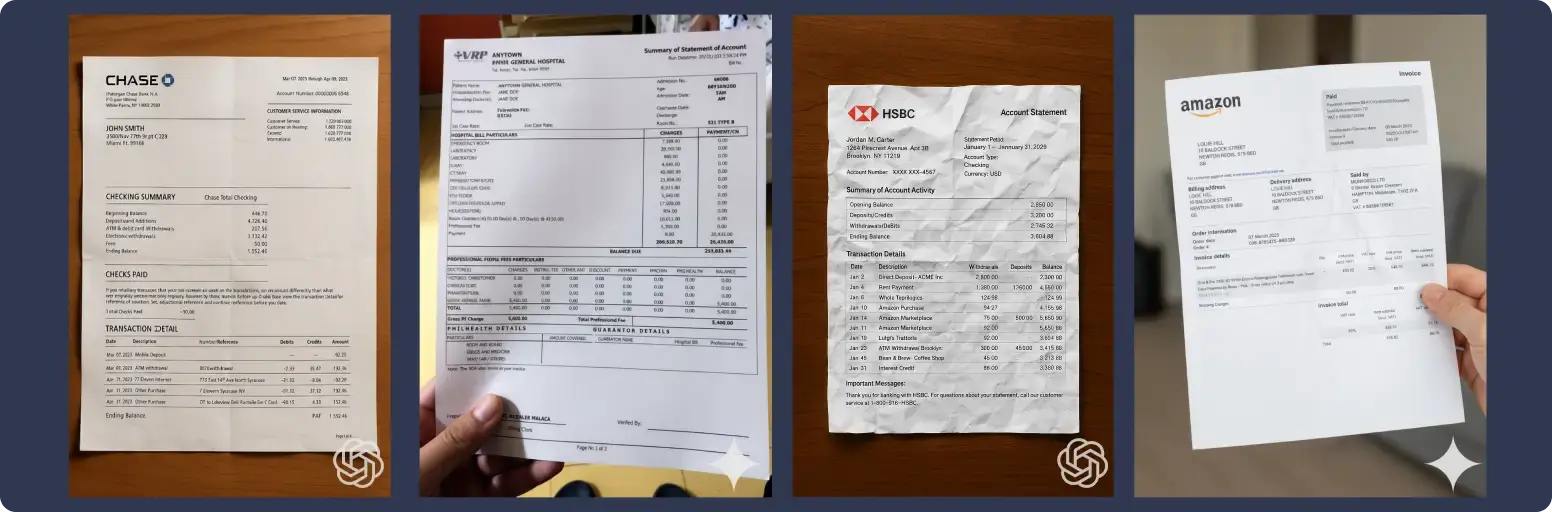

Generative AI fraud

Gen AI detectors identify tell-tale signs of fraud, analyzing both visual textures and structural patterns to flag submissions (no matter how real they look). Learn more

Tenant screening

Quickly spot forged documents in rental applications so you can approve trustworthy tenants without slowing down the leasing process. Learn more

Start detecting fraud in your documents

Join the secure few. Book a demo to talk to an expert today.

.png)